In today’s interconnected world, where borders blur and global trade flourishes, understanding foreign exchange (forex) is no longer an arcane pursuit. Forex, the vast and vibrant marketplace where currencies are traded, holds immense significance for individuals, businesses, and economies alike. With a reliable forex account in your bank, you can navigate the complexities of international transactions, seize lucrative opportunities, and protect your financial interests in an increasingly volatile global scenario.

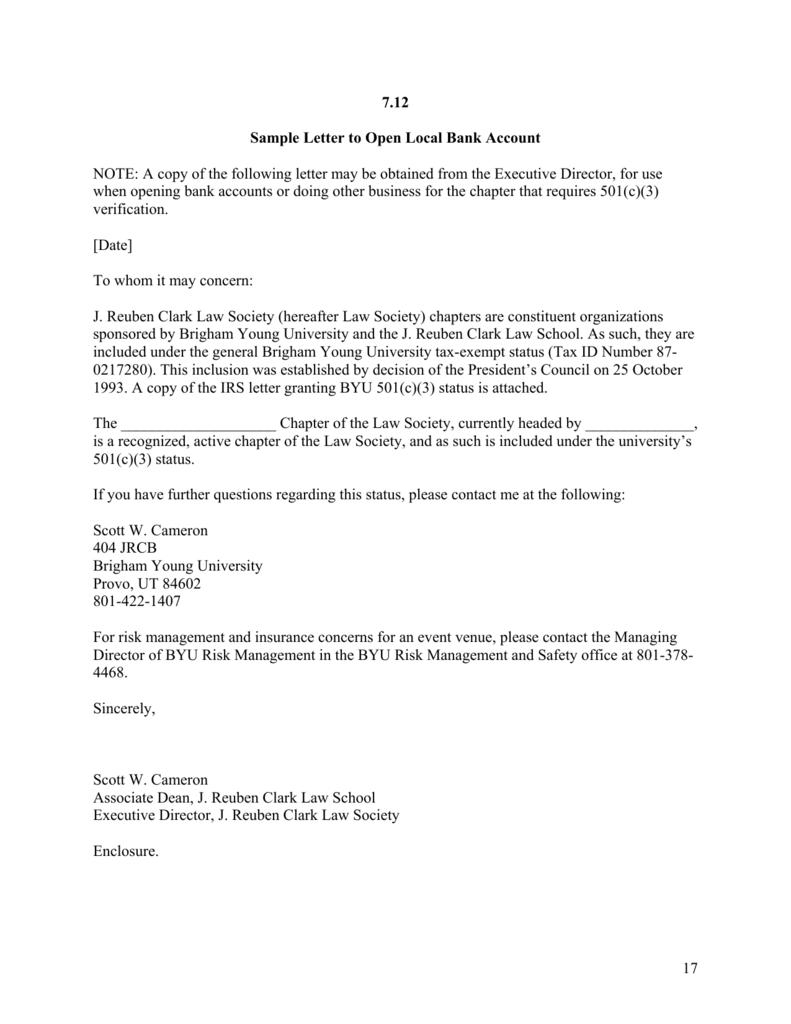

Image: studylib.net

Charting the Course to Forex Account Establishment

Opening a forex account is akin to embarking on an exciting journey into the realm of global finance. The process is surprisingly straightforward, often requiring just a few steps:

- Choose Your Navigational Compass: Selecting a Reputable Bank

Your forex account will be the vessel that carries your financial aspirations in the choppy waters of the currency market. Thus, selecting a credible, well-established bank with a proven track record in forex trading is paramount. Consider factors such as the bank’s regulatory compliance, security measures, customer service, and the trading platform it offers.

- Embarking on the Account Opening Voyage

Contact the chosen bank and inquire about their forex account offerings. Typically, you will be required to provide personal and financial information for account verification purposes. This includes your identification documents, proof of address, and bank account details.

- Setting Sail into the Market: Funding Your Account

Once your account is established, you need to inject it with funds, which serve as your capital for forex trading. Banks may offer various funding options, such as wire transfers, online banking, or credit/debit card payments.

Understanding the Forex Account Vocabulary

As you navigate the forex waters, it’s essential to familiarize yourself with some key terms:

-

Base Currency: The currency in which the account is denominated, typically your local currency.

