The Allure of Forex Trading

Forex, short for foreign exchange, captivates traders worldwide as the largest and most liquid financial market. It offers the tantalizing allure of profiting from currency fluctuations, attracting both seasoned professionals and aspiring individuals. The question lingers: is forex worth it in 2023? By delving into its inherent benefits and potential pitfalls, we can illuminate the true value of forex trading in today’s financial landscape.

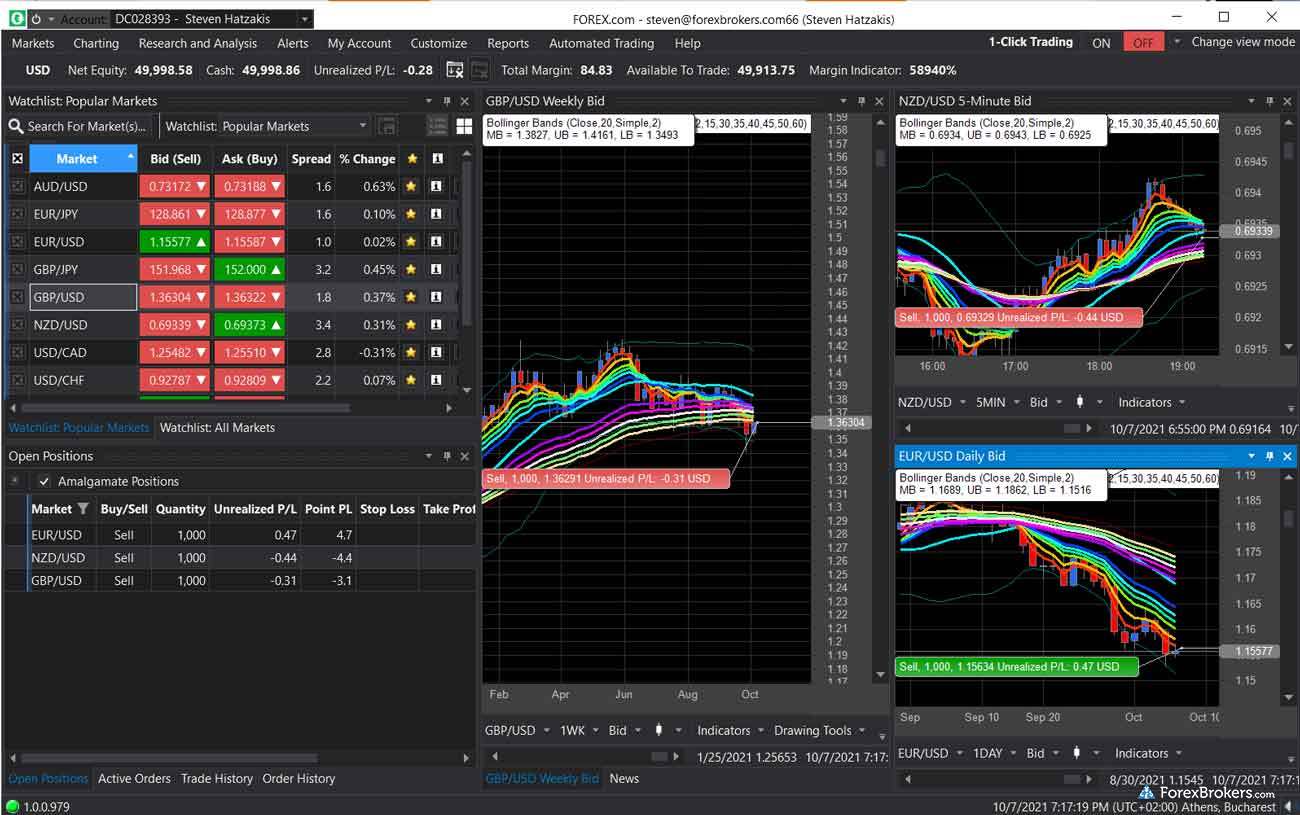

Image: www.brokernotes.co

Deciphering the Benefits of Forex Trading

Embarking on a forex trading journey offers a multitude of potential rewards, including:

-

Global Accessibility: Forex trading transcends geographic boundaries, operating around the clock, five days a week. This global reach grants traders the flexibility to enter and exit positions at opportune moments, regardless of their location.

-

High Liquidity: The forex market boasts unparalleled liquidity, with an average daily trading volume surpassing $5 trillion. This robust liquidity ensures swift execution of trades, minimizing slippage and maximizing potential profits.

