Travel enthusiasts, international business travelers, and frequent overseas shoppers, take note! Karur Vysya Bank’s Forex Card is your key to seamless financial transactions during your global adventures. In this comprehensive guide, we’ll unravel the intricacies of this invaluable travel companion, empowering you to navigate the world with confidence.

Image: www.youtube.com

Your Gateway to International Transactions

Karur Vysya Bank’s Forex Card is a prepaid, internationally accepted card designed specifically for foreign currency transactions. With this versatile card in your wallet, you can make purchases, withdraw cash, and access your funds conveniently at ATMs or PoS terminals worldwide. Say goodbye to the hassles of exchanging currency or carrying large amounts of cash, and embrace the ease and security of the Forex Card.

Benefits Galore: Why Switch to a Forex Card?

- Zero Hidden Costs: Enjoy transparent transactions without any hidden charges or exchange rate markups, maximizing your savings.

- Competitive Exchange Rates: Benefit from competitive exchange rates, ensuring you get the best value for your money.

- Ease of Use: No need to carry multiple currencies or exchange money at unfavorable rates. Simply load your Forex Card with the currency you need and make transactions with ease.

- Global Acceptance: Accepted at millions of merchant locations and ATMs around the world, the Forex Card provides unparalleled convenience for your international travels.

- Cashless Transactions: Reduce the risk of theft or loss by using the Forex Card for most transactions, keeping your cash safe.

- Real-time Tracking: Monitor your transactions and card balance in real-time, ensuring complete control over your finances.

Understanding the Nuances: Definition, History, and Significance

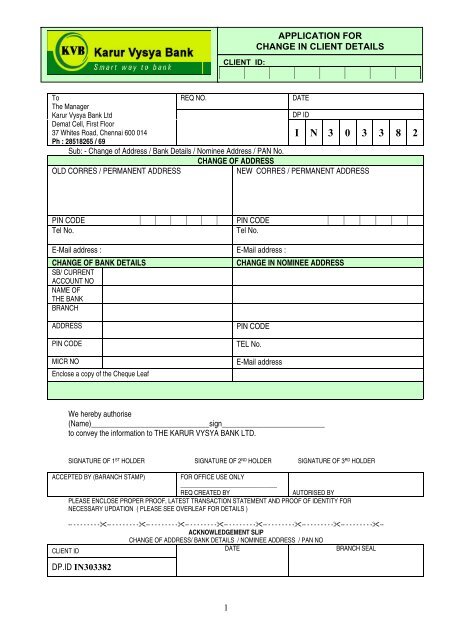

Image: www.yumpu.com

Definition:

A Forex Card is a multi-currency prepaid card that allows you to store multiple currencies on a single card. It is specially designed to facilitate international transactions, eliminating the need for traditional cash or traveler’s checks.

History:

Forex Cards originated in the 1990s as a more secure and convenient alternative to carrying large amounts of cash during international travel. They gained popularity due to their ease of use, competitive exchange rates, and global acceptance.

The Forex Market: A Snapshot

The foreign exchange market (Forex) is a vast and dynamic global market where currencies are traded. When you use a Forex Card to make a transaction in a foreign currency, your card issuer converts the amount from the loaded currency into the required currency at the prevailing exchange rate.

Types of Forex Cards:

Forex Cards come in two primary types:

- Single-currency Cards: These cards can only hold and transact in a single foreign currency, typically chosen based on your travel destination.

- Multi-currency Cards: As the name suggests, these cards allow you to store and transact in multiple currencies, providing greater flexibility and convenience for global travelers.

Expert Tips and Advice: Maximizing Your Forex Card Experience

To make the most of your Forex Card, follow these expert tips:

- Choose the Right Card: Select a card that aligns with your travel needs and currency requirements.

- Compare Exchange Rates: Research and compare exchange rates offered by different card issuers to find the best deals.

- Pre-load Wisely: Determine your estimated expenses and load your card with an appropriate amount to avoid excessive currency conversion fees.

- Keep Track of Your Transactions: Regularly monitor your transactions and balance to stay informed and avoid any unauthorized usage.

FAQs: Addressing Your Queries

Q: What are the charges associated with using a Forex Card?

A: Most Forex Cards charge a one-time issuance fee, as well as a small percentage fee for each transaction. Some cards may also charge exchange rate markups, so it’s important to compare different options before choosing a card.

Q: Can I withdraw cash with a Forex Card?

A: Yes, you can withdraw cash from ATMs using your Forex Card. However, there may be a withdrawal fee charged by both your card issuer and the ATM operator, so it’s advisable to withdraw larger amounts at a time to minimize charges.

Q: Do Forex Cards offer any security features?

A: Most Forex Cards are equipped with chip and PIN technology, providing enhanced security. Additionally, they offer features like real-time transaction notifications and fraud detection, ensuring the safety of your funds.

Karur Vysya Bank Forex Card

Conclusion: The Forex Card Advantage

If you’re planning a trip overseas, consider getting a Karur Vysya Bank Forex Card to streamline your financial transactions while enjoying peace of mind. With its competitive exchange rates, global acceptance, and user-friendly features, the Forex Card is an indispensable travel companion, empowering you to navigate the world with ease.

So, are you ready to unlock the benefits of a Forex Card? Visit your nearest Karur Vysya Bank branch or apply online today to experience the world without financial barriers.