Leveraging the Last Traded Price: A Guide to Precision Trading in Forex

Image: www.mql5.com

In the dynamic world of forex trading, precision is paramount. Traders navigate a vast ocean of market data, relying on every available tool to make informed decisions and maximize their potential. Among these essential tools, the last traded price stands tall, offering an invaluable window into market sentiment and providing traders with a solid foundation for strategic execution.

What is the Last Traded Price?

The last traded price, often abbreviated as LTP, represents the most recent price at which a currency pair was transacted in the forex market. Think of it as the final closing price, marking the end of one trading cycle and the beginning of the next. The LTP serves as a real-time snapshot of the current market value, reflecting the interplay of supply and demand.

Significance of the Last Traded Price

The LTP holds immense significance for forex traders, providing a gauge of market sentiment and acting as a vital reference point for decision-making. By closely observing the LTP, traders can discern the overall direction of the market and anticipate potential price movements.

For example, a steady rise in the LTP indicates an increase in buyers’ activity, suggesting that the market is bullish. Conversely, a sharp drop in the LTP signals increased selling pressure, indicating a bearish market condition.

Leveraging the LTP for Trading Success

Skilled traders utilize the LTP to refine their trading strategies and increase their profitability. Here are a few ways traders can leverage the LTP effectively:

1. Trend Identification: The LTP plays a crucial role in identifying market trends. When the LTP consistently moves in one direction, it indicates a well-defined trend. Traders can capitalize on these trends by aligning their trades with the prevailing market sentiment.

2. Market Entry and Exit Points: The LTP provides optimal entry and exit points for trades. By studying the historical LTP movements, traders can pinpoint areas of support and resistance, which act as potential turning points for the market.

3. Confirmation of Support and Resistance Levels: The LTP helps confirm the validity of support and resistance levels, critical levels that determine potential trade reversals. A consistent bounce at a support level or a sharp decline at a resistance level, corroborated by the LTP, increases traders’ confidence in making strategic decisions.

4. Scalping Techniques: The LTP is essential for scalpers, who execute numerous small-profit trades over short periods. The LTP provides a continuous stream of price information, enabling scalpers to swiftly react to even the slightest price fluctuations.

Conclusion

The last traded price (LTP) is an indispensable tool for forex traders, providing a real-time snapshot of market sentiment and offering valuable insights for decision-making. By incorporating the LTP into their trading strategies, traders can gain a competitive edge, identify profitable opportunities, and navigate the ever-evolving forex market with greater precision and confidence.

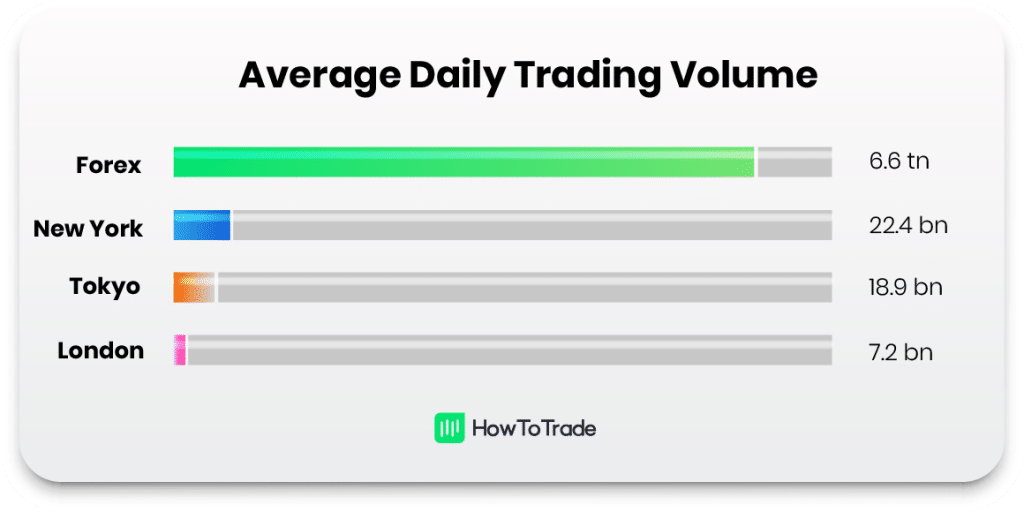

Image: howtotrade.com

Last Traded Price In Forex Mql