Breaking Barriers: Unveiling the Forex Trading Limit Landscape

In the fast-paced world of forex trading, understanding limits is paramount. Whether you’re a seasoned trader or just starting out, knowing the maximum limit for forex trading is crucial to mitigate risks and maximize profits. This guide will arm you with everything you need to know about forex trading limits, from definitions and history to the latest trends and expert advice.

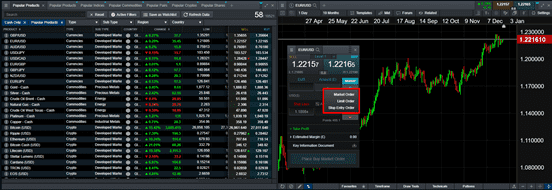

Image: www.dailyforex.com

Forex trading limits represent the maximum amount of currency that can be traded in a single transaction or within a specific time frame. These limits are imposed by various entities, including brokers, exchanges, and regulatory bodies, to maintain market stability and protect traders from excessive risk.

Navigating Trading Limits: A Comprehensive Overview

1. Order Size Limits

Order size limits, as the name suggests, restrict the size of a single trade. These limits are set by brokers to manage their risk exposure and ensure market stability. Typically, a maximum lot size is specified, beyond which traders cannot execute orders.

2. Position Limits

Position limits refer to the maximum amount of a particular currency pair that a trader can hold at a given time. These limits prevent excessive concentration of positions and potential market manipulation. Traders exceeding position limits may incur penalties or have their positions forcibly closed.

Image: laqenyberegi.web.fc2.com

3. Currency Pair Limits

Some brokers impose limits on the number of currency pairs that can be traded simultaneously. This measure helps ensure that brokers have sufficient liquidity to support all their clients’ trades.

4. Time-Based Limits

Time-based limits restrict the frequency of trades a trader can execute within a specific time frame. These limits aim to curb excessive trading and protect traders from impulsive decisions that could lead to losses.

Emerging Trends and Innovations in Forex Trading Limits

The forex market is constantly evolving, with new technologies and regulations shaping trading practices. Here are some key trends and developments:

- Increased Automation: Advanced trading platforms now allow traders to automate their trading strategies, reducing the risk of exceeding limits due to human error.

- Dynamic Limit Adjustments: Some brokers implement dynamic limit systems that adjust limits based on market conditions and trader risk profiles.

- Enhanced Risk Management Tools: Regulatory bodies are introducing stricter guidelines and risk management tools to monitor and enforce trading limits.

Expert Advice and Tips: Maximizing Trading Efficiency

Adhering to forex trading limits is essential for successful and sustainable trading. Here are some tips from seasoned experts:

- Understand Your Broker’s Limits: Always familiarize yourself with the trading limits imposed by your broker before placing orders.

- Plan Your Trades Strategically: Determine your trading strategy and order size before entering the market to avoid exceeding limits.

- Monitor Your Positions Regularly: Use trading platforms that provide real-time position monitoring tools to ensure you’re within limit boundaries.

- Manage Your Risk: Implement stop-loss and take-profit orders to minimize losses and prevent excessive position sizes.

Frequently Asked Questions: Demystifying Forex Trading Limits

Q: What are the consequences of exceeding forex trading limits?

Exceeding trading limits can result in penalties, margin calls, or forced position closures. It can also damage your trading reputation and reduce your access to certain brokers.

Q: How can I avoid exceeding trading limits?

To avoid exceeding trading limits, follow the expert advice outlined above, including understanding your broker’s limits, planning your trades strategically, and monitoring your positions regularly.

Maximum Limit For Forex Trading

https://youtube.com/watch?v=RMSZ_xnLecE

Conclusion: Seizing Opportunities within Forex Trading Limits

Forex trading limits serve a vital role in maintaining market stability and protecting traders from excessive risk. By understanding the maximum limit for forex trading, you can navigate market boundaries effectively and make informed trading decisions. Remember, adhering to limits is not a constraint but an opportunity to trade with confidence and maximize your potential in the dynamic world of forex.

Are you curious to learn more about forex trading limits? Explore our comprehensive resources and expert insights to elevate your trading journey.