-

Leverage Advantage: Forex brokers often offer leverage, enabling traders to control a larger position with a smaller initial deposit. While leverage can enhance returns, it also amplifies potential losses, requiring prudent risk management strategies.

-

Currency Hedging: Businesses and individuals can utilize forex trading as a risk management tool to hedge against currency fluctuations. By engaging in currency pairs that align with their business transactions, they can mitigate potential financial losses.

-

Potential for High Returns: Skilled forex traders can achieve significant returns by exploiting favorable market conditions and implementing effective trading strategies. However, it’s crucial to remember that forex trading involves inherent risks, and profitability is not guaranteed.

Navigating the Potential Risks of Forex Trading

Alongside the potential benefits, forex trading also carries inherent risks that every trader must comprehend:

-

Market Volatility: Currency markets are inherently volatile, susceptible to political events, economic data, and global uncertainties. This volatility can lead to rapid fluctuations in exchange rates, potentially resulting in significant losses for unprepared traders.

-

Leverage Risks: Utilizing leverage can undoubtedly amplify potential profits, but it also magnifies potential losses. Traders must exercise caution when employing leverage, ensuring they fully understand the risks involved and manage their leverage levels accordingly.

-

Psychological Factors: Forex trading can be emotionally demanding, testing the mental fortitude of traders. Fear, greed, and overconfidence can cloud judgment, leading to irrational decisions and costly mistakes. Traders must develop emotional discipline and robust risk management strategies to mitigate these psychological pitfalls.

-

Technical Proficiency: Successful forex trading requires a sound understanding of financial markets, economic indicators, and trading strategies. Traders must commit to continuous education and technical analysis to enhance their trading acumen.

-

Fraudulent Brokers: The forex industry has witnessed its share of fraudulent brokers. Choosing a reputable broker with a proven track record and strong regulatory oversight is paramount to safeguard your funds and avoid potential scams.

Evaluating Your Suitability for Forex Trading

Embarking on a forex trading endeavor demands introspection and a realistic assessment of one’s suitability for this dynamic market. Consider the following factors:

-

Financial Capacity: Forex trading involves the potential for significant losses. Traders should only risk capital they can afford to lose and ensure they have sufficient financial reserves to withstand potential downturns.

-

Knowledge and Skills: Forex trading requires a solid understanding of financial markets, economic indicators, and trading strategies. Traders must commit to continuous education and skill development to enhance their chances of success.

-

Time Commitment: Successful forex trading often demands a substantial time investment for research, analysis, and monitoring. Traders must assess whether they can allocate the necessary time to navigate the complexities of the market effectively.

-

Risk Tolerance: Forex trading is inherently volatile, and traders must possess the psychological resilience to withstand potential losses and emotional turmoil. Traders should assess their risk tolerance levels and ensure they align with the inherent risks involved.

Image: lbiinga.blogspot.com

Charting Your Path in Forex Trading

If your assessment indicates suitability for forex trading, meticulous preparation and diligent execution are essential for navigating the complexities of the market. Consider the following steps:

-

Educate Yourself: Invest in reputable educational resources to gain a comprehensive understanding of forex markets, trading strategies, and risk management techniques. Attend webinars, read books, and connect with experienced traders to deepen your knowledge base.

-

Develop a Trading Strategy: Define your trading approach, identifying the currency pairs you wish to trade, your entry and exit points, and your risk management parameters. Focus on developing a strategy that aligns with your risk tolerance and trading goals.

-

Practice with a Demo Account: Before venturing into live trading, practice your skills on a demo account. This risk-free environment allows you to test your strategies, refine your techniques, and gain confidence without the pressure of real money on the line.

-

Choose a Reputable Broker: Selecting a trustworthy and regulated broker is crucial for safeguarding your funds and ensuring fair trading conditions. Consider the broker’s reputation, regulatory status, trading platform, fees, and customer support.

-

Manage Your Risk: Implement a robust risk management strategy that includes setting stop-loss orders, defining position sizing, and diversifying your portfolio to mitigate potential losses. Never risk more than you can afford to lose.

Is Forex Worth It 2019

Is Forex Worth It in 2023: A Discerning Verdict

The question of whether forex is worth it in 2023 is subjective, contingent upon individual circumstances, risk tolerance, and trading objectives. While forex trading offers the allure of high returns and flexibility, it also carries inherent risks and demands a substantial commitment of time and effort. By thoroughly assessing your suitability, diligently preparing, and implementing prudent risk management strategies, you can enhance your chances of navigating the complexities of forex trading and potentially reaping its rewards.