Empowering Traders with Competitive Spreads

In the dynamic world of forex trading, spreads play a pivotal role in profitability. A spread refers to the difference between the ask and bid prices of a currency pair. The lower the spread, the more favorable it is for traders, as it directly impacts their profit potential. To cater to this demand, low spread forex brokers have emerged, offering traders exceptional advantages and enhanced performance.

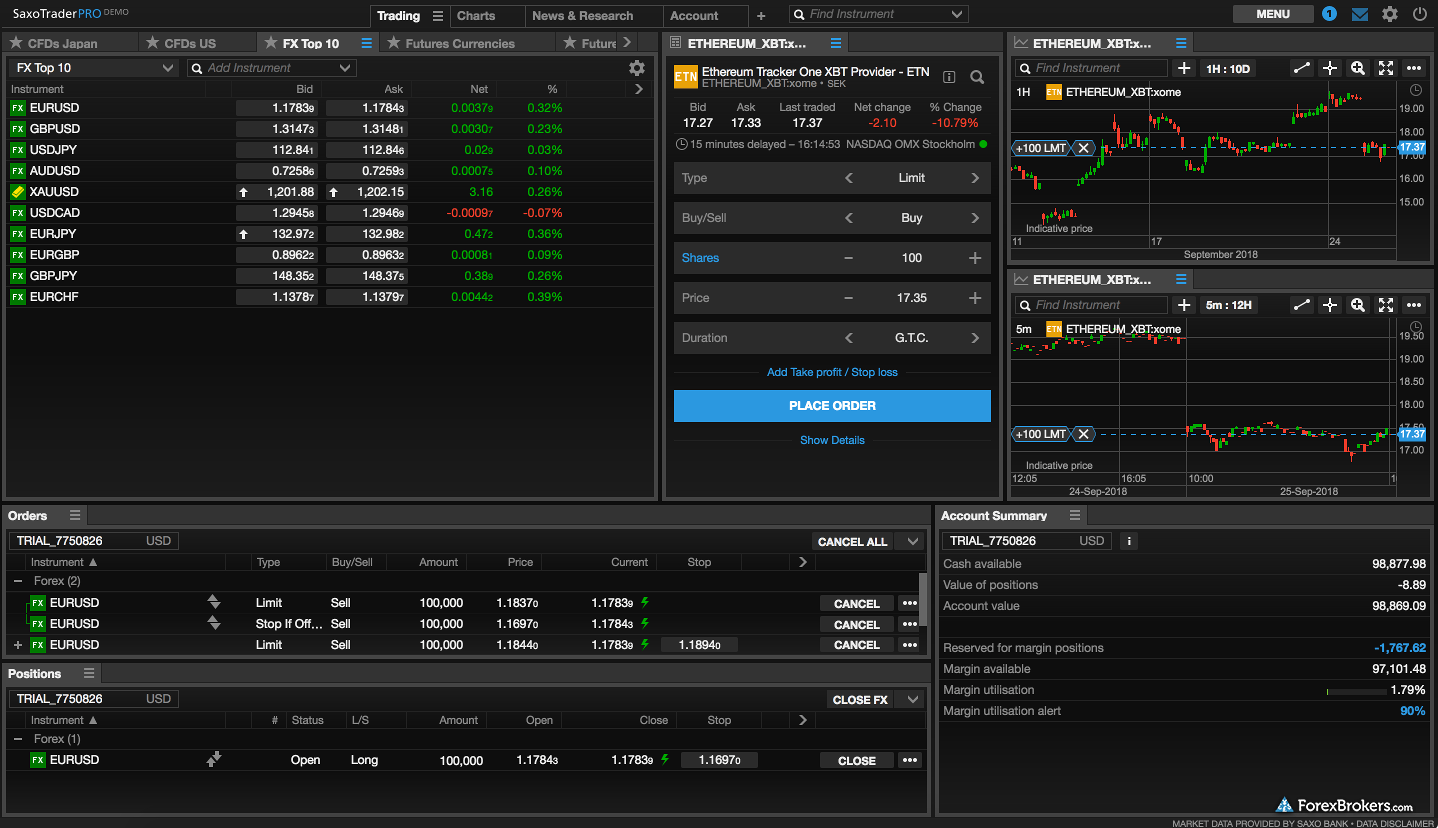

Image: forexbroker.ng

Low spread forex brokers prioritize providing traders with highly competitive spreads, typically ranging from 0.1 to 0.5 pips on major currency pairs. By significantly reducing the spread, traders can save substantial amounts on trading costs and maximize their earnings. This competitive advantage allows them to execute more trades profitably, even with smaller price movements.

Benefits of Low Spread FX Brokers

-

Reduced Trading Costs

The most apparent benefit of low spread FX brokers is the significant reduction in trading expenses. Lower spreads translate into smaller expenses, leaving traders with more profit potential. This cost efficiency is particularly advantageous for high-frequency traders who place numerous trades throughout the day or for traders who trade large volumes.

-

Increased Profitability

By minimizing spread expenses, traders can enhance their profitability. Each trade becomes more cost-effective, and traders can retain a larger portion of their earnings. This increased earning potential empowers traders to grow their accounts at a faster pace and achieve their financial objectives.

-

Image: www.ainfosolutions.comEnhanced Trading Execution

Low spreads enable traders to execute trades with greater speed and accuracy. The tighter spreads reduce the risk of slippage, ensuring that trades are executed closer to the intended price. This enhanced trade execution leads to improved performance and reduces uncertainties associated with wide spreads.

-

Competitive Advantage in the Market

In a competitive forex market, traders seek every opportunity to gain an edge. Low spread FX brokers provide traders with a clear advantage by reducing trading costs and enhancing profitability. This edge can make all the difference in volatile market conditions, allowing traders to capitalize on favorable opportunities with greater confidence and precision.

-

