Introduction:

Foreign Exchange (Forex), the vibrant arena of currency exchange, has become an alluring hunting ground for unscrupulous individuals seeking to prey on unsuspecting investors. India, with its burgeoning financial landscape, has emerged as a notable breeding ground for Forex scams, putting countless individuals at grave financial risk. To combat this insidious menace, it is imperative to recognize the prevalent scams and shield ourselves from their clutches. This comprehensive guide will shed light on the nefarious practices employed by Forex scammers in India, empowering investors with the knowledge to navigate this treacherous terrain.

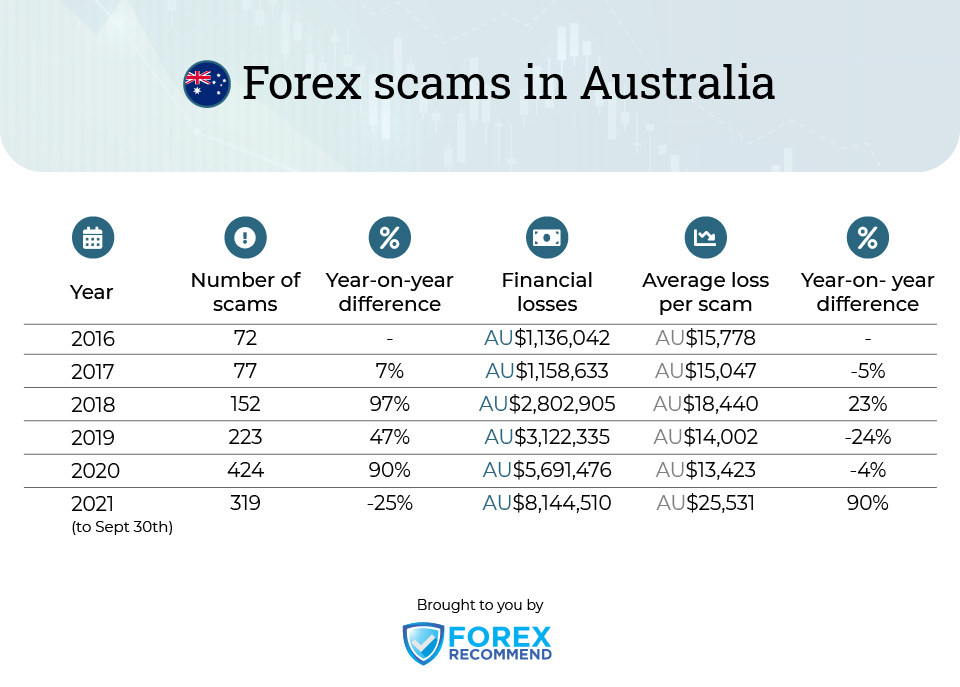

Image: forexrecommend.com

Types of Forex Scams in India:

The Forex scam landscape in India is a labyrinth of deceptive tactics, each designed to lure victims into a false sense of hope. Here are some of the most prevalent schemes:

-

Boiler Room Scams:

Boiler room scams, reminiscent of the infamous Wolf of Wall Street, involve high-pressure sales calls from seemingly legitimate brokerage firms. Armed with slick sales pitches and promises of astronomical returns, these scammers manipulate individuals into investing substantial sums in dubious Forex trading opportunities. Once the investment is made, the fraudsters vanish, leaving the victims high and dry.

-

Ponzi Schemes:

Ponzi schemes are characterized by a pyramid-like structure, where early investors are paid returns derived from funds contributed by newer recruits. The illusion of profitability is maintained until the inflow of new investors slows down, at which point the scheme collapses, leaving the unfortunate victims at the bottom of the pyramid with irrecoverable losses.

-

Image: www.forex.academyGuaranteed High Returns:

Forex scams often lure unsuspecting individuals with the promise of guaranteed high returns, which may seem too good to be true. While Forex trading does offer the potential for profit, it is essential to recognize that unrealistic returns are usually a red flag, indicating a possible scam.

-

Unlicensed Brokers:

In India, legitimate Forex brokers are required to be registered with regulatory bodies such as the Securities and Exchange Board of India (SEBI). Scammers often operate through unlicensed platforms, exploiting the lack of regulatory oversight to defraud unsuspecting investors. It is crucial to verify the authenticity of a brokerage firm before entrusting them with your hard-earned money.

Consequences of Forex Scams:

Falling prey to Forex scams can have devastating consequences for individuals. The financial losses incurred can range from minor setbacks to life-altering catastrophes. The emotional toll is equally significant, as victims often experience feelings of shame, betrayal, and shattered trust. Additionally, Forex scams can damage the reputation of legitimate Forex brokers and hinder the growth of the industry as a whole.

Red Flags to Watch Out for:

Recognizing the telltale signs of Forex scams is paramount to protecting oneself from financial ruin. Here are some red flags to be wary of:

-

High-Pressure Sales Tactics:

If a brokerage firm exerts undue pressure or employs aggressive sales tactics, it is a clear sign to proceed with caution. Legitimate brokers understand that investment decisions should be made after careful consideration and will provide ample time for research and due diligence.

-

Unrealistic Promises:

Promises of guaranteed or astronomical returns should be met with skepticism. Forex trading involves inherent risks, and any broker who claims to eliminate them or offer risk-free profits is most likely operating fraudulently.

-

Lack of Regulation:

As mentioned earlier, Forex brokers in India must be registered with SEBI. If a broker operates without the necessary regulatory oversight, it raises serious doubts about their legitimacy.

-

Unsolicited Contact:

Receiving unsolicited emails, phone calls, or social media messages from individuals claiming to be Forex brokers is a strong indication of a potential scam. Legitimate brokers typically do not initiate unsolicited contact with prospective clients.

How to Avoid Forex Scams:

Prevention is always better than cure. Here are some proactive steps to safeguard oneself from Forex scams:

-

Educate Yourself:

Knowledge is power, especially when it comes to protecting oneself from financial fraud. Take the time to educate yourself about Forex trading, its risks, and the regulatory landscape. This knowledge will empower you to make informed decisions and spot red flags.

-

Choose a Reputable Broker:

When selecting a Forex broker, it is crucial to conduct thorough research. Ensure that the broker is registered with a reputable regulatory body such as SEBI in India. Check online reviews and testimonials to gather insights into the broker’s reputation and track record.

-

List Of Forex Scams In India

Be Wary of Unsolicited Offers:

As mentioned earlier, unsolicited contact from individuals claiming to be Forex brokers is a major red flag. Never provide personal or financial information to such individuals and report them to the appropriate authorities.