Navigating the ever-evolving world of forex can be daunting, especially when encountering terms like “EUR/USD sell.” If you’re eager to unravel the intricacies of this currency pair and its implications in the forex market, join us as we delve into an in-depth exploration of EUR/USD sell.

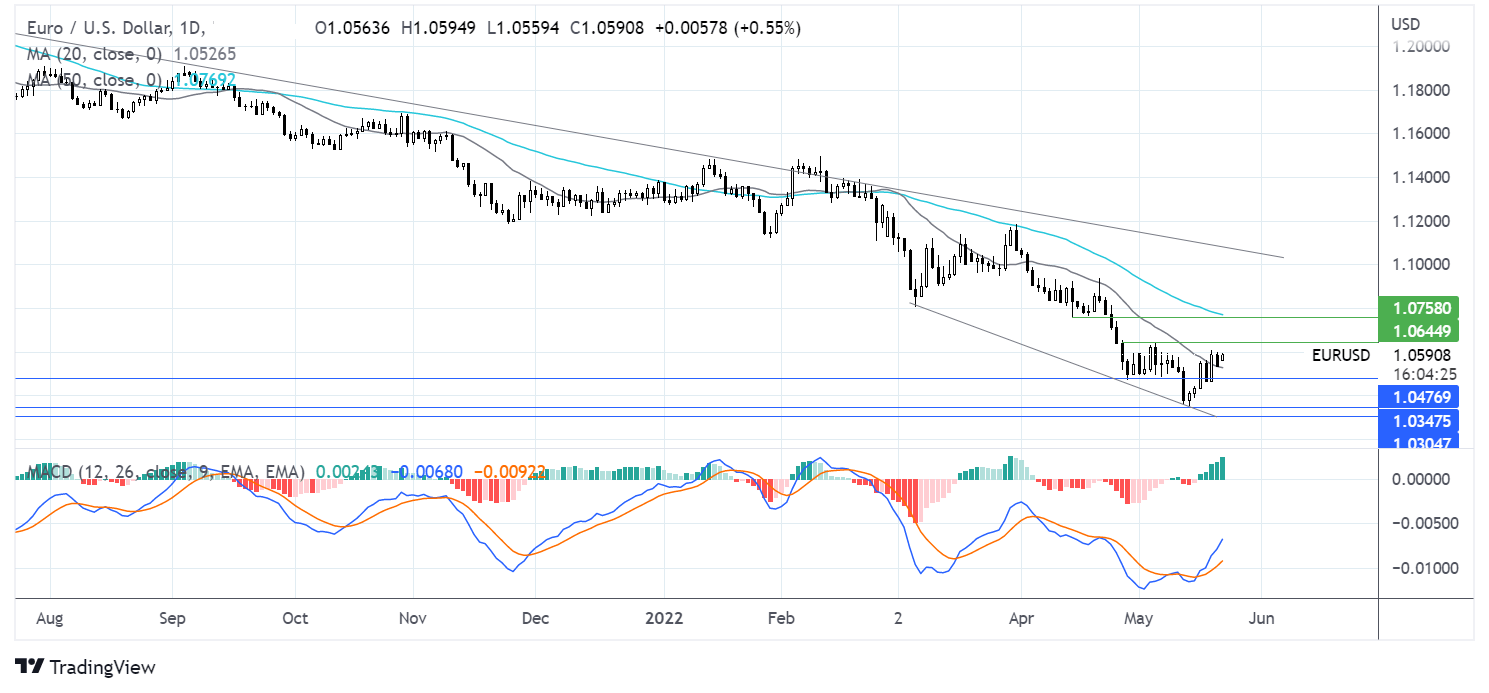

Image: tixee.com

Understanding EUR/USD Sell: A Concise Definition

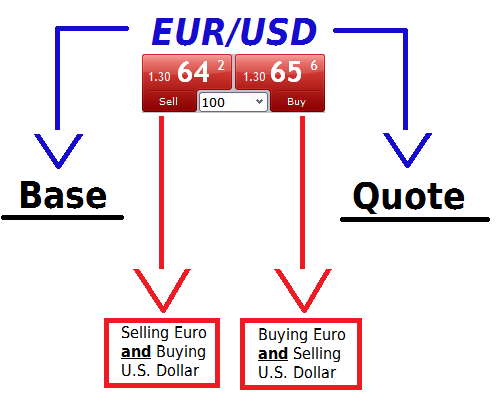

EUR/USD represents the exchange rate between the euro (EUR) and the US dollar (USD). When you “sell EUR/USD,” it means you’re exchanging euros for US dollars. This action indicates your belief that the value of the euro will decline relative to the US dollar in the future.

