Is Forex Exchange Business Profitable: Unlocking the Secrets of Currency Trading

Image: www.iconfinder.com

Introduction:

Are you drawn to the captivating world of currency trading, where fortunes are made and dreams are realized? Have you heard countless tales of individuals amassing wealth through forex exchange businesses, leaving you with an irresistible urge to join the pursuit of financial freedom? Understanding the profitability of forex exchange is paramount before venturing into this exciting yet potentially treacherous field. This comprehensive guide will delve deep into the intricacies of forex trading, uncovering the truth about its profitability and unraveling the secrets that can lead you toward financial success.

Unveiling the Essence of Forex Exchange:

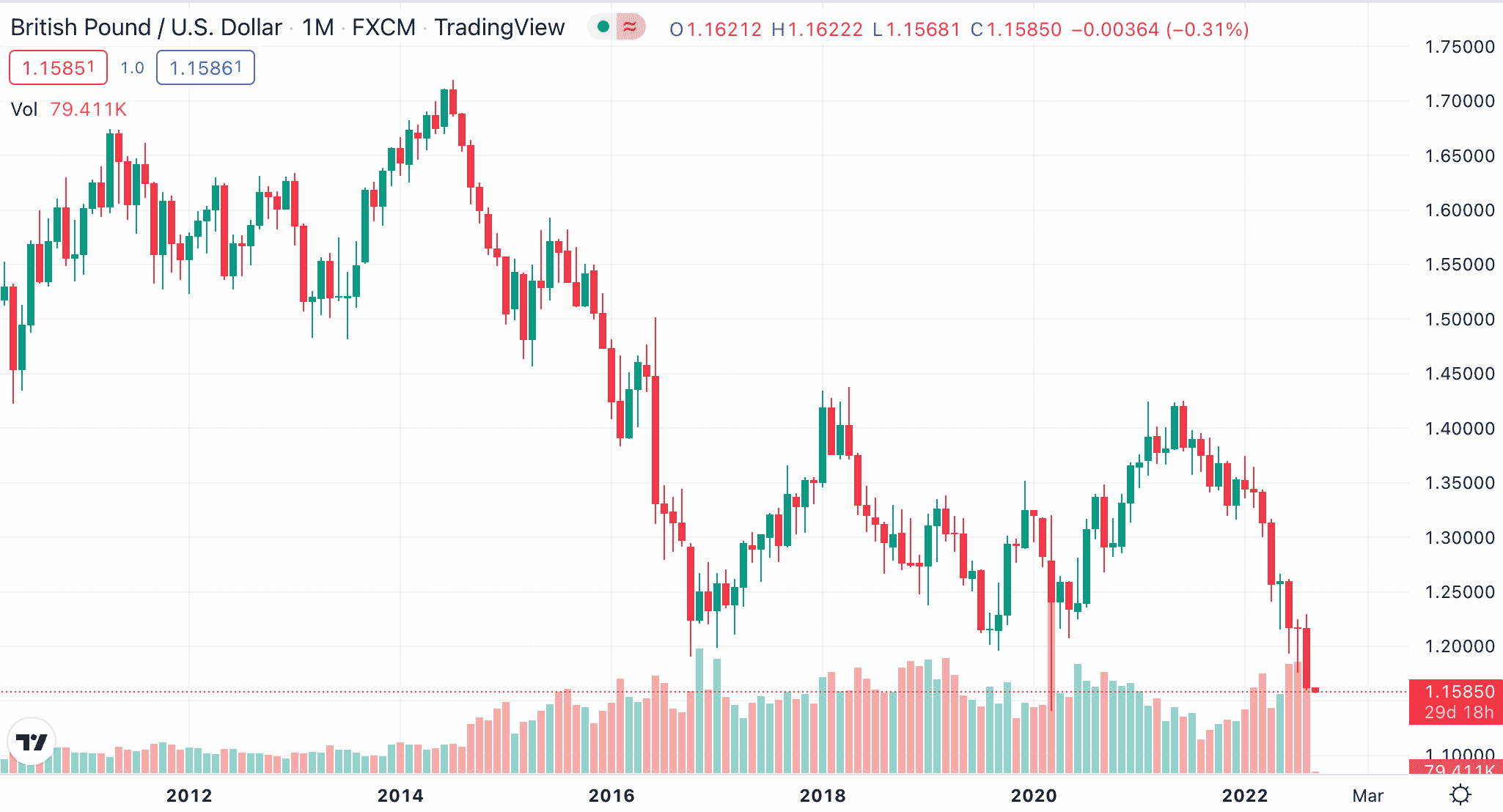

Forex exchange, also known as foreign exchange, is the global marketplace where currencies are traded. With a daily trading volume surpassing trillions of dollars, forex is the undisputed king of financial markets, offering immense liquidity and opportunities for savvy investors. The allure of currency trading lies in its potential for generating substantial profits by capitalizing on currency fluctuations.

Factors Influencing Forex Exchange Profitability:

Profitability in forex trading is not a mere coincidence; it is the result of careful planning, sound strategy, and a keen understanding of market dynamics. Several factors converge to determine the potential profitability of forex exchange businesses:

- Economic News and Events: Major economic events, such as interest rate changes, inflation reports, and geopolitical crises, can significantly impact currency values. Traders must stay abreast of these events and analyze their potential effects on exchange rates.

- Global Economic Conditions: The overall health of the global economy plays a crucial role in forex market behavior. A strong economy generally leads to a stronger currency, while a weak economy tends to devalue it.

- Technical Analysis: Many forex traders rely on technical analysis techniques to identify trading opportunities. These techniques involve studying historical price data to predict future price movements.

- Fundamental Analysis: Fundamental analysts focus on economic indicators, company earnings, and interest rates to assess the intrinsic value of currencies. By understanding the underlying factors that influence currency values, traders can make informed decisions about potential trades.

Leverage: A Double-Edged Sword:

Leverage is a double-edged sword that can amplify both profits and losses in forex trading. By utilizing leverage, traders can control a larger position size than their account balance would otherwise allow. While this strategy can increase potential returns, it also magnifies the risk involved. Traders must exercise caution when using leverage and ensure they fully comprehend its implications.

Expert Insights and Actionable Tips:

- “Always trade with a plan and stick to it. Don’t let emotions cloud your judgment.” – George Soros, legendary forex trader

- “Master the art of risk management. Protect your capital by using stop-loss orders and appropriate leverage levels.” – Bill Lipschutz, currency trader and author

- “Continuous education is key in forex trading. Stay updated with market trends, economic events, and technical analysis techniques.” – Kathy Lien, forex expert and author

- “Demo accounts are your friend. Practice trading strategies without risking real capital until you gain confidence and consistency.” – Andreas Clenow, forex trader and educator

Conclusion:

The profitability of forex exchange businesses is a multifaceted concept that hinges on a thorough understanding of market dynamics, sound trading strategies, and rigorous risk management practices. While the lure of quick riches may be tempting, the path to consistent profitability in forex is paved with hard work, dedication, and unwavering discipline. Arm yourself with knowledge, embrace a mindset of continuous learning, and navigate the forex market with caution. Remember, the key to unlocking the true potential of currency trading lies not only in identifying profitable opportunities but also in skillfully managing the inherent risks.

Image: www.business2community.com

Is Forex Exchange Business Profitable