Breaking Barriers: Unleashing Forex Trading with Low Capital

In the realm of online trading, IQ Option has emerged as a formidable player, empowering traders with a user-friendly platform and an extensive range of financial instruments. Among its offerings, forex trading has captivated many due to its fast-paced nature and potential for lucrative returns. However, the minimum assignment requirement often poses a hurdle for traders seeking to navigate the forex markets. In this comprehensive guide, we’ll unravel the intricacies of IQ Option’s forex minimum assignment, empowering you with the knowledge to seize opportunities and maximize your trading potential.

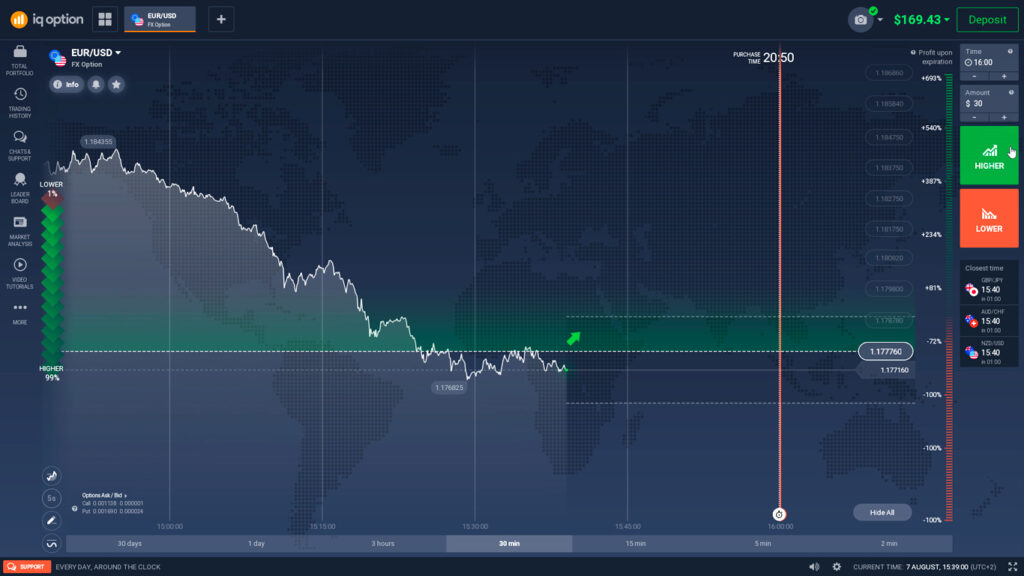

Image: www.kingdavidsuite.com

Defining the Forex Minimum Assignment

At its core, the minimum assignment represents the smallest unit of currency that a trader is permitted to trade on a given financial instrument. In the context of forex trading on IQ Option, the minimum assignment varies based on the specific currency pair being traded. For instance, the minimum assignment for the EUR/USD currency pair is 1,000 units, while the minimum assignment for the GBP/USD currency pair is 100 units. Understanding these variations is crucial to ensure that traders have sufficient capital to execute their trades effectively.

Determining Your Trading Capital

Before embarking on your forex trading journey, it’s essential to assess your financial resources and determine the amount of capital you’re willing to allocate to trading. While IQ Option’s low minimum assignments make forex trading accessible to a wider audience, it’s crucial to note that trading with a substantial capital base can provide a greater margin of safety and flexibility. A common rule of thumb is to risk no more than 1-2% of your trading capital on any single trade. This disciplined approach can safeguard your funds and mitigate potential losses.

Navigating the Forex Market with Minimum Assignments

Understanding the dynamics of the forex market is paramount for success. Forex prices fluctuate constantly due to a myriad of factors, including economic news, geopolitical events, and central bank decisions. With IQ Option’s low minimum assignments, traders can participate in the market even with limited capital by employing a sound trading plan and risk management strategies. Smaller trade sizes allow for greater flexibility and enable traders to adapt to changing market conditions swiftly.

Image: investerfy.com

Tips for Successful Forex Trading

- Capital Allocation: Determine your trading capital and allocate funds prudently, ensuring you have sufficient resources to cover potential losses.

- Trading Plan: Construct a comprehensive trading plan outlining your entry and exit points, risk tolerance, and trade management strategies.

- Risk Management: Implement robust risk management protocols, including stop-loss orders and position sizing strategies, to safeguard your capital.

- Technical Analysis: Equip yourself with sound technical analysis skills to identify potential trading opportunities and assess market trends.

- Stay Informed: Keep abreast of economic news, geopolitical developments, and central bank announcements that can impact currency prices.

Frequently Asked Questions

Q: What is the minimum assignment requirement for trading forex on IQ Option?

A: The minimum assignment varies depending on the currency pair traded. For instance, the EUR/USD currency pair has a minimum assignment of 1,000 units.

Q: How much capital do I need to trade forex with IQ Option?

A: While IQ Option’s low minimum assignments make trading accessible, it’s recommended to have sufficient capital to mitigate losses. Determine your trading capital and risk no more than 1-2% on any single trade.

Q: How can I mitigate risks with small trade sizes?

A: Implement effective risk management strategies, such as stop-loss orders and position sizing techniques, to safeguard your capital.

Iq Option Forex Minimum Assignment

Conclusion

Unlocking the potential of forex trading on IQ Option requires a comprehensive understanding of the minimum assignment requirements. By carefully navigating the forex market with low capital and employing sound trading practices, you can increase your chances of success. Our detailed guide has provided you with the insights, tips, and advice necessary to embark on your forex trading journey with confidence. Remember, the key to thriving in the forex markets lies in continuous learning, adaptation, and prudent risk management. Are you ready to conquer the world of forex trading with IQ Option?