When venturing into the world of forex trading with a $5,000 account, mastering the art of lot size management becomes crucial for success. A well-calculated lot size can amplify profits while mitigating risks, ensuring a harmonious balance in your trading endeavors. Dive into this comprehensive guide to unravel the intricacies of lot size determination, empowering you to optimize your trading strategies for maximum impact.

Image: www.elevate.in

Defining Lot Size: The Foundation of Forex Trading

In the realm of forex, a lot represents a standardized unit of currency pairs. The most common lot size is the standard lot, equivalent to 100,000 units of the base currency. For instance, in the popular EUR/USD pair, one standard lot represents 100,000 euros. Comprehending lot sizes is paramount as they directly influence the magnitude of your trades and the potential profit or loss associated with them.

Calculating the Ideal Lot Size: A Formula for Success

Determining the optimal lot size for your $5,000 forex account requires careful consideration of several key factors:

-

Risk Tolerance: Assessing your risk tolerance is the cornerstone of responsible trading. Determine the maximum amount of capital you’re willing to potentially lose on any single trade.

-

Account Balance: Your account balance establishes the financial boundaries within which you can trade. Ensure that your chosen lot size aligns with your available capital.

-

Leverage: Leverage, while amplifying profit potential, also magnifies risks. Choose a leverage ratio that complements your risk tolerance and trading strategy.

Once you’ve evaluated these factors, you can employ the following formula to calculate your ideal lot size:

Lot Size = (Account Balance Risk Percentage) / (Pip Value Leverage)

For instance, if your account balance is $5,000, your risk tolerance is 1%, the pip value for the currency pair you’re trading is $10, and you’re using a leverage of 100:1, your calculation would be:

Lot Size = (5000 0.01) / (10 100) = 0.5

This calculation indicates that a lot size of 0.5 is appropriate for your trading parameters.

Fine-Tuning Your Lot Size: Embracing Flexibility

While the formula provides a solid starting point, your lot size should remain flexible, adapting to changing market conditions and your evolving trading strategies. Consider employing smaller lot sizes during periods of high volatility or when testing new strategies. Conversely, you may increase your lot size when market trends favor your positions and you possess a higher degree of confidence.

Image: www.youtube.com

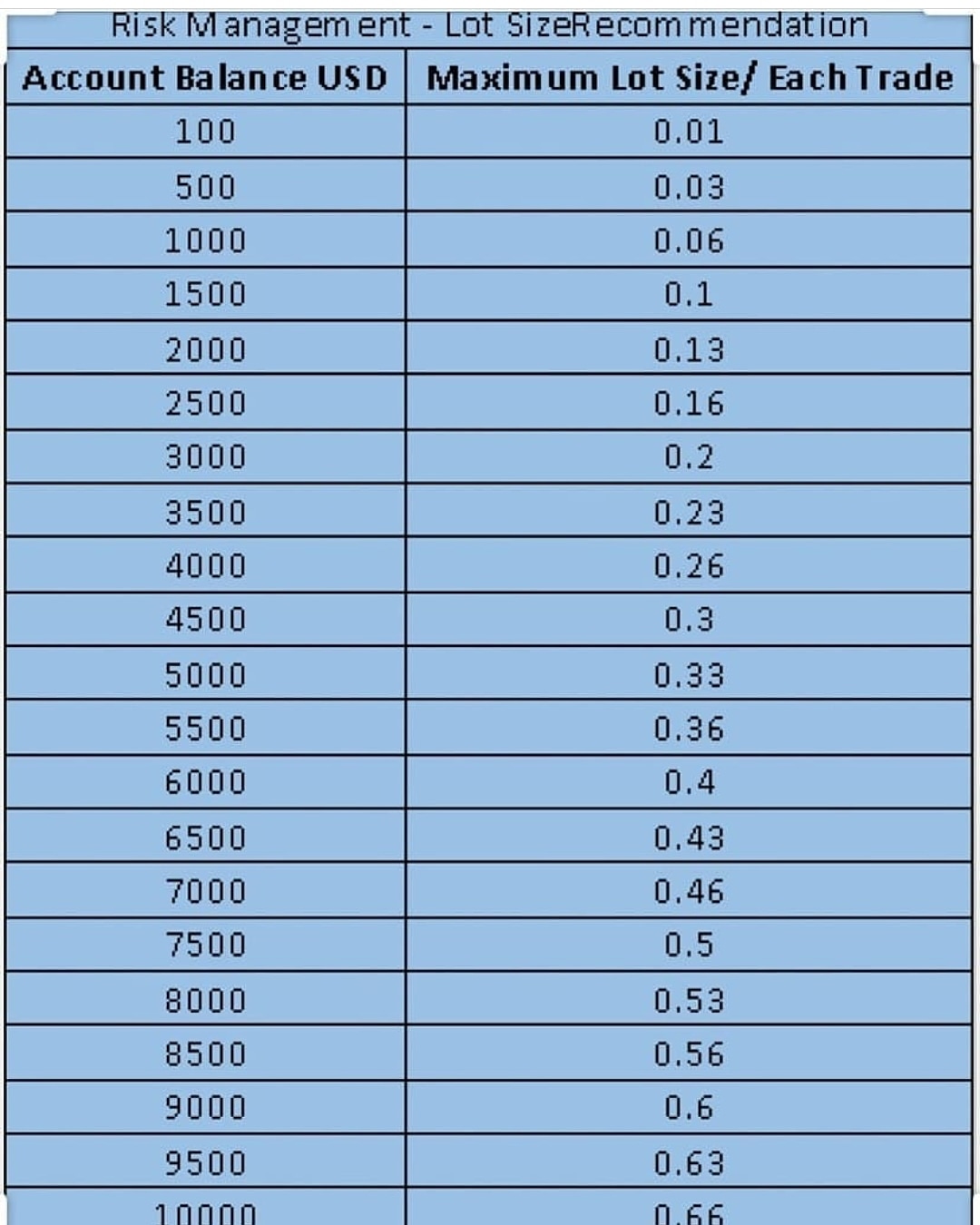

The Significance of Risk Management

Risk management lies at the heart of prudent forex trading. Determining the ideal lot size is an integral part of this process. By carefully calibrating your lot size, you minimize potential losses, preserving your capital and allowing you to stay in the game long-term. Remember, the goal isn’t to maximize profits on every trade but to ensure the sustainability of your trading career.

Lot Size For 5k Forex Account

Conclusion: The Art of Lot Size Mastery

Choosing the ideal lot size for a $5,000 forex account requires a thoughtful blend of calculation and adaptability. By considering your risk tolerance, account balance, leverage, and market conditions, you can optimize your lot sizes to enhance your trading performance. Always prioritize risk management, ensuring your trading journey is marked by informed decisions and sustained success. Embrace the art of lot size mastery, and let it guide you towards your forex trading goals.