Embark on the Thrilling Journey of Forex Trading in South Africa

Image: 24forex.co.za

Are you ready to delve into the world of forex trading and unlock the potential to generate substantial profits? South Africa presents an excellent platform for forex enthusiasts, offering a dynamic and lucrative market. However, navigating the complexities of forex trading requires knowledge, skill, and the right guidance. Join us as we explore the multifaceted world of forex trading in South Africa, providing you with the essential foundation to achieve success in this thrilling arena.

Unveiling the Realm of Forex Trading

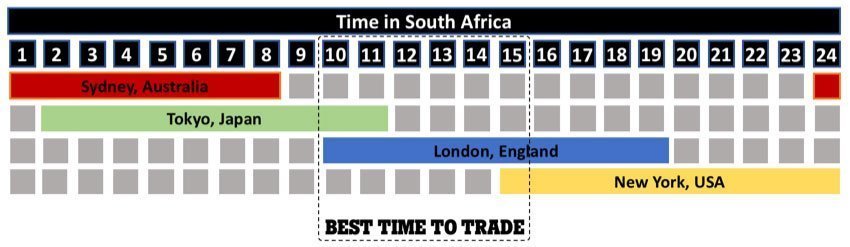

Forex, short for foreign exchange, involves the buying and selling of currencies from different countries. It’s the world’s most liquid and largest financial market, with a daily trading volume exceeding $5 trillion. The forex market operates 24 hours a day, five days a week, allowing traders to capitalize on market movements around the globe.

In South Africa, forex trading has gained immense popularity due to its accessibility, growth potential, and the opportunity to earn substantial returns. Whether you’re a seasoned trader or a curious novice, this comprehensive guide will equip you with the knowledge and insights necessary to navigate the forex market effectively.

Navigating Forex Trading in South Africa: A Step-by-Step Journey

1. Choose a Reliable Forex Broker:

Selecting a reputable and regulated forex broker is paramount to your trading success. Look for brokers with a solid track record, competitive spreads, and advanced trading platforms. Ensure they comply with industry regulations and offer secure account management.

2. Build a Solid Foundation of Knowledge:

Forex trading is not a get-rich-quick scheme. It requires in-depth knowledge of market dynamics, technical analysis, and risk management. Dedicate time to studying market trends, familiarizing yourself with trading strategies, and practicing on a demo account.

3. Determine Your Risk Tolerance:

Before embarking on forex trading, it’s crucial to assess your risk tolerance. This involves understanding how much you’re willing to lose in pursuit of potential gains. Align your trading decisions with your risk tolerance to mitigate losses and preserve capital.

4. Develop a Trading Strategy:

A well-defined trading strategy is the backbone of successful forex trading. Determine your trading style, identify trading opportunities, and establish clear entry and exit points. Stick to your strategy meticulously to avoid emotional decision-making and enhance profitability.

5. Manage Your Risk Wisely:

Risk management is key to safeguarding your capital and managing potential losses. Employ stop-loss orders to limit downside risk, set realistic profit targets, and diversify your portfolio across multiple currency pairs. Never risk more than you can afford to lose.

Unveiling the Power of Technical Analysis

Technical analysis plays an integral role in forex trading. By studying historical price data, traders can identify patterns and trends to forecast future market movements. Common technical analysis tools include candlestick charts, moving averages, and indicators like the relative strength index (RSI) and Bollinger Bands.

While technical analysis provides valuable insights, it’s important to remember that it’s not an exact science. Always combine technical analysis with fundamental analysis, which considers economic and geopolitical factors, for a more comprehensive market understanding.

Image: www.facebook.com

Understanding the South African Forex Market

The South African forex market is unique in several ways. The rand (ZAR) is highly sensitive to economic news and political developments, making it susceptible to volatility. Due to South Africa’s reliance on commodity exports, the rand tends to move in tandem with commodity prices.

Additionally, the South African Reserve Bank (SARB) plays a significant role in regulating the forex market and managing inflation. Understanding SARB’s monetary policy decisions and economic indicators can provide valuable context for making informed trading decisions.

Embracing the Forex Trading Ecosystem in South Africa

South Africa boasts a thriving forex trading ecosystem. Several local and international brokers cater to traders of all experience levels. The Johannesburg Stock Exchange (JSE) offers futures and options contracts on popular currency pairs, providing alternative ways to trade forex.

Furthermore, educational resources and trading communities abound in South Africa, enabling traders to refine their skills and connect with like-minded individuals. Webinars, seminars, and online forums provide opportunities for continuous learning and networking within the forex trading community.

Just Learn Forex South Africa

Conclusion: Unlocking Your Forex Trading Potential

Foreign exchange trading in South Africa presents a wealth of opportunities for savvy traders. By embracing knowledge, developing sound strategies, and managing risk prudently, you can harness the power of the forex market to achieve financial success.

Remember, consistent learning, unwavering discipline, and a resilient mindset are essential virtues for aspiring forex traders. As you navigate the dynamic forex trading landscape in South Africa, always strive to expand your knowledge and adapt to evolving market conditions.