The dynamics of global finance have always fascinated economists and investors alike. Among the many facets of this intricate system, one question that has sparked considerable debate is the role of foreign exchange (forex) in the balance of payments (BOP). In this article, we embark on a journey to understand the relationship between forex and BOP, exploring their interconnectedness and examining the impact each has on the other.

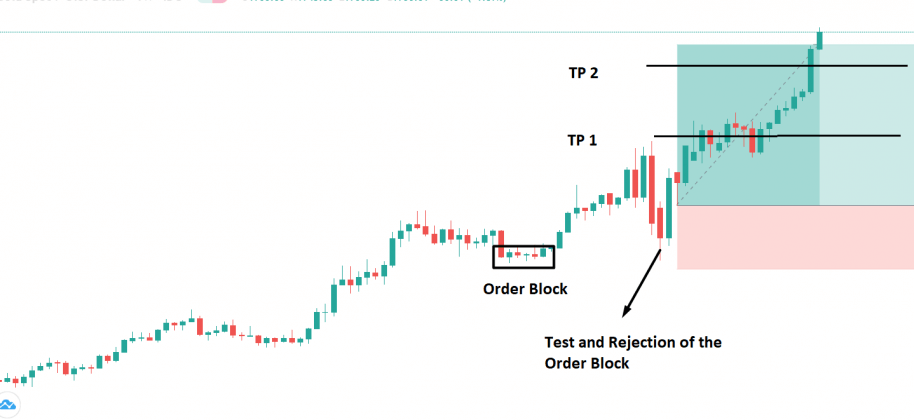

Image: www.forex.academy

Defining the Balance of Payments

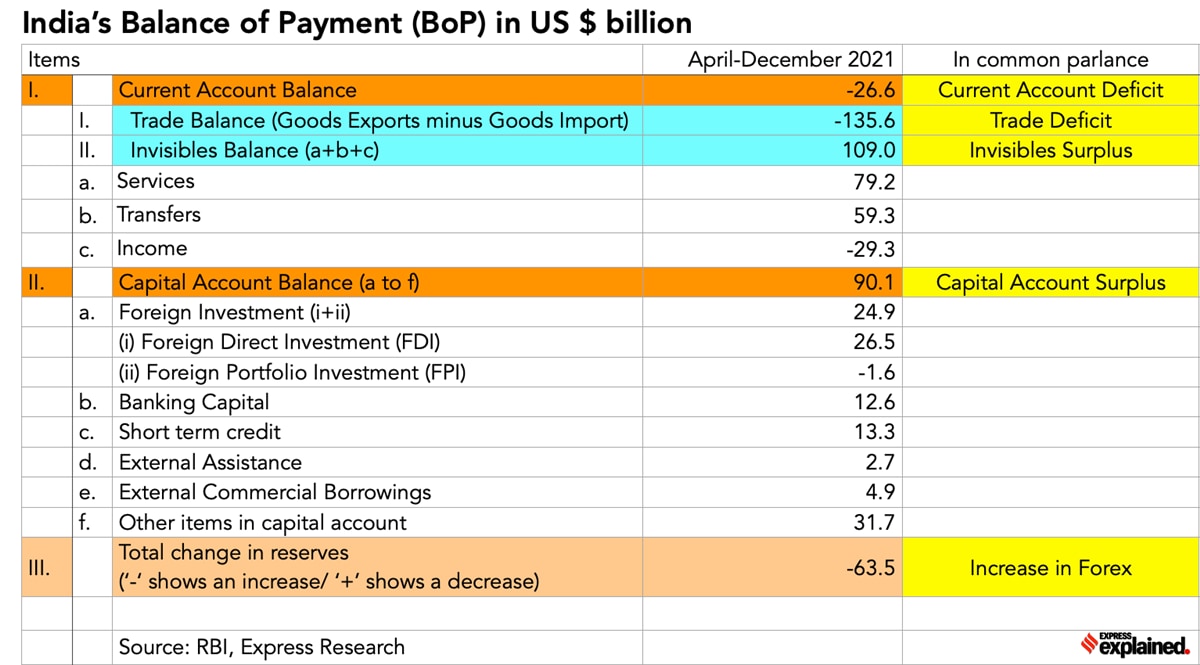

The balance of payments is a comprehensive record of all economic transactions between a country and the rest of the world over a specific period, typically a year. It consists of two main accounts: the current account and the capital and financial account. The current account tracks the flow of goods, services, and income, while the capital and financial account records international investments and financial transactions.

Forex and Current Account

Forex plays a central role in the current account, as it facilitates the exchange of currencies used to settle cross-border transactions. When a country exports more goods or services than it imports, its exports earn more foreign currencies than its imports require. This leads to an inflow of currencies, which strengthens the country’s exchange rate and is reflected as a surplus in its current account.

Conversely, when a country imports more than it exports, it needs to obtain foreign currencies to pay for its imports. This results in an outflow of currencies, weakening the exchange rate and creating a deficit in the current account.

Forex and Capital and Financial Account

Forex transactions also play a significant role in the capital and financial account. International investments and financial flows necessitate the conversion of currencies and can influence the supply and demand dynamics in the forex market. A country that attracts a large amount of foreign investment will see an inflow of currencies, which can appreciate its exchange rate.

On the other hand, a country that invests heavily abroad will have an outflow of currencies, potentially depreciating its exchange rate. The capital and financial account therefore provides another channel through which forex influences a country’s balance of payments.

Image: indianexpress.com

Interplay between Forex and BOP

The relationship between forex and BOP is a reciprocal one. Changes in the balance of payments can affect forex rates, and vice versa. A strong BOP position tends to strengthen a country’s currency, while a weak BOP can lead to currency depreciation.

This interplay is crucial for policymaking. Central banks often intervene in the forex market to stabilize their currencies and influence the BOP. By purchasing or selling currencies, central banks can manage the exchange rate, impacting the flow of goods and capital, and ultimately the overall balance of payments.

Is Forex Part Of Bop

Conclusion

The foreign exchange market and the balance of payments are inextricably linked, with each influencing the other in a dynamic relationship. Forex transactions facilitate the settlement of international transactions and influence the current account, while international investments and financial flows through forex impact the capital and financial account.

Understanding the connection between forex and BOP is essential for policymakers, investors, and anyone seeking to navigate the complex landscape of global finance. By recognizing this interconnectedness, we can better grasp the factors that shape exchange rates, trade flows, and macroeconomic outcomes.