Introduction

Navigating the Forex market presents a plethora of opportunities for traders seeking financial growth. Among the most innovative trading models is the Multi-Account Manager (MAM), a valuable tool that empowers traders to manage and monitor multiple trading accounts from a single interface. This article delves into the intricacies of MAM accounts, highlighting their benefits, applications, and essential considerations.

Image: www.youtube.com

Understanding MAM Accounts

A MAM account is a specialized account that allows traders to execute trades simultaneously across multiple accounts. It provides a centralized platform for managing and monitoring trading activities, streamlining the trading process by reducing the need for multiple logins and account transitions. Through the MAM interface, traders gain access to all their connected accounts, enabling them to analyze performance, monitor risk, and control trading strategies in real-time.

MAM accounts are particularly advantageous for:

- Asset Managers: Manage multiple client accounts seamlessly, optimizing investment strategies and maximizing returns.

- Professional Traders: Execute trades efficiently across various accounts, capitalizing on market fluctuations and diversifying risk.

- Hedging Funds: Monitor and control risk effectively by managing multiple accounts with diverse trading strategies.

Benefits of MAM Accounts

The advantages of using MAM accounts are multifaceted:

- Centralized Management: Manage all accounts from one platform, eliminating the need for multiple logins and streamlining operations.

- Risk Control: Monitor and control risk in real-time, reducing the potential impact of market volatility on individual accounts.

- Performance Analysis: Analyze the performance of multiple accounts comprehensively, identifying strengths, weaknesses, and areas for improvement.

- Scalability: Easily add or remove accounts to the MAM, adapting to changing market conditions and business needs.

- Customization: Customize trading settings independently for each connected account, catering to individual risk profiles and financial goals.

Applications of MAM Accounts

MAM accounts find applications in various trading scenarios:

- Investment Management: Managing client funds in separate MAM accounts, allocating investments based on individual goals and preferences.

- Multi-Account Trading: Simultaneously trading across multiple accounts with varying strategies, diversifying risk and maximizing profit potential.

- Hedging Strategies: Implementing hedging strategies by executing offsetting trades in different MAM accounts, mitigating the potential losses in one account by offsetting gains in another.

- Copy Trading: Replicating the trading strategies of successful traders through a MAM account, effectively following their trading styles and performance.

Image: www.daytrading.com

Considerations When Choosing a MAM Provider

When selecting a MAM account provider, traders should consider several key factors:

- Reputation and Credibility: Partner with a reputable and licensed broker with a proven track record in MAM services.

- Technology and Security: Ensure the MAM platform is technologically advanced, stable, and secure to safeguard against unauthorized access.

- Execution Quality: Opt for a provider with high-quality order execution, minimizing slippage and ensuring timely trade execution.

- Customer Support: Seek a provider with dedicated customer support to promptly address any queries or technical difficulties.

- Fees and Commissions: Compare providers’ fee structures, including management fees, commissions, and potential add-ons.

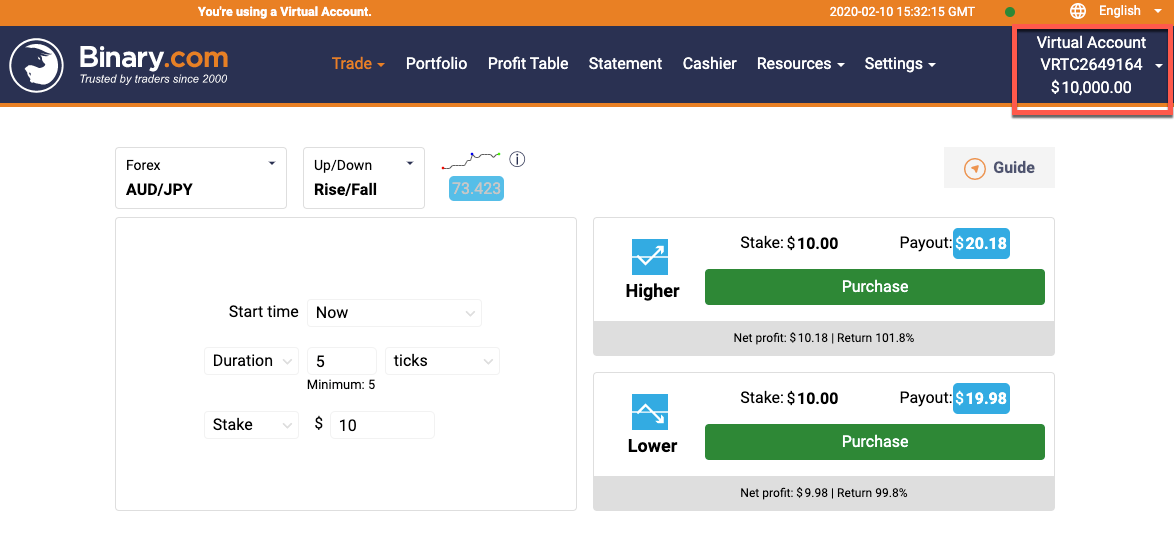

Mam Account Forex In Binary.Com

Conclusion

MAM accounts offer traders an unparalleled level of control, flexibility, and efficiency in Forex trading. By providing a centralized management platform and real-time monitoring capabilities, MAM accounts empower traders to manage multiple accounts simultaneously, optimize performance, and effectively manage risk. Whether seeking to diversify investments, implement hedging strategies, or streamline multi-account trading, MAM accounts present a powerful tool to enhance trading outcomes. It is crucial to carefully evaluate MAM providers, ensuring alignment with individual trading needs and preferences, to maximize the benefits and potential of MAM accounts in the Forex market.