Introduction

In the fast-paced and dynamic world of forex trading, the concept of CMP, or Current Market Price, stands as a pivotal indicator, providing traders with an up-to-the-minute snapshot of the real-time value of a currency pair. Understanding its significance is paramount to making informed trading decisions and maximizing your chances of success in the competitive forex market.

Image: community.cadence.com

Understanding the CMP

The CMP is essentially the price at which a currency pair is currently being traded at any given moment. It is determined by the constant interplay of supply and demand forces in the market, as buyers and sellers place their orders to either buy or sell the currency pair at specific prices. The CMP is dynamic, fluctuating constantly as these orders are executed, and thus provides a real-time representation of the market’s sentiment towards a particular currency pair.

The Importance of CMP in Forex Trading

-

Accurate Market Assessment: CMP offers traders an accurate representation of the market’s current valuation of a currency pair. By monitoring the CMP, traders can gauge the overall trend of the market and identify potential trading opportunities.

-

Support and Resistance Levels: CMP often acts as a support or resistance level, attracting buyers and sellers, respectively. Identifying these levels through CMP analysis can help traders anticipate price reversals and make profitable trading decisions.

-

Technical Analysis: CMP forms the basis of many technical analysis indicators and strategies, including moving averages, Bollinger Bands, and Ichimoku Kinko Hyo. These indicators help traders identify market trends, overbought and oversold conditions, and potential trading signals.

-

News and Event Analysis: Major news events and economic announcements can significantly impact CMP. By following the latest news and understanding its potential implications, traders can anticipate shifts in CMP and adjust their trading strategies accordingly.

Leveraging CMP for Effective Trading

-

Timing Entries and Exits: CMP can guide traders in determining optimal entry and exit points for their trades. Buying at a point where CMP is below a key support level or selling when CMP is above a resistance level can increase the probability of a profitable trade.

-

Managing Risk: By understanding CMP, traders can set appropriate stop-loss levels to limit potential losses if the market moves against their position. CMP also helps traders identify potential areas to take profits to secure their earnings.

-

Combining with Technical Indicators: Combining CMP analysis with technical indicators can provide a more comprehensive view of the market. For example, using a moving average can confirm a trend while CMP can identify specific entry or exit points within that trend.

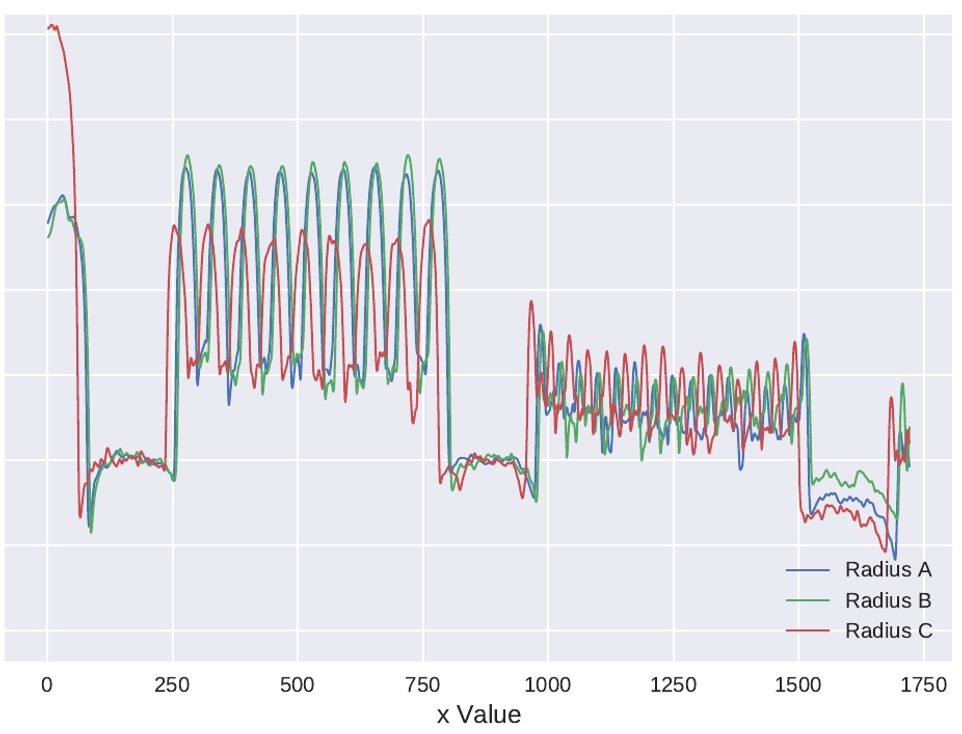

Image: www.semanticscholar.org

Meaning Of Cmp In Forex

Conclusion

The concept of CMP is an indispensable tool for forex traders, providing them with real-time insights into the market’s valuation of currency pairs. By understanding its significance and leveraging it effectively, traders can enhance their accuracy in market assessment, identify profitable trading opportunities, and manage risk. Whether you are a seasoned professional or a novice entering the forex market, incorporating CMP into your trading strategy is a crucial step towards achieving success. Remember, mastering the art of effective CMP analysis is a journey of continuous learning and practice that will empower you to navigate the complex and rewarding world of forex trading.