In the realm of treasury and forex management, market mechanisms play a pivotal role in regulating and determining prices, allocating resources, and facilitating the flow of funds.

Image: www.forex.academy

Understanding Market Mechanisms

Definition: A market mechanism is a decentralized system that facilitates interactions between buyers and sellers, allowing them to exchange goods, services, or currencies in an orderly and competitive environment.

**History:** Market mechanisms have evolved over centuries. Early examples include barter systems and agricultural markets. With the advent of money and financial instruments, market mechanisms have become increasingly complex and sophisticated.

Significance in Treasury and Forex Management

Treasury management involves managing an organization’s financial resources, including cash flow, investments, and foreign exchange. Forex management, on the other hand, deals with managing currency exchange risks and optimizing foreign currency transactions.

Market mechanisms are essential in both treasury and forex management because they provide: Efficient Price Discovery: Market mechanisms allow buyers and sellers to interact freely, determining equilibrium prices that reflect the true supply and demand dynamics.

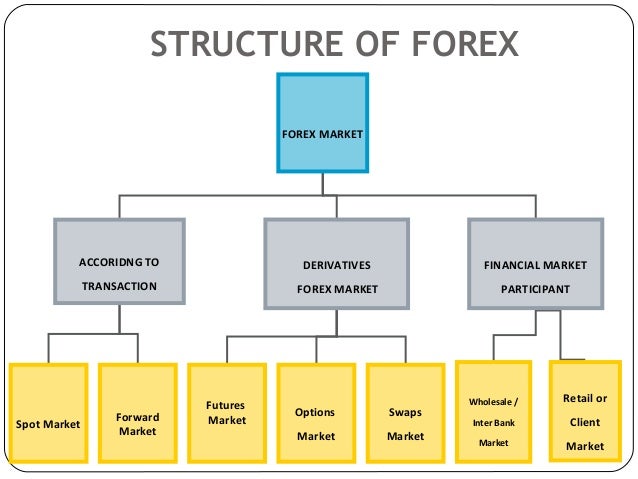

Types of Market Mechanisms

- **Perfect Competition:** A market where numerous buyers and sellers interact, each holding a small share of the market.

- **Monopolistic Competition:** A market with several differentiated sellers competing for consumer loyalty.

- **Oligopoly:** A market dominated by a few large firms that compete fiercely for market share.

- **Monopoly:** A market with a single seller, offering a unique product or service.

Image: yufyfiqec.web.fc2.com

Latest Trends and Developments

Technological advancements, such as algorithmic trading and electronic marketplaces, have revolutionized market mechanisms. These innovations enhance transparency, efficiency, and access to financial markets.

Regulatory changes, like the Dodd-Frank Wall Street Reform and Consumer Protection Act, have also impacted market mechanisms, emphasizing transparency and reducing systemic risks.

Tips and Expert Advice

- Monitor Market Conditions: Stay informed about economic indicators, geopolitical events, and industry trends that can influence currency rates and financial markets.

- Use Diversification Strategies: Spread investments and foreign exchange transactions across different asset classes, currencies, and markets to mitigate risks.

- Employ Risk Management Tools: Utilize hedging techniques like forward contracts and options to protect against currency fluctuations.

FAQs

- What is the role of market mechanisms in treasury management?

Market mechanisms help determine interest rates, bond prices, and other financial instruments, allowing treasury managers to optimize their organization’s financial performance.

- How do market mechanisms affect forex management?

Market mechanisms enable forex traders to hedge currency risks, maximize currency exchange opportunities, and make informed trading decisions.

Market Mechanism Meaning In Treasury And Forex Management

Conclusion

Market mechanisms are the backbone of the global financial system, providing transparency, efficiency, and liquidity in treasury and forex management. By understanding market mechanisms, treasury and forex managers can make informed decisions, optimize financial performance, and navigate the evolving landscape of financial markets.

Are you interested in delving deeper into the fascinating world of market mechanisms? If yes, consider reaching out to a reputable financial institution or a certified treasury or forex professional for further insights.