In the fast-paced world of financial markets, copy trading has emerged as a revolutionary concept that empowers retail traders to leverage the expertise of successful investors. By enabling traders to "copy" the trades of more experienced traders, copy trading democratizes access to lucrative investment opportunities, offering a potential path to financial success for both novices and seasoned investors alike.

Image: www.bitget.com

This comprehensive guide will delve into the captivating world of copy trading, unraveling its intricacies and exploring its numerous advantages. We will explore the historical roots of copy trading, decipher its basic principles, and examine its diverse applications in the realm of financial markets. Whether you are a seasoned professional seeking to enhance your trading strategies or a novice yearning to delve into the world of automated trading, this guide is tailored to provide you with a holistic understanding of copy trading.

Understanding Copy Trading: A Historical Perspective

The concept of copy trading can be traced back to the advent of automated trading platforms in the early 2000s. These platforms provided the technological infrastructure for traders to execute trades automatically based on predefined algorithms or trading signals. As these platforms gained traction, they paved the way for the development of copy trading services, offering a simplified approach to automated trading for a wider audience.

The Essence of Copy Trading: Unveiling the Mechanics

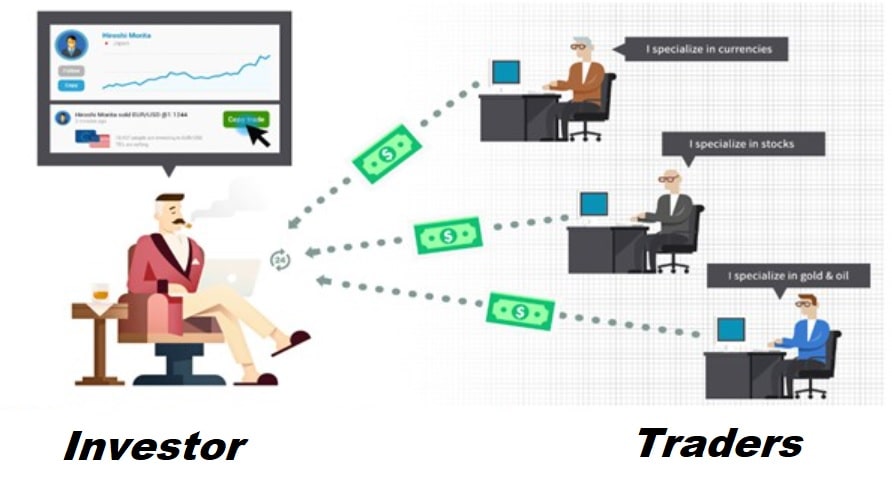

Copy trading operates on a fundamental principle: it enables traders to replicate the trading decisions of other traders, referred to as "signal providers." Signal providers are experienced traders who share their trading strategies and signals with subscribers, who can then automatically execute the same trades in their own accounts. This arrangement provides a unique opportunity for novice traders to benefit from the expertise and decision-making of seasoned professionals.

The process of copy trading typically involves selecting a reputable copy trading platform, choosing a suitable signal provider, customizing the trading parameters, and initiating the automatic execution of trades. The platform acts as an intermediary, facilitating the seamless replication of trades between signal providers and subscribers.

Advantages of Copy Trading: Unveiling the Transformative Benefits

Copy trading offers numerous advantages, making it an attractive proposition for traders of all levels of experience.

- Accessibility to Expertise: Copy trading empowers novice traders to access and leverage the knowledge and expertise of experienced traders, who have spent years honing their skills and developing successful trading strategies.

- Automation of Trading: Copy trading eliminates the need for constant manual monitoring and execution of trades, freeing up traders’ time and allowing them to focus on other aspects of their financial lives.

- Reduced Emotional Bias: By automating the trading process, copy trading helps traders mitigate the impact of emotions on their decision-making, leading to more disciplined and rational trading behavior.

- Diversification of Portfolio: Copy trading provides an opportunity for traders to diversify their portfolios by copying the trades of multiple signal providers with different strategies, reducing the overall risk exposure.

- Potential for Enhanced Returns: While it’s important to emphasize that copy trading doesn’t guarantee profitability, it offers the potential for enhanced returns by harnessing the expertise and strategies of successful traders.

Image: binaryoptionz.club

Applications of Copy Trading: Uncovering the Diverse Use Cases

Copy trading finds application in a wide range of financial markets and instruments, catering to the diverse needs of traders. The most prevalent applications include forex trading, stock trading, cryptocurrency trading, and commodity trading. Additionally, copy trading can be employed across various time frames, from intraday trading to long-term investments.

Selecting a Signal Provider: A Journey Towards Success

One of the critical factors in copy trading is the selection of a signal provider. Here are some crucial considerations:

- Trading History: Analyze the signal provider’s past performance to gauge their consistency and profitability.

- Risk Tolerance: Assess the signal provider’s risk appetite and ensure that it aligns with your own tolerance level.

- Trading Strategy: Understand the signal provider’s trading strategy and ensure that it resonates with your investment goals and risk preferences.

- Transparency and Communication: Choose signal providers who are transparent about their trading activities and provide regular updates to their subscribers.

What Is Copy Trade

Conclusion: Unveiling the Transformative Power of Copy Trading

Copy trading has revolutionized the financial markets, offering a unique approach to automated trading that empowers both novice and experienced traders. By enabling traders to leverage the expertise of successful traders, copy trading democratizes access to lucrative investment opportunities and presents a path to financial success for individuals from all walks of life. As copy trading continues to evolve, it is poised to become an even more transformative force in the financial markets, unlocking new possibilities for traders worldwide.

Embrace the power of copy trading today and embark on a journey of financial growth and achievement. Remember to conduct thorough research, select a reputable signal provider, and tailor your trading strategy to your specific needs. With copy trading as your guide, the path to financial success has never been more accessible.