Suitability for All Trading Strategies

Low spread FX brokers cater to traders with diverse trading strategies. Whether pursuing scalping, day trading, or swing trading, competitive spreads benefit all approaches. By minimizing transaction costs, traders can tailor their strategies to their desired risk tolerance and profit objectives.

Choosing a Low Spread FX Broker: Essential Considerations

-

Spread Comparison

Thoroughly compare the spreads offered by different brokers. Look for brokers that consistently provide low spreads across major currency pairs. Check for any hidden fees or commissions that may offset the benefits of low spreads.

-

Regulation and Credibility

Choose a broker that is regulated by reputable financial authorities. Verify their credentials and regulatory measures to ensure the safety of your funds and the reliability of their trading services.

-

Customer Support and Service

A responsive and knowledgeable customer support team is essential for a smooth trading experience. Ensure that the broker provides comprehensive support through multiple channels, including live chat, email, and telephone, to address any queries or concerns promptly.

-

Trading Platform and Tools

Inquire about the trading platform offered by the broker. Evaluate its usability, features, and stability. Consider additional tools and resources provided by the broker, such as economic calendars, trading signals, and educational materials.

-

Account Features and Fees

Review the account types offered by the broker. Consider factors such as minimum deposit requirements, margin call levels, and any associated fees, including withdrawal and inactivity fees. Ensure that the broker’s account features align with your trading needs and financial capabilities.

Low Spread Forex Brokers Fxbook

https://youtube.com/watch?v=8laFCJbP-lY

Conclusion: Empowering Traders with Low Spread Forex Brokers

Low spread FX brokers offer traders significant advantages in the competitive forex market. By providing tighter spreads, traders can save on trading costs, maximize their profits, and enhance their overall trading performance. When choosing a low spread FX broker, it is crucial to carefully evaluate factors such as spreads, regulation, customer support, and trading platform. By selecting a broker that meets your needs, you can unlock the full potential of low spread forex trading and excel in the dynamic financial markets.