-

Quote Currency: The currency being bought or sold against the base currency, usually displayed as a currency pair (e.g., EUR/USD).

-

Spread: The difference between the bid and ask prices, representing the bank’s profit on the transaction.

-

Leverage: A tool that allows you to trade with more capital than you have, potentially amplifying both profits and losses.

The Treasures of Forex Trading

Forex trading offers a treasure trove of opportunities. Whether you seek to:

-

Hedge Currency Risks: Protect your assets from fluctuations in exchange rates.

-

Take Advantage of Currency Movements: Buy and sell currencies at strategic moments to profit from their price changes.

-

Diversify Your Investment Portfolio: Spread your investments across different asset classes, including forex, to reduce overall risk.

With a solid understanding of the market and a dependable forex account, you can unlock these treasures and embark on a rewarding financial adventure.

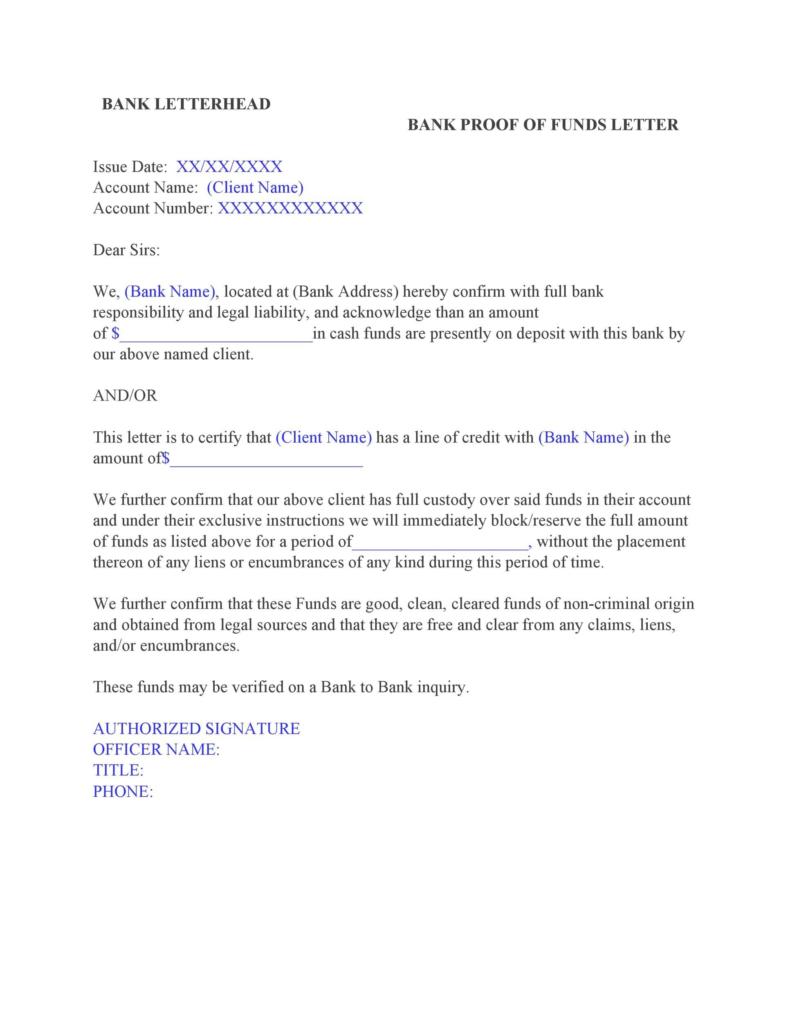

Image: templatelab.com

Riding the Forex Waves with Expert Guidance

Navigating the forex market successfully requires not only knowledge but also sound advice. Seek mentorship from experienced forex traders or financial advisors who can provide valuable insights, trading strategies, and risk management techniques. By leveraging their expertise, you can navigate the market’s complexities with greater confidence.

Letter For Open New Forex Account In Bank

Conclusion

Establishing a forex account in your bank is like acquiring a passport to the global currency market. It empowers you to participate in one of the most dynamic and lucrative financial arenas, offering opportunities to protect your assets, capitalize on market movements, and diversify your investment portfolio. By choosing a reputable bank, understanding forex terminology, and seeking expert guidance, you can embark on a rewarding financial journey in the vast realm of forex.