In the labyrinthine realm of financial markets, the behavior of investors plays a pivotal role in shaping market dynamics. Understanding the psychological and cognitive biases that influence investors’ decisions can empower traders and investors alike to make more informed and strategic choices. Behavioral finance, an emerging field of study, delves into the intricate relationship between the human psyche and financial decision-making. This article embarks on a comprehensive journey, unraveling the complexities of investor behavior, specifically in the context of stock, commodity, and forex markets.

Image: www.chegg.com

The Psychology of Investment Behavior

Behavioral finance unveils the profound influence of emotions, cognitive biases, and social factors on investor behavior. Investors are often swayed by heuristics, mental shortcuts that can lead to irrational decision-making. Overconfidence, anchored bias, and herding behavior are just a few examples of these biases that can impair judgment in financial markets.

Emotion and Market Volatility

Emotions, both positive and negative, can cloud investors’ rationality and lead them astray. Fear and greed are powerful forces that can fuel irrational buy and sell decisions, exacerbating market volatility. Understanding and managing emotions is crucial for investors seeking to navigate market fluctuations effectively.

Cognitive Biases and Investment Decisions

Cognitive biases, such as the availability bias or the confirmation bias, can prevent investors from making objective and informed judgments. Availability bias can lead investors to overweight recent events in their investment decisions, while confirmation bias can cause them to seek out information that confirms their existing beliefs.

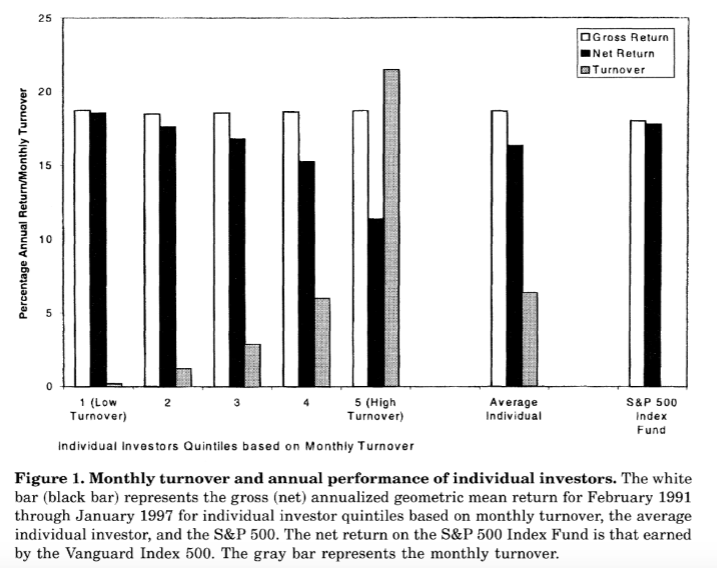

Image: www.chegg.com

Social Influence and Herd Mentality

Social interactions and group dynamics can significantly impact investor behavior. Herding behavior, the tendency to follow the actions of others, is prevalent in financial markets. This can lead to bubbles and market downturns as investors abandon rational decision-making in favor of conforming to the herd mentality.

Behavioral Finance in Practice

Behavioral finance’s insights have invaluable practical applications in stock, commodity, and forex markets. Understanding investor behavior can help traders identify trading opportunities, manage risk, and optimize investment strategies.

Stock Market Anomalies

Behavioral finance can explain several stock market anomalies, such as the January effect or the size effect. The January effect refers to the tendency for stocks to perform better in the first month of the year, while the size effect suggests that smaller stocks tend to outperform larger stocks over the long term.

Commodity Market Sentiment

In commodity markets, behavioral finance can help investors gauge market sentiment and identify potential market reversals. Sentiment indicators, such as the Commitment of Traders report, can provide insights into the positioning of large traders and potential shifts in market trends.

Investors Behaviour Behavioral Finance With Respect To Stock Commodity Forex

Forex Market Intervention

Central banks and governments sometimes intervene in forex markets to influence exchange rates. Understanding investor behavior can help investors anticipate such interventions and position themselves accordingly.