Unlocking the Legalities of Global Currency Transactions

In the ever-evolving world of financial markets, the foreign exchange (forex) market stands as a behemoth, attracting traders from all corners of the globe. However, as you embark on this intriguing yet potentially lucrative journey, a crucial question arises: is forex trading banned anywhere? Let’s delve into the legal intricacies surrounding forex trading, ensuring that your financial ventures unfold seamlessly.

Image: www.youtube.com

Defining Forex Trading and Its Global Landscape

Forex trading, the act of exchanging one currency for another, has become an integral part of international commerce and personal investments. This $6.6 trillion-a-day market operates over-the-counter, meaning it’s not confined to a central exchange but facilitated through a network of banks and other financial institutions. Its decentralized nature and global reach raise the question: does forex trading face legal restrictions in certain jurisdictions?

Navigating the Legal Maze: Exploring Forex Trading’s Legal Status

To comprehensively address the question of forex trading bans, we must embark on a global exploration, examining the legal frameworks that govern this financial activity. While many countries embrace forex trading as a legitimate investment opportunity, certain jurisdictions have imposed restrictions or outright bans on the practice. These variations in legal treatment stem from diverse cultural, economic, and regulatory factors.

Unveiling the Banned Zones: Countries with Forex Trading Prohibitions

Although forex trading flourishes in most parts of the world, a handful of countries have chosen to ban it altogether. These nations, often driven by concerns about financial stability, consumer protection, or religious beliefs, have enacted strict laws prohibiting their citizens from engaging in forex transactions. Examples of countries with forex trading bans include:

-

Iran: Forex trading is strictly prohibited by Iranian law, and violators face severe penalties.

-

Malaysia: While forex trading was once legal in Malaysia, it was banned in 1998 due to concerns over financial stability and market manipulation.

-

Pakistan: Forex trading is prohibited in Pakistan for individuals and non-banking financial institutions.

-

China: Forex trading is largely banned in mainland China, with strict regulations in place to control capital flows.

