In the tumultuous realm of global finance, where fortunes are made and lost in the ebb and flow of currencies, there exists a hidden world of professionals whose meticulous efforts ensure the smooth functioning of this colossal ecosystem: Forex backoffice executives.

Image: reviewmotors.co

As the backbone of every successful Forex brokerage, these individuals play a pivotal role in maintaining operational efficiency, safeguarding client funds, and sustaining competitive advantage. So, let us venture behind the scenes to unravel their enigmatic and enigmatic persona.

The Guardians of Integrity and Compliance

Overseeing KYC/AML Procedures

Forex backoffice executives act as gatekeepers of financial integrity and compliance, meticulously verifying the identities of clients (Know Your Customer or KYC) and adhering to stringent Anti-Money Laundering (AML) regulations. Through rigorous due diligence, they mitigate the risk of fraudulent or illicit activities within the Forex ecosystem.

Ensuring Regulatory Compliance

In a rapidly evolving regulatory landscape, backoffice executives stay abreast of the latest regulations and ensure that their brokers operate in full compliance. From tax reporting and trade surveillance to data protection and dispute resolution, they navigate the complex legal terrain, safeguarding the reputation and integrity of their firms.

Image: www.velvetjobs.com

The Masters of Operational Excellence

Managing Client Accounts and Transactions

Backoffice executives are responsible for the smooth functioning of client accounts, processing trades, executing orders, and handling settlement processes. Their attention to detail and accuracy ensures that all transactions are executed seamlessly, providing clients with a reliable and efficient trading experience.

Monitoring and Reconciling Accounts

To maintain the integrity of financial records, backoffice executives meticulously monitor and reconcile client accounts to identify any discrepancies or irregularities. Their vigilant oversight helps prevent errors and fraud, upholding the trust and confidence of clients.

The Champions of Risk Management

Implementing Risk Control Measures

Risk management is paramount in the dynamic Forex market. Backoffice executives devise and implement comprehensive risk mitigation strategies to protect their brokers and clients from potential losses. These strategies include setting stop-loss orders, managing margin levels, and monitoring market volatility.

Conducting Stress Testing and Scenario Analysis

To prepare for unforeseen events, backoffice executives conduct thorough stress testing and scenario analysis to assess the resiliency of their risk management protocols. These simulations help identify vulnerabilities and develop contingency plans, ensuring operational continuity during market downturns or financial crises.

The Advisors and Innovators

Providing Expert Market Insights

Backoffice executives leverage their deep understanding of the Forex market to provide valuable insights and advice to brokers and clients alike. They analyze market trends, identify trading opportunities, and stay informed about the latest news and developments affecting exchange rates.

Driving Innovation and Technology Adoption

In the ever-evolving digital age, backoffice executives champion the adoption of innovative technologies to enhance operational efficiency and improve client experience. From automated account management to artificial intelligence-powered risk assessment, they embrace technological advancements to drive growth and maintain a competitive edge.

FAQs: Unveiling the Hidden World of Forex Backoffice Executives

Q: What skills are essential for a successful Forex backoffice executive?

A: A strong understanding of Forex markets, compliance frameworks, and risk management principles are crucial. Excellent analytical and problem-solving abilities, attention to detail, and a proactive mindset are also key.

Q: Are there opportunities for career growth within the Forex backoffice field?

A: Yes, with experience and expertise, Forex backoffice executives can advance to leadership positions within brokerage firms or move into specialized roles in compliance, risk management, or financial analysis.

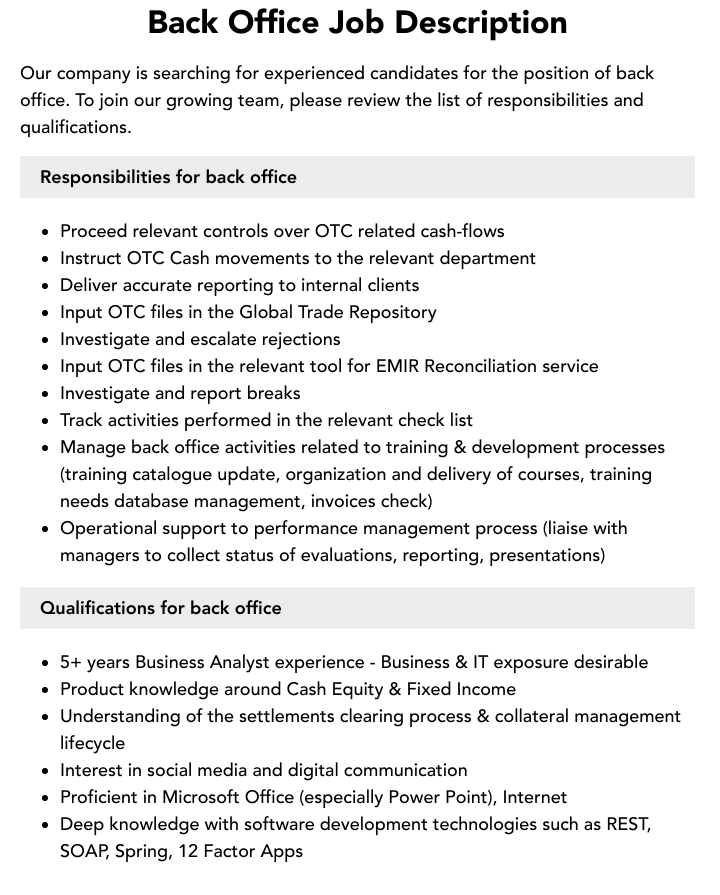

Job Profile Of Forex Backoffice Executive

Conclusion

The role of Forex backoffice executives is an intricate tapestry of integrity, efficiency, and innovation. As the unsung heroes of the Forex industry, they play a vital role in protecting brokers and clients, ensuring the smooth functioning of the market, and driving technological advancements. By shining a light on their indispensable contributions, we not only recognize their invaluable work but also inspire aspiring professionals seeking to join this dynamic and rewarding field.

Are you ready to explore the fascinating world of Forex backoffice executives?