Image: www.litefinance.org

As a seasoned forex trader, I’ve witnessed firsthand the importance of understanding trade volume—the lifeblood of the forex market. By analyzing trade volume, traders can gain insights into market sentiment, currency strength, and potential trading opportunities. In this comprehensive guide, we’ll delve into the trade volume of major forex pairs, exploring their significance and how it can empower your trading strategies.

Grasping Forex Pair Trade Volume

In forex trading, the trade volume of a currency pair signifies the total amount of transactions executed over a specific period. This data provides traders with valuable information about the market’s activity, volatility, and liquidity. It’s crucial to consider trade volume alongside price action to make informed trading decisions.

Forex Market Liquidity and Volume

Trade volume also serves as a measure of market liquidity. Higher trade volume typically indicates a more active and liquid market, allowing traders to execute trades more efficiently and with tighter spreads.

Forex Market Volatility and Volume

Moreover, trade volume can shed light on market volatility. Rapid upswings in trade volume often coincide with increased volatility, meaning traders may encounter larger price fluctuations in a shorter timeframe.

Image: in.pinterest.com

Overview of the Majors’ Trade Volume

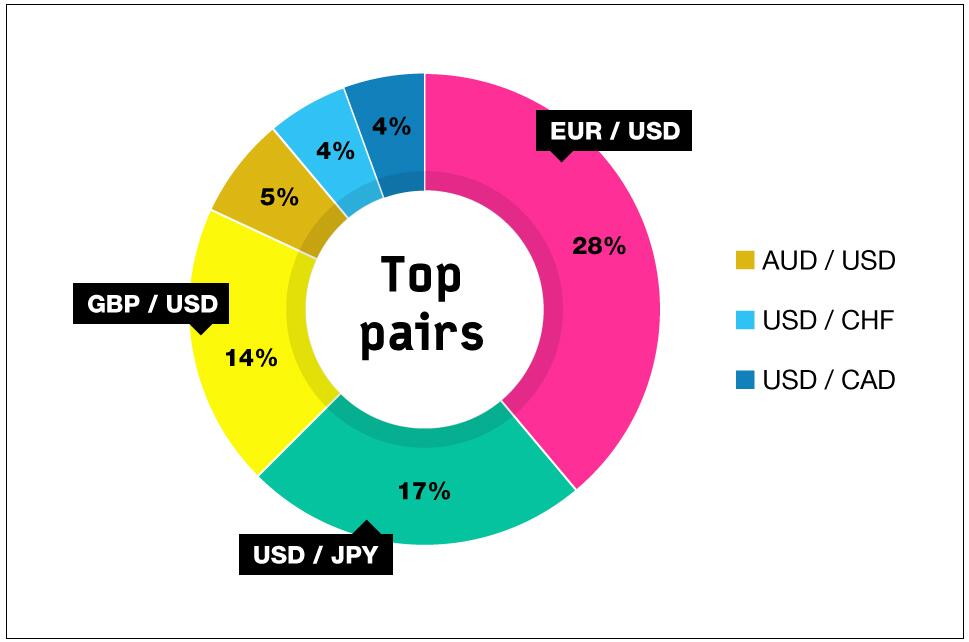

Among the various forex pairs traded globally, a handful stand out as majors due to their high liquidity, trading volume, and global influence. These major forex pairs include:

- EUR/USD (Euro vs. US dollar)

- USD/JPY (US dollar vs. Japanese yen)

- GBP/USD (British pound vs. US dollar)

- USD/CHF (US dollar vs. Swiss franc)

- AUD/USD (Australian dollar vs. US dollar)

These major pairs generally account for the majority of daily forex trading volume, boasting high liquidity and predictable trading patterns, making them attractive to traders of all levels.

> EUR/USD: The Dominant Currency Pair

The EUR/USD is the most widely-traded forex pair, commanding approximately 24% of the market’s daily trading volume. This pair reflects the economic relationship between the Eurozone and its largest economy, Germany, making it a popular choice for traders seeking exposure to the global economy.

> USD/JPY: Volatility and Liquidity

The USD/JPY is another heavily traded pair, accounting for roughly 19% of the forex market’s volume. This pair offers traders exposure to the Japanese economy and often exhibits higher volatility compared to other major pairs, creating potential opportunities for earnings.

Tips and Expert Advice for Reading Trade Volume

Understanding trade volume is crucial in forex, but interpreting it effectively can elevate your trading game:

- Monitor volume spikes: Sudden increases in trade volume often indicate a significant market event or economic news release, signaling the potential for increased volatility.

- Assess volume trends: Consistent high trade volume suggests market confidence and strong liquidity, while declining volume may indicate decreasing interest and potential market reversals.

By incorporating these tips into your trading, you can develop a more comprehensive understanding of the forex market and make well-informed decisions.

Frequently Asked Questions (FAQs)

1. What factors influence trade volume?

Several factors can affect trade volume, including economic events, central bank announcements, political stability, and market sentiment.

2. How can trade volume aid in risk management?

High trade volume suggests increased liquidity, making it easier to enter and exit trades with minimal slippage. This reduced risk makes it easier to manage your positions effectively.

3. Which forex pairs have the highest volume?

The EUR/USD, USD/JPY, GBP/USD, USD/CHF, and AUD/USD are the major currency pairs with the highest trading volume.

Major Forex Pairs Trade Volume

Conclusion

Comprehending and analyzing trade volume is an essential aspect of successful forex trading. By incorporating trade volume into your trading approach, you can enhance your understanding of market dynamics, make informed decisions, and optimize your risk management strategies. Remember, the forex market is ever-evolving, so staying up-to-date with market news and economic events that can impact trade volume is vital. Are you ready to unravel the world of forex trade volume? Let’s dive in and explore its potential together!