Speculating on Exchange Rate Fluctuations

Traders who sell EUR/USD anticipate that the euro will weaken against the US dollar. By initiating this transaction, they aim to profit from the potential depreciation of the euro. If their prediction holds true, they can buy back euros at a lower price, generating profits on the exchange rate difference.

Hedging against Currency Risks

Businesses and investors can use EUR/USD sell as a hedging strategy to mitigate currency risks. For example, a European company with significant US dollar-denominated income may sell EUR/USD to secure a favorable exchange rate for converting their earnings into euros.

Image: www.exchangerates.org.uk

Key Factors Influencing EUR/USD Dynamics

Numerous economic, political, and market forces shape the movement of EUR/USD. Here are some key factors to consider:

- Economic data: Employment, inflation, and GDP growth in the eurozone and the United States can impact exchange rates.

- Interest rates: Differing interest rates between the European Central Bank and the US Federal Reserve influence the attractiveness of each currency.

- Political events: Elections, economic reforms, and geopolitical tensions can affect currency sentiment.

li>Carry trade: Investors may borrow one currency with low interest rates to invest in another with higher interest rates, influencing exchange rates.

li>Speculative activity: Market sentiment and speculative trading can drive price movements.

Analyzing EUR/USD Trends and News

Staying informed about the latest news, economic releases, and market analysis is crucial for making informed EUR/USD sell decisions. Real-time tracking of major economic indicators, such as GDP figures or unemployment rates, can provide insights into potential currency trends.

Monitoring reliable news sources and analyzing expert opinions on forex forums and social media platforms can further enhance your understanding of market sentiment and potential trading opportunities.

Expert Tips and Strategies for Selling EUR/USD

Selling EUR/USD successfully requires a strategic approach. Here are some valuable tips:

- Identify trend direction: Determine the overall trend of EUR/USD before initiating a sell trade to increase your chances of success.

- Set clear entry and exit points: Define specific levels at which you will enter and exit the trade to manage risk and maximize profit potential.

- Adopt a risk management strategy: Use stop-loss and take-profit orders to limit potential losses and protect profits.

- Monitor market conditions closely: Stay informed about economic releases, news events, and market sentiment to adjust your strategy accordingly.

- Consider using technical analysis: Utilize technical indicators and chart patterns to support your trading decisions.

FAQ on EUR/USD Sell

To further clarify your understanding, here are some frequently asked questions related to selling EUR/USD:

- Q: Is selling EUR/USD suitable for all traders?

A: Forex trading involves a level of risk, so it’s not suitable for all individuals. Consult with a financial advisor to assess your risk tolerance. - Q: What are the risks involved in selling EUR/USD?

A: The primary risk is that the value of the euro may rise against the US dollar, resulting in losses on your trade. - Q: Can I automate my EUR/USD sell trades?

A: While automated trading systems exist, they require careful evaluation and monitoring to ensure they align with your trading strategy.

Meaning Of Eur Usd Sell In Forex Eur Usd

Conclusion

Understanding the dynamics of EUR/USD sell is vital for navigating the forex market effectively. By considering key factors, analyzing trends and news, and implementing proven strategies, you can increase your chances of success when selling EUR/USD. Whether you’re a seasoned trader or a curious beginner, the insights presented here should empower you in your forex endeavors.

Are you fascinated by the world of EUR/USD and eager to explore further? Share your thoughts and questions in the comments, and let’s delve into the intricacies of this captivating currency pair. Your contributions and curiosity will help shape the conversation and deepen our collective understanding.