I remember the first time I saw a candlestick chart. My broker had sent it to me as part of a technical analysis package, and I was immediately drawn to the visual appeal of the charts. However, the technical jargon and complex patterns seemed like an insurmountable obstacle at the time.

Image: www.publish0x.com

If you’re in a similar boat, don’t worry—I’m here to break down everything you need to know about candlestick support and resistance. By the end of this guide, you’ll be able to use these patterns to identify potential trading opportunities and make better-informed trading decisions.

What Are Candlestick Charts?

Candlestick charts are a type of technical analysis tool that helps us to visualize price movements and identify trends. They are composed of consecutive candlesticks, each of which represents a specific period of time, such as a day, week, or month.

The body of the candlestick is formed by the difference between the open and close prices. If the candle is green (white), it indicates that the close price was higher than the open price. If the candle is red (black), it indicates that the close price was lower than the open price. The wicks (or “shadows”) represent the high and low prices of the period.

Support and Resistance in Candlesticks

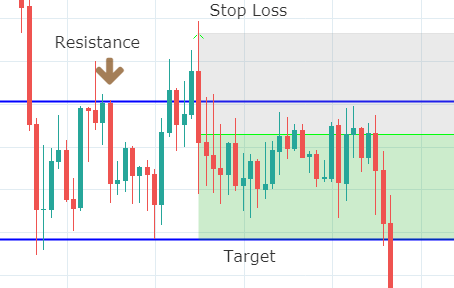

In technical analysis, support is a price level at which a downtrend is believed to end and an uptrend is believed to begin. Conversely, resistance is a price level at which an uptrend is believed to end and a downtrend is believed to begin.

Support and resistance levels are often identified by looking at historical price data and identifying areas where price has repeatedly reversed direction. For example, a previous resistance level may become a support level in the future, and vice versa.

How to Identify Support and Resistance Levels Using Candlesticks

There are a number of candlestick patterns that can be used to identify support and resistance levels. Some of the most common include:

- Bullish Engulfing Pattern

- Bearish Engulfing Pattern

- Hammer

- Hanging Man

- Shooting Star

To learn more about these patterns and how to identify them on a candlestick chart, be sure to refer to my comprehensive guide to candlestick patterns.

Image: www.forex.academy

Tips and Expert Advice for Using Candlesticks

Here are some tips and expert advice for using candlesticks effectively:

- Consider the context. Support and resistance levels are more reliable when they are formed over multiple time frames.

- Risk Management: Remember to set appropriate stop-loss levels and implement a risk management plan before you trade.

- Keep Your Emotions in Check: Trading can be an emotional rollercoaster, so it’s important to keep your emotions in check and never risk more than you can afford to lose.

- Use Multiple Technical Indicators: Candlesticks are a powerful tool, but they should be used in conjunction with other technical indicators to improve accuracy, such as moving averages, relative strength index (RSI), and stochastic oscillator.

FAQs About Candlestick Support and Resistance

Here are some of the most frequently asked questions about candlestick support and resistance:

- What are the strongest support and resistance levels?

The strongest support and resistance levels are those that have been tested multiple times and have held up over time. - How can I use support and resistance to trade?

You can use support and resistance levels to identify potential trading opportunities. When the price of an asset is near a support level, it may be a good time to buy. When the price is near a resistance level, it may be a good time to sell. - Should I always trade according to support and resistance levels?

Support and resistance levels are a valuable tool for technical analysis, but they are not foolproof. It is important to consider other factors, such as the overall market trend, before making any trading decisions. - How Do I Know When a Support or Resistance Level Has Broken? A key way is to look for volume – if the price passes through the level on higher-than-average volume it could be a sign of a genuine breakout.

Candlestick Support And Resistance

Conclusion

Candlestick charts are a versatile tool that can be used to identify support and resistance levels, which can be valuable for identifying potential trading opportunities.

Keep in mind that on their own, candlestick patterns are not always reliable. Combining them with other technical analysis tools and indicators is often advisable for more accurate results.

So, are you ready to start using candlesticks to trade? Just remember to trade responsibly, and good luck!