In the intricate world of international business, where transactions transcend borders and currencies, the movement of funds through foreign exchange (forex) payments becomes an indispensable part of global commerce. However, as the volume of forex payments surges, heightened scrutiny and stringent regulations have emerged to ensure transparency, mitigate risks, and combat illicit financial activities. One crucial question often arises in this context: is a certificate from an auditor a mandatory requirement for forex payments?

Image: www.yumpu.com

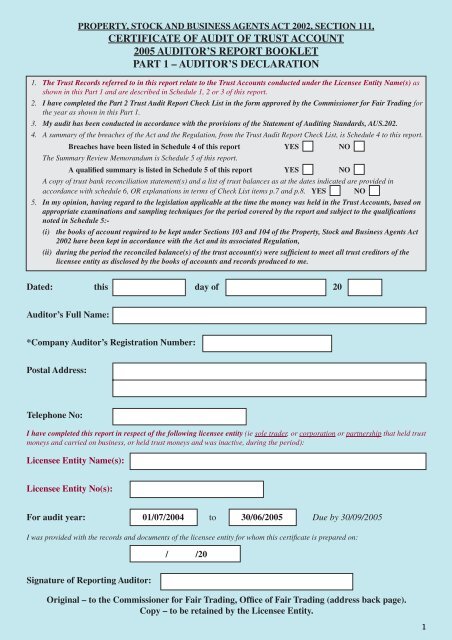

To unravel this question, it’s imperative to delve into the significance of audits and the regulatory landscape governing forex transactions. Audits, conducted by independent and qualified professionals, provide an impartial assessment of financial records, ensuring accuracy, compliance, and adherence to established accounting principles. In the realm of forex, audits play a pivotal role in verifying the authenticity and legitimacy of financial activities, thereby enhancing confidence and reducing the potential for fraud.

When is a Certificate from an Auditor Mandatory?

While the necessity of an auditor’s certificate for forex payments hinges on several factors, it’s generally required in specific circumstances:

- Large Transactions: For forex payments exceeding a certain threshold (typically determined by individual countries or financial institutions), an auditor’s certificate becomes a mandatory requirement to substantiate the transaction’s legitimacy and prevent money laundering.

- Suspicious Activities: Financial institutions are obligated to exercise due diligence and scrutinize transactions that raise red flags or suspicions of illicit activities. In such cases, an auditor’s certificate can provide assurance and mitigate risks associated with potential financial crimes.

- Regulatory Compliance: Certain jurisdictions and regulatory bodies impose specific requirements for forex payments, including the submission of an auditor’s certificate to demonstrate adherence to established standards and guidelines.

Benefits of an Auditor’s Certificate for Forex Payments

Obtaining an auditor’s certificate for forex payments offers numerous advantages:

- Enhanced Credibility: An auditor’s certificate adds credibility to forex payments, as it verifies the accuracy and reliability of the financial information presented.

- Increased Trust: By providing an independent assessment, auditor’s certificates bolster trust among parties involved in forex transactions, facilitating smoother and more efficient cross-border payments.

- Risk Mitigation: Auditor’s certificates help mitigate risks associated with forex payments by ensuring compliance with regulatory requirements and minimizing the potential for fraud or errors.

- Streamlined Transactions: By meeting the necessary requirements, auditor’s certificates can expedite the processing and approval of forex payments, reducing delays and ensuring timely execution.

Image: learning.icai.org

Is Certificate From Auditor Required For Forex Payments

Conclusion

While the requirement for an auditor’s certificate for forex payments may vary depending on specific circumstances, obtaining such a certificate is highly recommended to enhance credibility, foster trust, mitigate risks, and streamline transactions. By embracing the insights and guidance provided in this article, individuals and organizations engaged in international business can navigate the complexities of forex payments with greater confidence and assurance.