Navigating the ever-fluctuating forex market demands a blend of strategy and adaptability. Among the diverse trading approaches, mean reversion stands out as a time-tested technique that seeks to exploit the inherent tendency of prices to revert to their historical averages. This detailed guide will delve deeply into the intricacies of mean reversion trading, empowering you with the knowledge and skills to harness this profitable strategy.

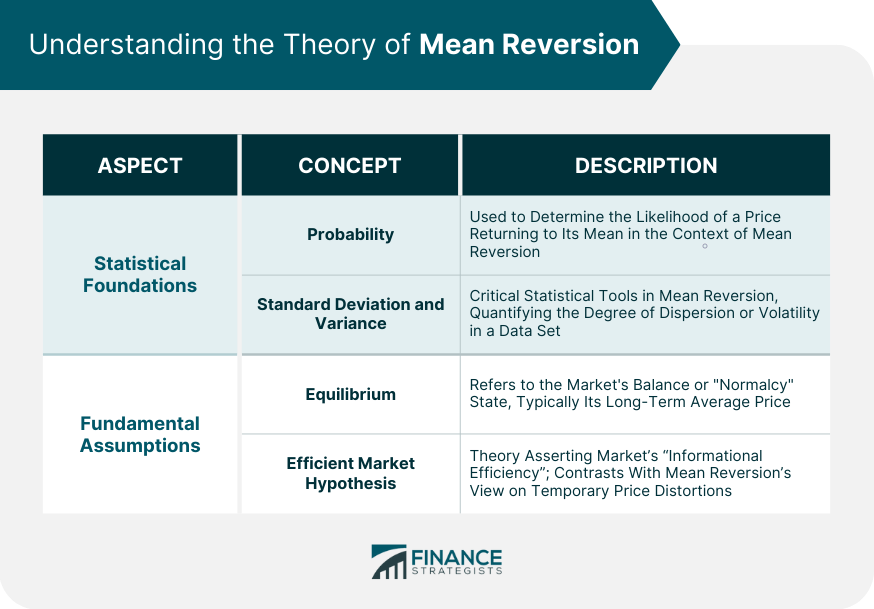

Image: www.financestrategists.com

Understanding Mean Reversion: The Cornerstone of the Strategy

Mean reversion is predicated on the financial market’s natural inclination to oscillate around a central value or average. This tendency manifests in a wide array of markets, ranging from stocks and bonds to currencies and commodities. When prices deviate significantly from their historical averages, a force often arises that propels them back towards their mean. This phenomenon forms the foundation of mean reversion trading.

Identifying Mean Reversion Opportunities: A Step-by-Step Approach

Successfully profiting from mean reversion requires meticulous identification of market inefficiencies or extreme price deviations. Here’s a systematic approach to spotting these opportunities:

- Define Historical Averages: Calculate the moving averages (MA) of the desired security over varying periods, such as 50-day, 100-day, or 200-day averages, to establish historical reference points.

- Identify Price Deviations: Monitor market prices relative to historical averages. When prices move significantly above or below their MAs, it signifies a potential opportunity for mean reversion.

- Determine Entry and Exit Points: Establish clear entry points when prices exceed or fall below predefined deviation levels. Similarly, set exit points to lock in profits when prices return closer to their averages.

- Risk Management: Implement robust risk management strategies to minimize losses, including setting stop-loss orders and position sizing in accordance with acceptable risk tolerance levels.

Exploring Mean Reversion Trading Techniques: A Toolkit for Success

The mean reversion trading strategy encompasses a spectrum of techniques tailored to different market conditions and risk appetites. Here are some widely used approaches:

- Band Trading: This involves buying an asset when its price drops below a predefined lower Bollinger Band and selling when it rises above the upper Bollinger Band.

- Channel Trading: Similar to band trading, channel trading involves identifying parallel trendlines that serve as support and resistance levels. Trades are executed when prices approach or breach these lines.

- Flag and Pennant Patterns: Mean reversion traders often look for flag and pennant patterns, which represent consolidation periods within a broader trend. When prices break out of these patterns, it often signals a continuation of the trend.

Image: www.goodreads.com

Advanced Concepts for Seasoned Traders: Unleashing the Full Potential of Mean Reversion

For experienced traders seeking advanced techniques, the following concepts offer additional insights:

- Regression to the Mean: This statistical concept highlights the tendency of random data points to cluster around the mean over time, supporting the mean reversion hypothesis.

- Momentum Indicators: Incorporating momentum indicators, such as the Relative Strength Index (RSI) or Stochastic Oscillator, can aid in identifying overbought or oversold conditions, respectively.

- Correlation Analysis: Understanding the correlations between different currency pairs can help traders diversify their mean reversion portfolio and spread risk.

Mean Reversion Trading Strategy Forex

Conclusion: Mastering the Mean Reversion Trading Strategy for Consistent Profits

Mean reversion trading provides a robust and time-tested approach to profiting from market fluctuations. By meticulously identifying price deviations from historical averages, employing effective trading techniques, and managing risk judiciously, traders can harness the power of mean reversion to generate consistent returns. Whether you’re a beginner or an experienced trader, incorporating mean reversion into your trading arsenal can significantly enhance your profitability and resilience in the dynamic forex market.

Remember, trading involves inherent risks, and it’s imperative to conduct thorough research, practice discipline, and exercise sound judgment before committing capital. With a comprehensive understanding of the mean reversion trading strategy, you’re well-equipped to navigate market turbulence and capitalize on opportunities for growth.