Navigating the dynamic world of forex trading requires a keen understanding and utilization of effective strategies. One such strategy involves the judicious use of the 1:1000 calculation, which serves as a pivotal tool for managing risk and maximizing potential returns.

Image: tradingonlineguide.com

The 1:1000 calculation is a simple yet powerful formula utilized to determine the optimal trade volume for a given account balance. Calculated as 1% of the account balance per pip of risk, this metric ensures that traders avoid overleveraging their accounts, a prevalent pitfall that can lead to substantial losses.

Defining the 1:1000 Calculation

The 1:1000 calculation is rooted in the concept of risk management. In forex trading, each currency pair fluctuates constantly against each other, and these fluctuations are measured in pips (percentage in points). One pip represents the smallest price movement possible, typically 0.0001 for most currency pairs.

By adhering to the 1:1000 calculation, traders essentially limit their risk exposure to 1% of their account balance per pip. This cautious approach ensures that even in unfavorable market conditions, their losses remain manageable, preserving the longevity of their trading capital.

Example of the 1:1000 Calculation

To illustrate the practical application of the 1:1000 calculation, consider a trader with an account balance of $10,000. Using the formula, the trader can calculate the appropriate trade volume for a given trade setup as follows:

- 1% of $10,000 = $100 (amount risked per pip)

- $100 / 0.0001 (pip value) = 1,000,000 (lot size in units)

Therefore, the trader would trade with a lot size of 1,000,000 units, which equates to 10 standard lots.

Benefits of Using the 1:1000 Calculation

Incorporating the 1:1000 calculation into one’s trading strategy offers numerous advantages, including:

- Risk Management: By limiting risk exposure to a manageable level, traders safeguard their account balance against significant drawdowns.

- Capital Preservation: The 1:1000 calculation enables traders to preserve their trading capital, ensuring they have sufficient funds to capitalize on future opportunities.

- Psychological Well-being: Trading with appropriate risk management measures reduces stress and anxiety, fostering a more positive trading mindset.

Image: www.forexblog.org

Tips for Effective Use of the 1:1000 Calculation

To maximize the efficacy of the 1:1000 calculation, traders should consider the following tips:

- Calculate Accurately: Ensure that the calculation is performed correctly to avoid unnecessary risks.

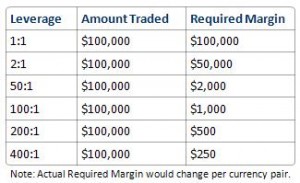

- Factor in Leverage: Adjust the calculation based on the leverage being used, which varies across different brokers.

- Consider Market Volatility: In volatile market conditions, traders may opt for a more conservative approach by reducing the calculated trade volume.

FAQs on the 1:1000 Calculation for Forex Trading

- What purpose does the 1:1000 calculation serve?

The 1:1000 calculation determines the appropriate trade volume for a given account balance, limiting risk exposure to 1% of the account balance per pip.

- Why is risk management essential in forex trading?

Risk management is crucial to avoid overleveraging and preserve trading capital, protecting against substantial losses.

- How does the 1:1000 calculation benefit traders?

Traders utilizing the 1:1000 calculation reduce risk, preserve capital, and enhance psychological well-being.

Leverage 1 1000 Calculation Forex Time

Conclusion

In the highly competitive realm of forex trading, the judicious use of the 1:1000 calculation empowers traders to navigate market fluctuations with greater confidence and control. By meticulously implementing this risk management strategy, traders can optimize their trade volume, preserve their capital, and increase the likelihood of achieving long-term trading success.

Would you like to learn more about the 1:1000 calculation and its application in forex trading? Join our community of traders today for exclusive insights, strategies, and resources to elevate your trading journey.