Unveiling the Power of Moving Averages in Intraday Forex Trading

The fast-paced and dynamic nature of intraday forex trading demands traders to have effective strategies to navigate the volatile markets. Among the most widely used and time-tested technical indicators, moving averages (MAs) stand out as a powerful tool for identifying trends, predicting price movements, and optimizing trading decisions. In this comprehensive guide, we will delve into the intraday moving average strategy for forex, empowering traders with the knowledge and techniques to unlock profitable opportunities in the currency markets.

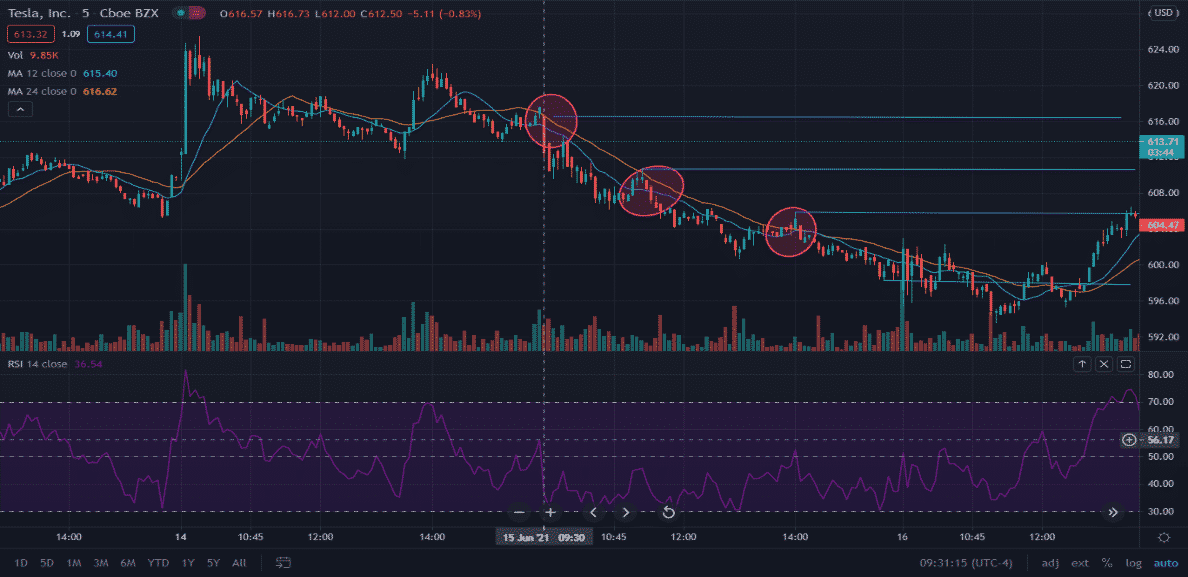

Image: optionstradingiq.com

Understanding Moving Averages

Moving averages are technical indicators that smooth out price fluctuations by calculating the average price over a specified period. They help traders filter out short-term market noise and identify the underlying trend of the market. There are different types of moving averages, with the most popular being the simple moving average (SMA), exponential moving average (EMA), and weighted moving average (WMA). Each type has its advantages and is suitable for different trading styles.

Applying Moving Averages to Intraday Forex Trading

Intraday trading involves making multiple trades within a single trading session, often holding positions for a few hours or even minutes. Moving averages become particularly valuable in this context as they provide real-time insights into the market’s direction and momentum. By setting multiple moving averages with different time frames, traders can identify potential entry and exit points, anticipate trend reversals, and assess the strength of the trend.

Popular Moving Average Strategies

Traders can experiment with various moving average strategies based on their risk appetite and trading style. Some popular strategies include:

-

Crossover Strategy: Traders wait for shorter-term moving averages to cross longer-term moving averages. A buy signal is generated when the shorter-term MA crosses above the longer-term MA, while a sell signal is triggered when it crosses below.

-

Envelope Strategy: This strategy involves using two moving averages, one above the price and one below. Traders look for price breakouts above the upper MA (buy signal) or below the lower MA (sell signal).

-

Divergence Strategy: Traders compare the movement of the price with the movement of the moving average. A bullish divergence occurs when the price makes a higher high while the MA makes a lower high, signaling a potential trend reversal; a bearish divergence is the opposite.

:max_bytes(150000):strip_icc()/dotdash_Final_Moving_Average_Strategies_for_Forex_Trading_Oct_2020-01-7559aba839cc410d8553868da1f1afc3.jpg)

Image: www.investopedia.com

Tips and Expert Advice for Maximizing Results

-

Combine Multiple Time Frames: Using multiple moving averages with different time frames provides a more comprehensive view of the market.

-

Consider Volatility: Adjust the period of the moving averages based on the volatility of the currency pair being traded.

-

Use Additional Indicators: Moving averages can be combined with other technical indicators, such as oscillators or volume indicators, for more accurate and reliable signals.

-

Set Realistic Profit Targets and Stop-Loss Levels: Determine appropriate profit targets and stop-loss levels based on historical data and market conditions.

-

Practice on Demo Accounts: Before implementing the strategy in live trading, practice it on a demo account to refine your approach and gain confidence.

FAQs about Intraday Moving Average Strategies

Q: What moving average period should I use?

- A: The optimal period depends on the currency pair, time frame, and trading style. Experiment with different periods to find what works best for you.

Q: Can I use moving averages for all currency pairs?

- A: Yes, moving averages can be applied to any currency pair, but they are particularly effective for trending markets.

Q: Is the moving average strategy profitable?

- A: While no trading strategy guarantees profits, the moving average strategy can provide valuable insights and improve trading performance when used effectively.

Intraday Moving Average Strategy Forex

Conclusion

Mastering the intraday moving average strategy for forex trading empowers traders with a powerful tool to navigate the volatile currency markets. By understanding the principles of moving averages, applying them strategically, and combining them with other indicators, traders can enhance their decision-making abilities, identify profitable opportunities, and maximize their returns. Remember, continuous research, practice, and a disciplined approach are essential for long-term success in forex trading.

Are you ready to elevate your intraday forex trading strategy with the power of moving averages? Embrace the wealth of information provided in this guide and embark on a journey towards profitability. The world of forex awaits your exploration.