Introduction

Pip value, a fundamental concept in foreign exchange (forex) trading, holds the key to determining the potential profit or loss in every trade. It represents the smallest increment of price movement for a currency pair and plays a crucial role in calculating both risk and reward. Understanding how to calculate pip value is essential for traders looking to navigate the dynamic forex market effectively.

Image: www.tradingview.com

Calculating Pip Value

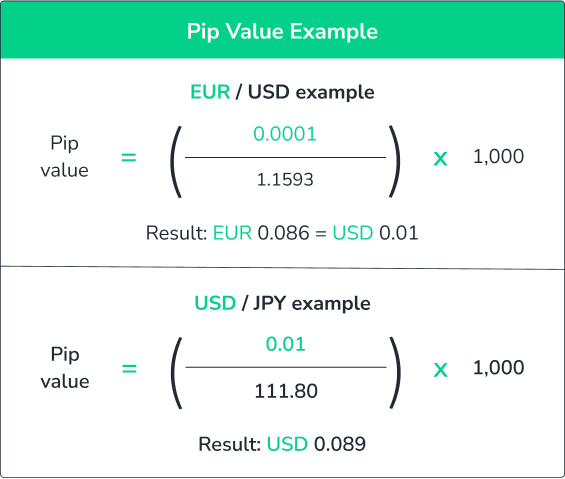

The calculation of pip value involves multiplying the pip value of a currency pair by the trade size. The pip value, in turn, is determined based on the exchange rate between the base currency and the quote currency. Here’s the formula:

Pip Value = (1 Pip / Exchange Rate) x Trade Size

For instance, let’s consider the EUR/USD currency pair with an exchange rate of 1.15. If you trade 10,000 units (0.1 lots), the pip value would be calculated as follows:

Pip Value = (1 Pip / 1.15) x 10,000 = $0.000087

This means that for every one-pip movement in the EUR/USD exchange rate, you would either gain or lose 0.87 cents per traded lot (10,000 units).

Determining Trade Size

The trade size, expressed in lots, is another crucial factor in calculating pip value. A lot is a standardized unit of measurement in forex trading, typically representing 100,000 units of the base currency. Traders can choose to trade in multiples of 0.01 lots (1,000 units) known as micro lots or 0.1 lots (10,000 units) known as mini lots.

The trade size you choose should align with your trading style, risk tolerance, and available capital. It’s important to avoid trading with more capital than you can afford to lose.

The Impact of Pip Value on Trading Strategies

Pip value plays a significant role in shaping trading strategies. Scalpers, who typically enter and exit trades within minutes or hours, focus on capturing small price movements. In such strategies, a higher pip value results in smaller profits and losses per trade.

Trend traders, on the other hand, aim to capitalize on longer-term market trends. They prefer currency pairs with lower pip values since the potential profit per pip is higher, allowing them to accumulate more significant gains as the trend progresses.

Image: tylaralesio.blogspot.com

How To Calculate Pip Value

Conclusion

Calculating pip value is a cornerstone of successful forex trading. Whether you’re a seasoned trader or just starting out, a thorough understanding of pip values empowers you to accurately assess risk, optimize trade sizes, and develop effective trading strategies. By mastering this fundamental concept, you unlock the potential to maximize your profits and minimize your losses in the dynamic forex market.