Imagine you’re a budding investor, eager to venture into the exhilarating world of Forex trading. You’ve heard whispers of the lucrative possibilities, the mind-boggling profits. But as you delve into the realm of currencies, a daunting question arises: How can you maximize your gains while minimizing your risk? The answer lies in understanding the delicate balance between minimum deposit and maximum leverage. Brace yourself for an illuminating journey that will empower you to trade confidently and strategically.

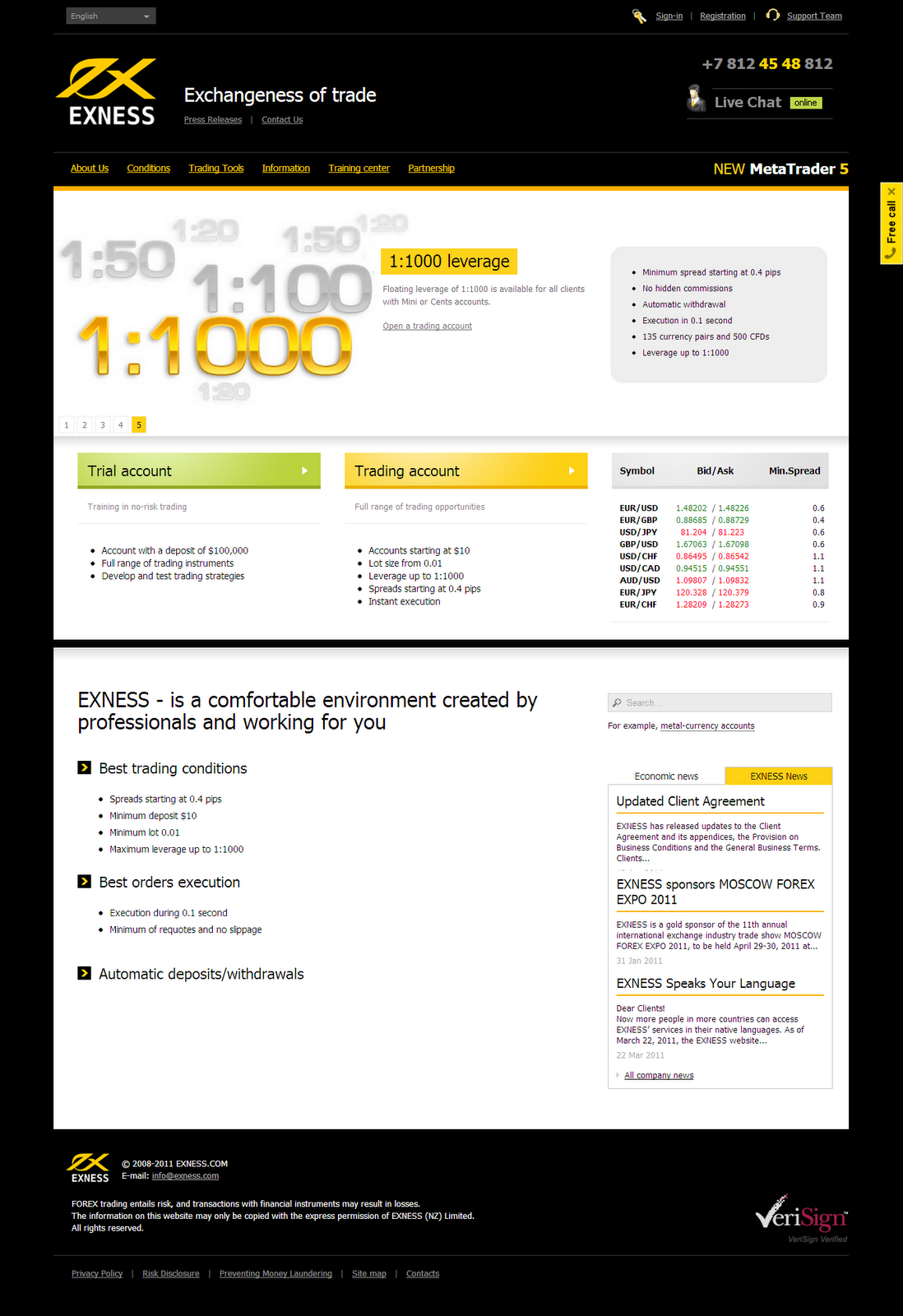

Image: exness-review.blogspot.com

What’s Minimum Deposit?

Think of it as the initial investment you must make to open a Forex trading account. This acts as your financial footing in the market, determining the amount of currency you can control. While some brokers set minimum deposits as low as $1, others may require substantial sums.

What’s Maximum Leverage?

Leverage is the secret sauce that amplifies your trading power. It’s like a magnifying glass that takes a small sum of money and makes it seem much larger. However, this power comes with a double-edged sword. Leverage magnifies not only your profits but also your potential losses.

The Correlation: Minimum Deposit vs. Maximum Leverage

The relationship between these two elements is inverse. A higher minimum deposit often correlates with a lower maximum leverage. This is because brokers mitigate their risk by requiring you to put up more of your own money if they’re granting you the privilege of wielding higher leverage.

Choosing the Right Combination

Finding the sweet spot between minimum deposit and maximum leverage is crucial. It requires a careful assessment of your risk appetite, trading experience, and financial objectives.

- Rookies: Beginners should opt for a lower minimum deposit to limit their initial exposure. A maximum leverage of 50:1 to 100:1 is a sensible starting point.

- Intermediate Traders: As you gain experience and confidence, consider a higher minimum deposit to unlock access to maximum leverage of 100:1 to 500:1.

- Seasoned Pros: Experienced traders with a substantial trading account balance can entertain the idea of minimum deposits well into the thousands and maximum leverage exceeding 1000:1.

Example

Suppose you’re starting with a minimum deposit of $500. With maximum leverage of 100:1, this essentially means you can control up to $50,000 worth of currency. While this may sound tempting, remember that you’re also exposing yourself to potential losses of up to $50,000.

Expert Insights

“Leverage is a double-edged sword. Use it wisely, and it can propel your gains to unimaginable heights. Use it recklessly, and it can amplify your losses to devastating proportions,” cautions Ethan James, a seasoned Forex trader with over a decade of experience.

“Don’t chase after the highest leverage possible. Choose the level that aligns with your risk tolerance and trading strategy,” advises Dr. Anya Petrov, a leading Forex analyst.

Actionable Tips

- Set Realistic Expectations: Forex trading involves both rewards and risks. Set realistic profit targets and be prepared to accept losses.

- Practice: Use a demo account to hone your skills and familiarity with the platform before risking real capital.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Spread your investments across multiple currency pairs and strategies to minimize risk.

- Learn Risk Management Techniques: Take every possible step to manage your risk, including setting stop-loss orders and position sizing strategies.

- Seek Mentoring or Training: Consider seeking guidance from experienced traders or enrolling in courses to enhance your knowledge and skills.

Conclusion

The Forex market is a lucrative yet volatile landscape. By understanding the interplay between minimum deposit and maximum leverage, you can optimize your trading experience. Remember to assess your risk appetite, choose wisely, and always trade with caution. With the right approach, you can navigate the ups and downs of the currency markets and achieve your financial goals.

Image: forextrading.africa

Minimum Diposite Maximum Leverage Forex