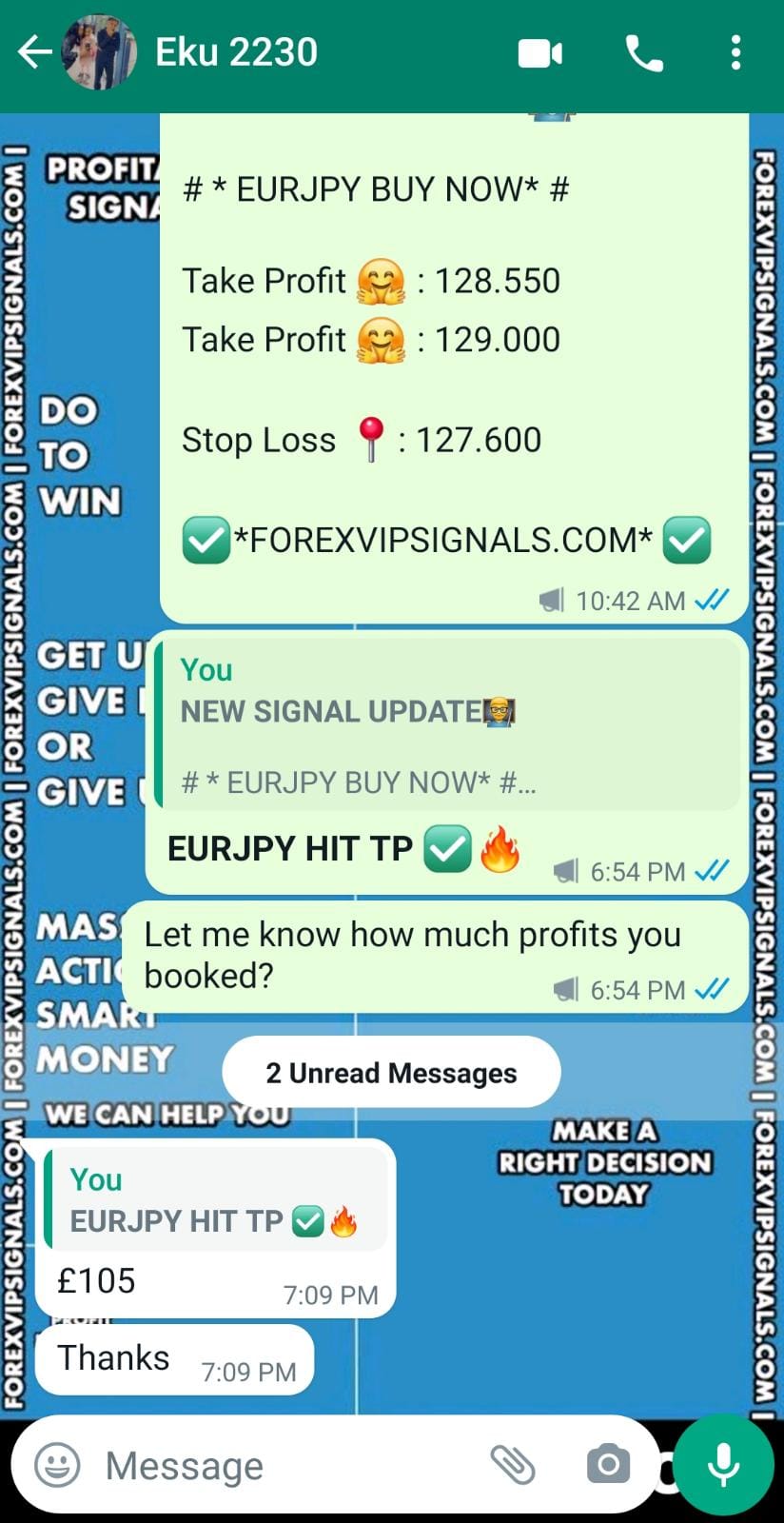

Image: www.forexvipsignals.com

Partial Restrictions: Countries with Conditional Forex Trading Allowance

In addition to outright bans, some countries have implemented partial restrictions on forex trading. These restrictions may take various forms, such as limiting access to certain types of forex transactions or requiring traders to obtain special licenses or approvals. Countries with partial forex trading restrictions include:

-

India: Forex trading in India is permitted for authorized individuals and institutions, but certain restrictions apply, such as limits on daily trading volumes.

-

Russia: Forex trading is legal in Russia, but it requires a license from the Central Bank of Russia.

-

South Africa: Forex trading is generally allowed in South Africa, but certain types of forex transactions are prohibited, such as proprietary trading.

Understanding the Rationale Behind Forex Trading Restrictions

The reasons for forex trading bans and restrictions vary significantly from country to country. Some of the most common rationales include:

-

Financial Stability Concerns: Regulators may impose bans or restrictions to prevent excessive speculation and its potential impact on the stability of the financial system.

-

Consumer Protection: Bans aim to protect inexperienced investors from the risks associated with forex trading, which can lead to significant financial losses.

-

Compliance with Religious Beliefs: In certain countries with strong religious ideologies, forex trading may be deemed incompatible with religious principles, leading to its prohibition.

Embracing Regulatory Frameworks: Ensuring a Safe and Transparent Forex Market

While some countries may resort to bans or restrictions, the vast majority of jurisdictions have opted for regulatory frameworks to govern forex trading. These frameworks aim to strike a balance between fostering market growth and protecting investors’ interests. Key elements of such frameworks include:

-

Licensing Requirements: Regulators may require forex brokers and other market participants to obtain licenses or authorization to operate, ensuring their financial stability and adherence to ethical standards.

-

Risk Management Measures: Regulators often impose risk management requirements on forex brokers, such as margin limits and leverage restrictions, to minimize excessive financial risks for traders.

-

Transparency and Disclosure: Regulations mandate forex brokers to provide clear and transparent information to their clients, including details of trading fees, spreads, and risk disclosures.

Is Forex Trading Banned Anywhere

Conclusion

The legal landscape surrounding forex trading is a complex tapestry woven with varying degrees of acceptance and restriction. While outright bans exist in a few countries, most jurisdictions have opted for regulatory frameworks to balance market growth and investor protection. By understanding the legal status of forex trading in your jurisdiction, you can navigate this global marketplace with confidence and seek financial success within the bounds of the law.