Navigating the French Tax Labyrinth for Forex Traders

As the allure of the global forex market enchants more French investors, the question of taxation remains paramount. This article delves into the complexities of the French fiscal landscape, providing a comprehensive guide to whether and how income derived from forex trading is subject to taxation.

Image: dicajytuh.web.fc2.com

Taxable Income: Forex Trading’s Contribution

France’s tax code categorizes income into various categories, each with its unique tax implications. Income from forex trading, like many other investment activities, falls under the umbrella of “professional income” (bénéfices non commerciaux). This designation signifies that forex trading is recognized as a legitimate income-generating activity.

Determining Taxable Status: Professional Trader vs. Occasional Speculator

Crucially, the taxability of forex income hinges on the trader’s status. The French tax authorities differentiate between occasional speculators and professional traders.

-

Occasional Speculators: Traders who engage in forex trading sporadically, as a supplement to their primary income, are considered occasional speculators. Their forex earnings are exempt from income tax and social security contributions but subject to a flat tax of 12.8%.

-

Professional Traders: Individuals who trade forex as their primary occupation, generating a substantial portion of their income from the activity, qualify as professional traders. Their forex income is taxed under the income tax and social security contribution rules, similar to traditional business income.

Calculating Taxes: Navigating the Professional Trader Landscape

For professional traders, the calculation of income tax differs from that of salaried employees or traditional business owners. Professional traders must determine their annual trading profits by subtracting business expenses from their total earnings.

The resulting taxable profit is then subject to progressive income tax rates, ranging from 0% to 45%. Additionally, professional traders must pay a separate contribution for universal health coverage (contribution pour la couverture maladie universelle or CMU).

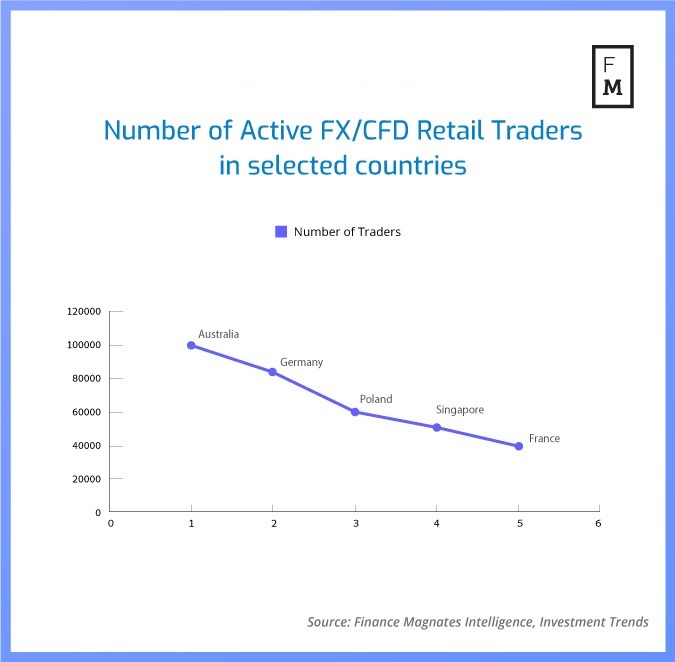

Image: www.financemagnates.com

Maximizing Tax Efficiency: Tips and Expert Advice

Whether you’re a novice or seasoned forex trader, optimizing tax efficiency is crucial to maximizing your returns. Here are some expert tips to consider:

-

Maintain Accurate Records: Keeping meticulous records of your trading activities, including profits, expenses, and account balances, is essential for tax declaration purposes.

-

Segregate Business Expenses: Clearly distinguish between personal and business expenses. Legitimate business expenses, such as hardware, software, subscriptions, and travel related to trading, are deductible from your trading profits.

-

Consider Tax-Advantaged Accounts: Exploring tax-advantaged investment options, such as the PEA (Plan d’Épargne en Actions) account, which provides tax exemptions for long-term capital gains, may further minimize your tax liability.

FAQs: Demystifying Taxation for Forex Traders

Q: What is the tax rate for professional forex traders?

A: Professional forex traders are subject to progressive income tax rates ranging from 0% to 45%, depending on their annual taxable profit.

Q: Do occasional speculators have to declare their forex earnings?

A: Occasional speculators are not required to declare their forex earnings on their income tax return.

Q: Are there any tax breaks available for forex traders?

A: Professional forex traders may deduct legitimate business expenses from their trading profits to reduce their taxable income.

Is Income From Forex Trade Taxable In France

Conclusion: Understanding and Complying

Understanding the intricacies of forex taxation in France is paramount for navigating the financial complexities associated with this lucrative yet complex market. By carefully considering your status as an occasional speculator or professional trader, diligently maintaining records, and exploring tax-saving opportunities, you can optimize your tax efficiency and maximize your trading returns.

Is the topic “is income from forex trade taxable in france” interesting to you? Let us know in the comments below!