Introduction

In the intricate world of foreign exchange (forex) trading, the concept of leading and lagging forex payment discounts plays a crucial role in optimizing profits and managing financial risks. This article delves deep into this fascinating topic, equipping you with a comprehensive understanding of how these discounts work, their advantages, and strategic applications. Let’s embark on this journey to master the art of forex payment discounts and unlock enhanced financial outcomes.

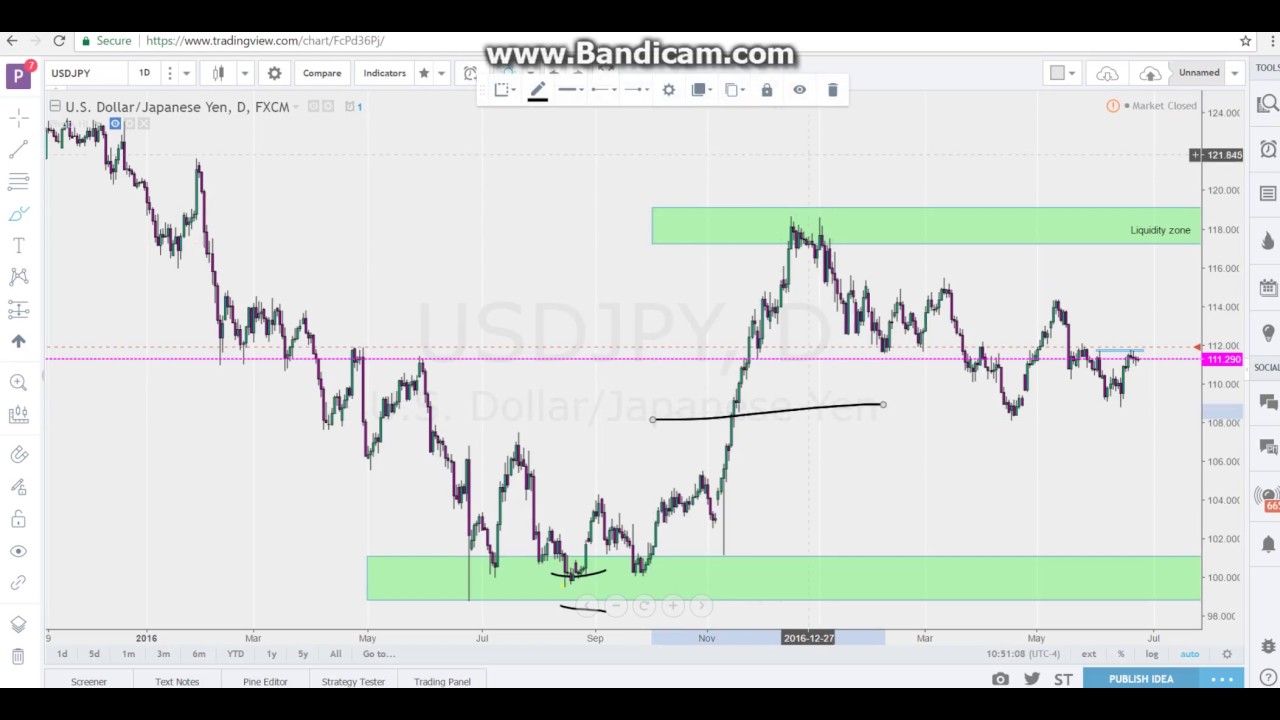

Image: haipernews.com

Understanding Leading and Lagging Forex Payment Discounts

Leading and lagging forex payment discounts refer to payment arrangements where the import or export of goods and services is settled on a date that differs from the original invoice date. These payment discounts offer a flexible and strategic way to manage cash flow, reduce transaction costs, and optimize foreign exchange risk.

- Leading Payment Discounts: In a leading payment discount arrangement, the importer agrees to pay for the goods or services before the invoice date. This early payment entitles the importer to a discount on the total amount due. These discounts are typically offered by suppliers to encourage early settlement and speed up cash flow.

- Lagging Payment Discounts: Conversely, in a lagging payment discount arrangement, the importer secures a discount by paying for the goods or services after the invoice date. This delay in payment provides the importer with extended credit and can be strategically used to offset fluctuations in foreign exchange rates.

Advantages of Utilizing Forex Payment Discounts

Leading and lagging payment discounts offer several key advantages for businesses involved in international trade:

Financial Benefits:

- Reduced transaction costs through discounted exchange rates

- Improved cash flow by accelerating payments (leading) or delaying payments (lagging)

- Mitigation of foreign exchange risk by locking in exchange rates in advance

Operational Benefits:

- Enhanced supplier relationships by offering incentives for early payment

- Simplified import and export processes by streamlining payment schedules

- Improved financial visibility through better control of cash flows

Strategic Applications of Forex Payment Discounts

Businesses can employ leading and lagging payment discounts strategically to achieve specific financial objectives:

Boosting Profits: Leading payment discounts can significantly increase profitability by securing lower exchange rates. This strategy is particularly beneficial when the importer anticipates the exchange rate to rise in the future.

Managing Currency Risk: Lagging payment discounts provide a hedge against currency fluctuations. By delaying payments, importers can wait for a more favorable exchange rate, reducing the impact of adverse currency movements.

Optimizing Cash Flow: Leading payment discounts accelerate cash flow, providing importers with earlier access to funds. Lagging payment discounts, on the other hand, extend credit and improve liquidity management.

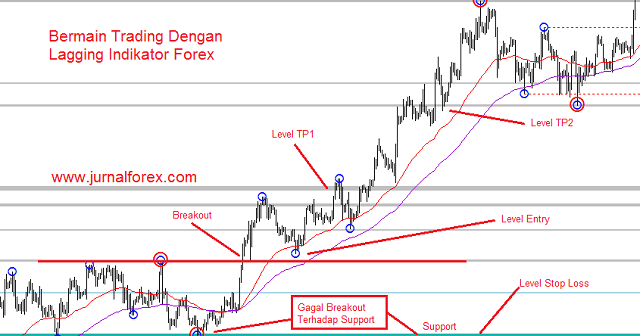

Image: www.jurnalforex.com

Expert Insights and Real-Life Case Studies

International trade expert, Dr. Emily Carter, emphasizes the importance of understanding the interplay between forex payment discounts and market dynamics. “By leveraging timely market intelligence and rigorous analysis, businesses can identify optimal discount opportunities and avoid potential risks,” she advises.

Industry analysts cite the example of a multinational manufacturing company that successfully used leading payment discounts to secure a 3% discount on a large import order. This discount translated into significant cost savings and improved profitability.

Leading And Lagging Forex Payment Discount By Supplier

https://youtube.com/watch?v=2uuAaK4jUDk

Conclusion

Leading and lagging forex payment discounts offer a powerful tool for businesses engaged in international trade. By understanding the mechanics and advantages of these payment arrangements, importers and exporters can maximize profits, mitigate risks, and streamline their financial operations. While the strategic application of these discounts requires careful consideration and market knowledge, the potential rewards can be substantial. Embrace the insights shared in this comprehensive guide and explore the world of forex payment discounts to unlock unprecedented opportunities for your business.