An Introduction to the Inverted Hammer Candlestick

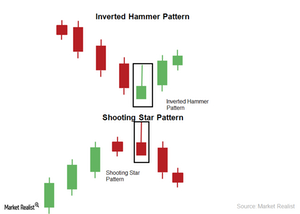

The inverted hammer candlestick is a pivotal technical analysis pattern that offers precious insights into potential price reversals in forex trading. It derives its name from its distinctive shape, resembling an inverted hammer: a long lower wick, a short upper wick or no wick at all, and a small body that forms at the bottom of the trading range.

Image: marketrealist.com

This pattern typically emerges at the end of a downtrend and signifies a potential bullish reversal. When traders spot an inverted hammer on their charts, it suggests that the bears are losing their grip on the market and the bulls are poised to take control.

Unlocking the Meaning of the Inverted Hammer Candlestick

An inverted hammer candlestick forms when the market opens at a price close to its previous close. Buyers initially push the price higher, but sellers step in and drive the price down, creating the long lower wick. This selling pressure is met with renewed buying interest, causing the price to rebound and form the small body at the bottom of the trading range.

The length of the lower wick is crucial in determining the strength of the reversal signal. A long lower wick indicates strong selling pressure, while a short lower wick suggests a more modest attempt by the bears to drive the price down. The absence of an upper wick further strengthens the bullish implications.

Assimilating Inverted Hammer Candlesticks into Your Trading Strategy

Traders often combine the inverted hammer candlestick with other technical indicators to confirm their analysis. For instance, they might look for a confirmation candle, such as a green candle that closes above the inverted hammer’s body, indicating a continuation of the bullish momentum.

Additionally, traders may utilize support and resistance levels to identify potential trading opportunities. An inverted hammer candlestick that forms at or near a support level can be a stronger indication of an impending bullish reversal.

Unearthing Expert Advice and Tips

Seasoned forex traders recommend the following strategies when encountering an inverted hammer candlestick:

- Monitor the ensuing price action for confirmation of the reversal signal.

- Consider placing a buy order if the price breaks above the inverted hammer’s high.

- Utilize stop-loss orders to mitigate risk in case the reversal fails.

- Trade with caution, as inverted hammer candlesticks are not foolproof indicators.

Image: howtotrade.com

Enlightening Inquiries Frequently Raised

Q: What is the significance of the inverted hammer candlestick in forex trading?

A: It is a potential bullish reversal pattern that suggests that the bears are losing control and the bulls are gaining momentum.

Q: How do I identify an inverted hammer candlestick?

A: Look for a long lower wick, a short or non-existent upper wick, and a small body that forms at the bottom of the trading range.

Q: What additional factors should I consider when trading based on an inverted hammer candlestick?

A: Confirmation candles, support and resistance levels, and overall market sentiment can provide valuable context.

Inverted Hammer Candle Forex In How Trade

Conclusion

The inverted hammer candlestick is an indispensable tool for forex traders seeking to identify potential price reversals. By understanding its formation, meaning, and implications, traders can make more informed decisions and enhance their trading strategies.

Dear reader, are you intrigued by the power of the inverted hammer candlestick? Share your thoughts and experiences in the comments below!