Losing a Rupee Every Time You Transfer a Dollar? Uncover the Hidden Costs of Forex

In the realm of international finance, foreign exchange (forex) plays a pivotal role in facilitating cross-border transactions. However, hidden beneath the convenience of transferring funds across currencies lies a subtle yet significant loss that can accumulate over time—the loss of one rupee per dollar. This article delves into the intricacies of this phenomenon, shedding light on its causes, effects, and possible solutions.

Image: blog.iimb.ac.in

Understanding Forex and How it Affects Currency Exchanges

Forex is the global marketplace where currencies are traded. When you transfer money from one currency to another, a forex broker or bank acts as an intermediary, converting one currency to another. However, this conversion process involves a spread, a small difference between the buy and sell prices of the currency. For instance, if the exchange rate is $1 to ₹82.25, you may get a buy rate of ₹81.75 and a sell rate of ₹82.75. This spread represents the broker’s profit.

The Rupee Loss: A Hidden Cost in Forex Transactions

In the case of the rupee, there is an additional layer of loss that arises from the spread between the interbank rate and the retail rate. The interbank rate is the rate at which banks exchange currencies among themselves. However, retail customers are offered a different rate, which includes the broker’s profit and a mark-up by the bank.

Let’s say the interbank rate is $1 to ₹82.10. The bank may offer a retail rate of $1 to ₹82.50. This means that for every dollar you transfer, you lose 40 paise due to the spread between the interbank rate and the retail rate.

Accumulating Losses: The Silent Drain on Your Funds

While the loss of one rupee per dollar may seem insignificant, it can accumulate over time, especially if you make frequent international transfers. For instance, if you transfer $10,000 annually, you would lose ₹10,000 over the year. And this loss is compounded if you transfer larger amounts or make multiple transfers.

Image: brainly.in

Impact of Retail Markup on Forex Transactions

The retail markup charged by banks on forex transactions varies. Some banks offer competitive rates, while others impose higher markups. This variation can further impact the amount you lose on each transaction.

To mitigate these losses, it is crucial to compare forex rates offered by different banks and choose the one with the most favorable rates.

Minimizing Losses: Tips for Smart Forex Transactions

-

Use a Forex Broker: Forex brokers typically offer lower spreads than banks. By choosing a reputable broker, you can reduce the transaction costs.

-

Negotiate the Exchange Rate: If you are making a large transfer, you may be able to negotiate a better exchange rate with your bank or broker.

-

Transfer Larger Amounts Less Frequently: While it may be convenient to make multiple small transfers, aggregating your transfers into larger amounts and doing them less frequently can help you save on spreads.

-

Explore Alternative Transfer Methods: Services like SWIFT GPI and TransferWise offer lower transfer fees and faster transaction times.

-

Be Aware of Hidden Costs: Always check for any transaction fees, hidden spreads, or markups when transferring money.

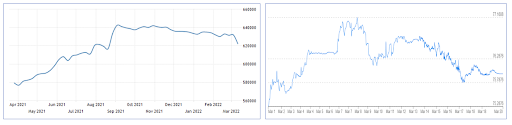

Loss Of One Rupee Per Dollar While Transfer Using Forex

Conclusion

The hidden loss of one rupee per dollar while transferring forex is a subtle but significant issue that can impact your finances. By understanding the mechanisms behind this phenomenon and implementing smart strategies, you can mitigate these losses and ensure that your cross-border transfers are as cost-efficient as possible. Remember, it’s the small losses that often add up to make a big difference in the long run.