Stepping into the realm of foreign exchange, you’ll encounter a multitude of currency pairs. Each pair represents the value of one currency in relation to another. Major and minor forex pairs dominate this market, playing a pivotal role in global trade, investment, and speculation. Understanding these pairs is crucial for any trader navigating the fast-paced forex landscape.

Image: howtotradeonforex.github.io

Classifying Currency Pairs

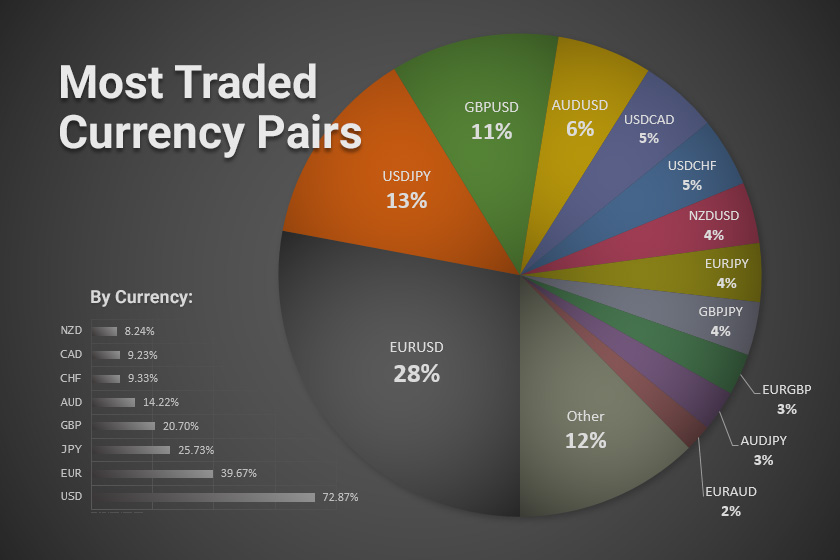

Major forex pairs, as their name suggests, are the dominant forces in the market, consisting of the most commonly traded currencies. They account for the lion’s share of daily trading volume and carry significant influence in shaping global currency values. Minor forex pairs, on the other hand, involve currencies from smaller or less economically developed countries. While they play a lesser role globally, minor pairs offer unique opportunities for traders seeking diversification and specific market exposures.

Major Forex Pairs: The Currency Giants

The “majors” include the following pairs:

- EUR/USD (Euro/U.S. Dollar)

- USD/JPY (U.S. Dollar/Japanese Yen)

- GBP/USD (British Pound/U.S. Dollar)

- USD/CHF (U.S. Dollar/Swiss Franc)

- USD/CAD (U.S. Dollar/Canadian Dollar)

- AUD/USD (Australian Dollar/U.S. Dollar)

- NZD/USD (New Zealand Dollar/U.S. Dollar)

These pairs are highly liquid, meaning they can be traded easily and quickly, with minimal spreads between the buy and sell prices. They exhibit stability, making them less volatile than their minor counterparts. Traders favor major pairs for their reliability and predictable patterns, suitable for both novice and experienced individuals.

Minor Forex Pairs: Exploring Diversification

Minor forex pairs present a more diverse range of trading opportunities. They involve currencies from countries such as South Africa, Brazil, and Mexico, providing exposure to emerging markets. Minor pairs offer traders several benefits:

- Diversification: Minor pairs offer an avenue for spreading risk by investing in currencies outside the major pairs.

- Profitability: While less liquid than major pairs, minor pairs can provide substantial profits if correctly traded.

- Unique Exposures: Minor pairs provide exposure to specific regions and economic trends, which may not be accessible in major pairs.

However, traders must be aware of the increased volatility associated with minor pairs, necessitating a higher level of risk management.

Image: carlfajardo.com

Trading Tips and Expert Advice

Seasoned traders often share valuable insights to enhance your forex journey. Here are some tips and expert advice to heed:

1. Understand the Fundamentals: Study the economic and political factors influencing currency values. Stay updated on news, announcements, and economic reports.

2. Choose a Suitable Strategy: There’s no one-size-fits-all strategy. Explore different trading approaches and identify the one that aligns with your goals and risk tolerance.

3. Manage Risk Effectively: Utilize stop-loss orders and money management techniques to mitigate losses and protect your capital.

4. Be Patient: Building a successful trading career takes time. Avoid impulsive decisions and focus on long-term profitability.

5. Seek Education: Engage in continuous learning through webinars, courses, and market analysis to expand your knowledge and stay ahead of market trends.

Frequently Asked Questions (FAQs)

Q: Which is more profitable, major or minor forex pairs?

A: Profitability is not solely determined by the type of currency pair. Both major and minor pairs offer opportunities for profit, depending on strategy and market conditions.

Q: Is it risky to trade minor forex pairs?

A: Minor pairs present higher volatility compared to major pairs, making them riskier. Traders should exercise caution and employ appropriate risk management strategies.

Q: How many forex pairs are there?

A: Thousands of forex pairs exist, but the most widely traded are the major and minor pairs, comprising approximately 100 pairs.

List Of Major And Minor Forex Pairs

Conclusion

Understanding the major and minor forex pairs provides a solid foundation for successful forex trading. Whether you’re a seasoned trader or just starting your journey, these pairs offer opportunities for profit, diversification, and market insights. By leveraging expert advice and employing sound risk management, you can navigate the forex landscape with confidence and achieve your trading aspirations.

Are you eager to delve deeper into the world of forex trading? Take the next step towards enriching your knowledge by exploring our umfassend resource center.