Navigating the Risks and Benefits of Foreign Exchange Trading

In the realm of investing, the foreign exchange (forex) market holds immense allure, offering the potential for substantial returns and unparalleled liquidity. However, as with any financial venture, there are inherent risks that must be carefully considered. One critical question that every prospective forex trader faces is the safety of their funds in a brokerage account. This article delves deep into the safeguards and potential vulnerabilities associated with brokerage accounts, empowering you to make informed decisions about the security of your investments.

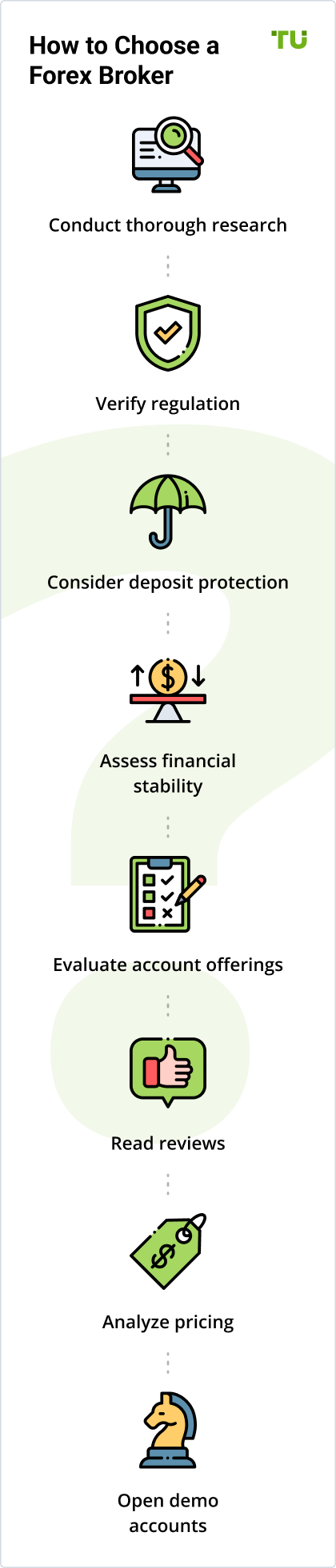

Image: tradersunion.com

Regulation and Security Measures: Assuring the Safety of Funds

To ensure the safety of client funds, reputable forex brokerages adhere to stringent regulations and implement robust security measures. These measures aim to protect investors from fraudulent activities and safeguard the integrity of their financial transactions. One of the most significant factors to consider is regulatory oversight. Well-regulated brokerages operate under the watchful eye of respected financial authorities, such as the Financial Conduct Authority (FCA) in the United Kingdom or the National Futures Association (NFA) in the United States. These organizations enforce stringent guidelines, including stringent capital requirements and transparent reporting practices, ensuring that brokerages maintain sufficient financial reserves and operate with integrity.

Beyond regulatory frameworks, reputable forex brokerages deploy advanced security measures to protect client funds. These measures include:

-

Encryption: Brokerages typically employ strong encryption protocols to safeguard sensitive data, including personal and financial information.

-

Segregation of Client Accounts: To prevent commingling of funds, responsible brokerages maintain segregated accounts for each client’s holdings. This segregation ensures that brokers cannot access or utilize client funds for their own purposes.

-

Two-Factor Authentication (2FA): Many brokerages offer 2FA as an additional layer of security, requiring users to provide two methods of identification, such as a password and a one-time code sent via text message or email.

-

Negative Balance Protection: Negative balance protection ensures that traders cannot lose more than the amount they have deposited in their accounts, mitigating the risk of substantial financial losses.

Assessing Forex Brokerage Trustworthiness: Avoiding Fraudulent Operators

Despite the safeguards implemented by regulated and reputable brokerages, investors must exercise caution to avoid falling victim to unscrupulous operators. The forex market can attract fraudulent entities seeking to exploit unsuspecting traders.

To safeguard against scams and ensure the trustworthiness of a potential brokerage:

-

Check Regulatory Status: Verify the brokerage’s regulatory status by visiting the websites of regulatory bodies and cross-referencing the brokerage’s information.

-

Scan for Negative Reviews: Scour online forums and review websites for any complaints or negative feedback regarding the brokerage.

-

Assess Trading Conditions: Scrutinize the brokerage’s trading conditions, including spreads, commissions, and minimum deposit requirements. If these conditions appear excessively favorable, they may indicate a scam brokerage.

-

Check Customer Support: Reliable brokerages prioritize excellent customer support. Contact the brokerage’s support team to assess their responsiveness, professionalism, and willingness to address your queries.

Educating Against Common Forex Scams

While regulatory bodies and security measures aim to protect traders, it is equally important for investors to arm themselves with knowledge to avoid falling prey to common forex scams:

-

Ponzi Schemes: Be wary of brokers that promise guaranteed returns with minimal risk. The forex market is inherently volatile, and no reputable brokerage can guarantee profits.

-

Clone Brokers: Scammers often create websites and marketing materials that closely resemble legitimate brokerages. Always verify a brokerage’s identity using reliable sources.

-

Unregulated Brokers: Avoid brokerages that operate without proper regulation. Trading with unregulated entities significantly increases the risk of fraud and financial loss.

-

Emotional Trading: Be mindful of your emotions and refrain from impulsive trades. Scammers often use aggressive marketing tactics to pressure traders into making quick decisions without due diligence.

Image: paxforex.org

Insurance and Compensation Schemes: Enhancing Investor Protection

In the unfortunate event that a brokerage fails or engages in fraudulent activities, investors may have limited recourse to recover their losses. However, certain markets offer insurance or compensation schemes to enhance investor protection:

-

FSCS (Financial Services Compensation Scheme): In the United Kingdom, eligible clients of FSCS-member brokerages may receive compensation up to £85,000 if the brokerage becomes insolvent.

-

NFA (National Futures Association): NFA offers a fidelity bond coverage program, providing compensation to clients of NFA member brokerages in the event of fraud or misappropriation of funds.

Is Money Safe In A Brokerage Account Forex

Conclusion: Safeguarding Your Investments in Forex Brokerage Accounts

By understanding the regulatory frameworks, security measures, and potential risks associated with forex brokerage accounts, investors can make informed decisions about the safety of their funds. Choosing a reputable, regulated brokerage that adheres to industry best practices and implements robust security measures is paramount. Furthermore, arming oneself with knowledge against common forex scams and exercising due diligence can significantly reduce the risk of financial loss. By adhering to these principles, investors can approach forex trading with confidence, knowing that their investments are protected to the fullest extent possible.