Introduction

In the ever-evolving realm of finance, streamlining your financial obligations has become paramount. One such hassle-軽減ing measure is linking your Aadhaar card to your HDFC Forex account for swift and effortless foreign exchange transactions. This article delves into the world of Aadhaar-HDFC Forex linkage, deciphering its importance, benefits, and step-by-step instructions for seamless implementation.

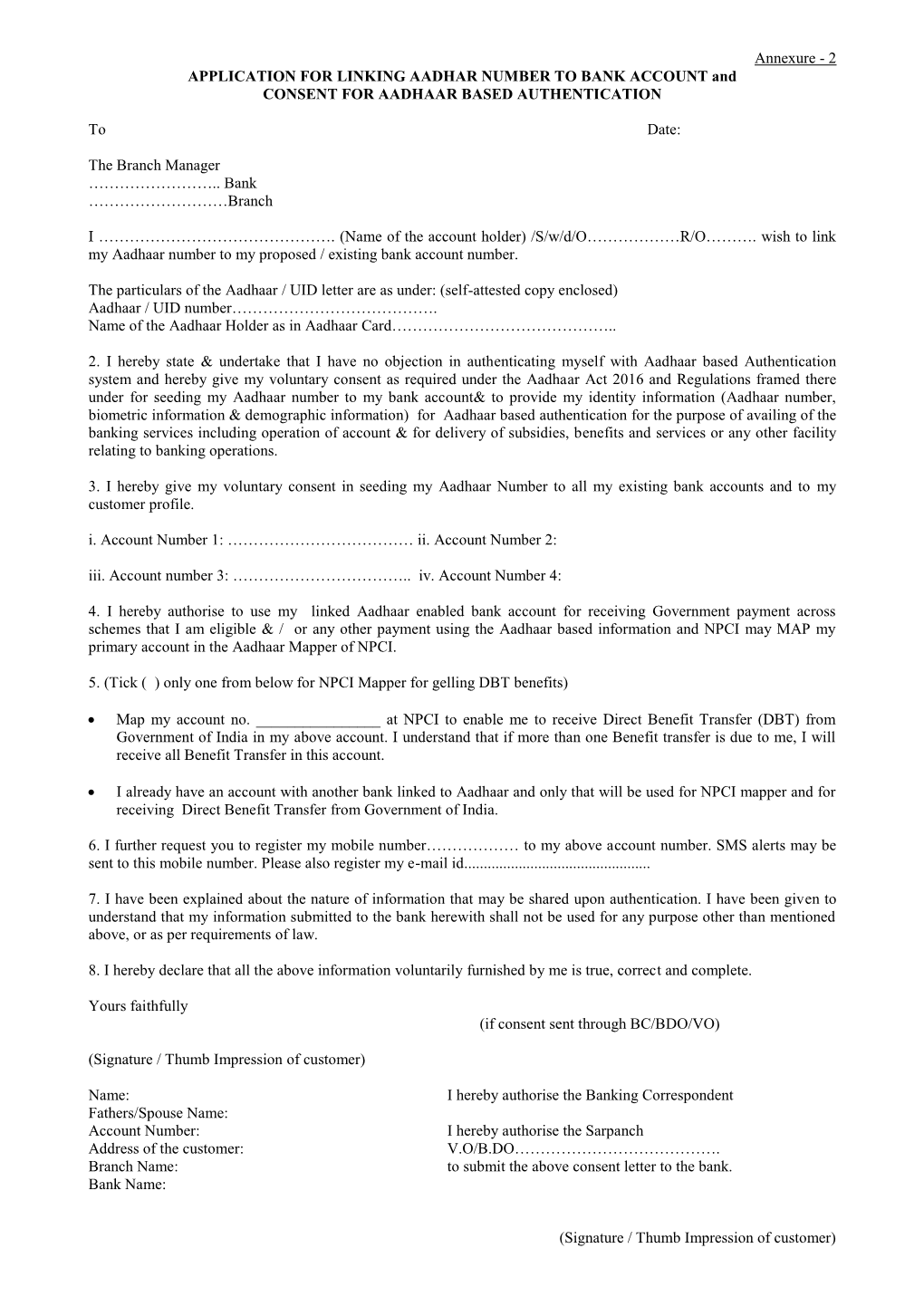

Image: docslib.org

Understanding Aadhaar and HDFC Forex Services

Aadhaar, India’s unique identification system, serves as a repository of personal data linked to a 12-digit unique identification number. This number, coupled with biometric information, enables seamless identity and address verification processes across various domains, including banking and financial services.

HDFC Forex, a subsidiary of HDFC Bank, facilitates hassle-free foreign exchange services such as currency exchange, remittance, and travel-related financial assistance. By integrating Aadhaar’s robust identity verification mechanism, HDFC Forex streamlines its customer onboarding and transaction processes, enhancing convenience and security.

Benefits of Linking Aadhaar to HDFC Forex

-

Swift and Seamless Transactions: Integrating Aadhaar with HDFC Forex eliminates the need for physical document submission, significantly expediting the transaction process. Transactions are processed instantly, ensuring timely access to foreign exchange services.

-

Enhanced Security: Aadhaar’s robust authentication protocols add an additional layer of security to your HDFC Forex transactions. The biometric authentication process minimizes the risk of identity fraud, providing peace of mind.

-

Simplified Documentation: By linking your Aadhaar, you eliminate the hassle of submitting multiple physical documents for KYC verification. This streamlined documentation process saves time and effort, making foreign exchange transactions more convenient.

-

Convenience at Your Fingertips: With Aadhaar-based authentication, you can access HDFC Forex services through their online and mobile banking platforms. This eliminates the need for in-person visits, allowing you to manage your forex needs anytime, anywhere.

How to Link Aadhaar to HDFC Forex

To connect your Aadhaar with your HDFC Forex account, follow these simple steps:

-

Visit HDFC Forex Branch: Visit the nearest HDFC Forex branch with original KYC documents (Aadhaar card, PAN card, passport, etc.).

-

Submit KYC Details: Submit your KYC documents to the HDFC Forex representative and provide your Aadhaar number.

-

Biometric Authentication: Undergo the biometric authentication process (fingerprint scan and iris scan) for Aadhaar verification.

-

Aadhaar Verification: HDFC Forex will verify your Aadhaar details with the UIDAI database and link it to your forex account.

-

Confirmation: Upon successful verification, you will receive a confirmation message and your Aadhaar will be linked to your HDFC Forex account.

Image: tradingqna.com

Linking Aadhar To Hdfc Forex

Conclusion

Linking your Aadhaar card to your HDFC Forex account offers a plethora of benefits, including expedited transactions, enhanced security, streamlined documentation, and convenient access. Whether you’re planning an overseas trip, studying abroad, or fulfilling global business obligations, HDFC Forex, coupled with the Aadhaar-based authentication system, empowers you with a secure and efficient platform for all your foreign exchange requirements. Embrace this seamless integration and unlock a world of hassle-free financial transactions.