Introduction

In the ever-connected global village, intrepid travelers and discerning entrepreneurs alike grapple with the challenge of managing multiple currencies effortlessly. Amidst a plethora of options, the MMT Hdfc Forex Card and the Multicurrency Forxplus emerge as formidable contenders, beckoning us to delve into their intricacies and discover the path to seamless cross-border financial transactions.

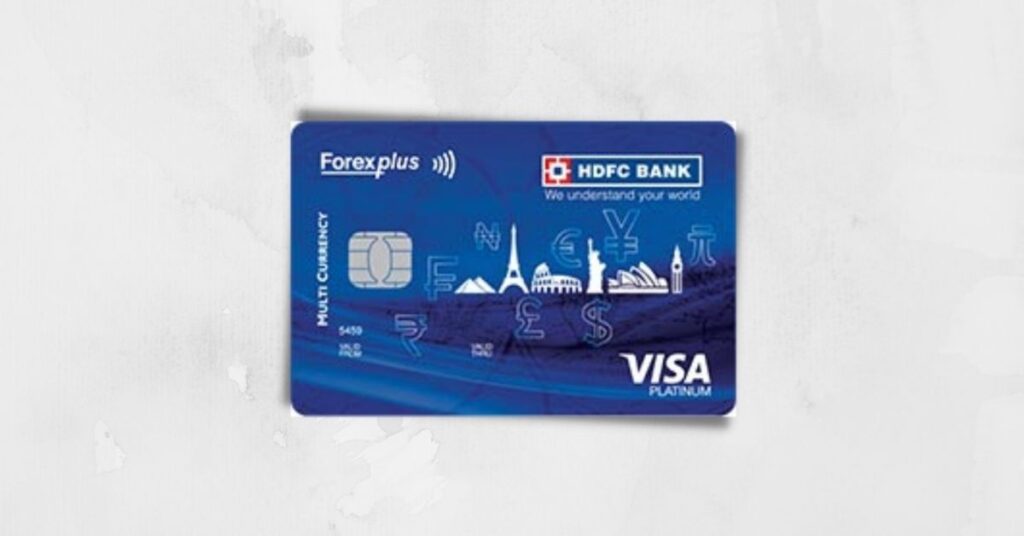

Image: fincards.in

MMT Hdfc Forex Card: A Gateway to Simplified Currency Exchange

The MMT Hdfc Forex Card is a prepaid travel card that liberates you from the complexities of currency conversion and ATM withdrawals. Issued by Hdfc Bank, one of India’s leading financial institutions, this card offers a wide range of benefits, including:

- Multi-currency Support: Load up to 15 global currencies onto your card, eliminating the need for multiple cards or currency exchanges.

- Competitive Exchange Rates: Enjoy real-time currency rates that match or surpass market benchmarks, saving you time and money.

- Extensive Acceptance: Your MMT Hdfc Forex Card is accepted at millions of merchant locations and ATMs worldwide, ensuring seamless transactions in a multitude of destinations.

Multicurrency Forxplus: The Digital Currency Aggregator

Multicurrency Forxplus, on the other hand, takes a different approach. It’s a digital wallet that allows you to hold and manage multiple currencies in one unified account. With Forxplus, you gain access to the following advantages:

- Virtual Account: Create virtual accounts for different currencies, enabling you to segregate funds and track transactions effortlessly.

- Interbank Exchange Rates: Forxplus leverages interbank exchange rates, ensuring that you always secure the most favorable rates possible.

- Diverse Payment Options: Fund your account, pay merchants, and withdraw funds using various methods, including bank transfers, credit/debit cards, and e-wallets.

MMT Hdfc Forex Card vs Multicurrency Forxplus: A Comparative Analysis

While both MMT Hdfc Forex Card and Multicurrency Forxplus offer unique features, their suitability depends on your specific needs and preferences. Here’s a comparative analysis to help you make an informed choice:

-

Physical vs Digital: The MMT Hdfc Forex Card is a physical card that can be used in offline scenarios. Multicurrency Forxplus, on the other hand, is a digital wallet primarily used for online transactions.

-

Currency Support: The MMT Hdfc Forex Card supports up to 15 currencies, while Forxplus offers a more comprehensive range of over 45 currencies.

-

Exchange Rates: While both services claim to offer competitive exchange rates, Forxplus’s interbank rates often provide a marginal advantage.

-

Fees: MMT Hdfc Forex Card charges a small issuance fee and transaction fees for certain operations. Forxplus has a lower fee structure, with no issuance fees and minimal transaction fees.

-

Convenience: For physical transactions, the MMT Hdfc Forex Card offers greater convenience. However, Forxplus’s virtual account feature and mobile app provide unmatched convenience for digital payments.

Image: www.forex.academy

Which One is Right for You?

The optimal choice between MMT Hdfc Forex Card and Multicurrency Forxplus hinges upon your individual requirements. If you prioritize physical card usage, prefer fewer currencies, and require streamlined access to funds, the MMT Hdfc Forex Card is a viable option. However, if you primarily conduct digital transactions, need a wide range of currency options, demand real-time currency conversion, and appreciate low fees, Multicurrency Forxplus is your ideal companion.

Mmt Hdfc Forex Card Vs Multicurrency Forxplus

https://youtube.com/watch?v=MmT9rqKhT8A

Conclusion

Whether you’re planning an adventure across continents or navigating the complexities of global commerce, choosing the right currency management solution is paramount. The MMT Hdfc Forex Card and Multicurrency Forxplus offer distinct benefits, empowering you to conquer international financial challenges with ease. By understanding their nuances and aligning them with your own needs, you can unlock a world of convenience, savings, and financial freedom, paving the way for successful global endeavors.