In the tumultuous ocean of financial markets, the art of interpreting descriptive statistics holds the key to navigating uncertain waters. For the discerning forex trader, these statistical measures provide a beacon of clarity, enabling them to discern patterns, evaluate risk, and make informed decisions.

:max_bytes(150000):strip_icc()/Descriptive_statistics-5c8c9cf1d14d4900a0b2c55028c15452.png)

Image: www.investopedia.com

The Cornerstones of Forex Descriptive Statistics

Descriptive statistics encompass a multifaceted array of measures designed to summarize and elucidate data.

Averages, such as the mean and median, delineate the typical value of a dataset. Measures of dispersion, including variance and standard deviation, quantify the spread or variability within the data. And shape indicators, such as skewness and kurtosis, outline the distribution’s asymmetry or peakedness.

Disentangling the Nuances of Averages

The mean, or the average value, is a common measure of central tendency. It represents the sum of all data points divided by the number of observations. The median, on the other hand, reflects the middle value when the data is arranged in ascending order. In skewed distributions, the median provides a more representative indication of the typical value.

Appraising Risk with Dispersion Measures

Measures of dispersion quantify the extent to which data values deviate from the central tendency. Variance, the square of the standard deviation, calculates the average squared difference between each data point and the mean. A higher variance implies greater variability, indicating higher risk.

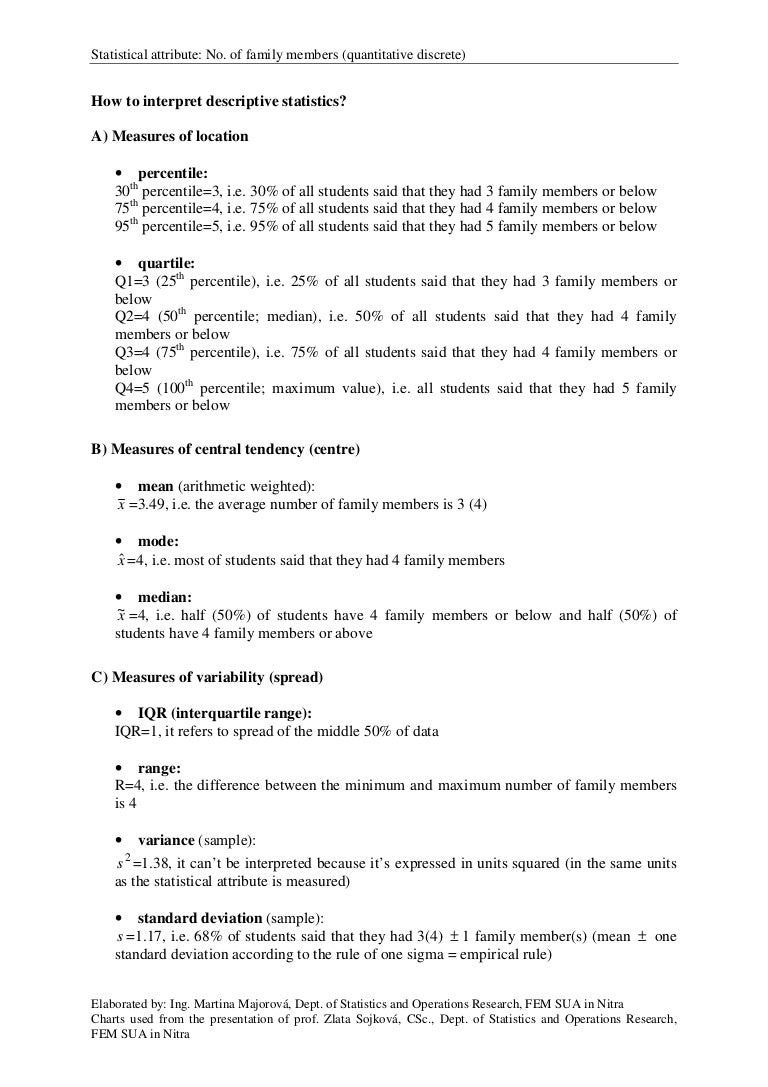

Image: www.slideshare.net

Unveiling Patterns with Shape Indicators

Shape indicators, particularly skewness and kurtosis, unravel the underlying structure of a data distribution. Skewness measures the data’s asymmetry, indicating whether it is skewed towards higher or lower values. Kurtosis evaluates the peakedness or flatness of the distribution. A positive kurtosis suggests a peaked distribution, while a negative kurtosis denotes a flatter distribution.

Expert Insights and Practical Tips

Harnessing the power of descriptive statistics requires a nuanced understanding. Here are some expert tips to enhance your interpretive prowess:

– **Analyze multiple measures:** Employ a holistic approach, considering both averages and dispersion measures to gain a complete picture.

– **Understand outliers:** Identify and handle outliers, as they can significantly influence statistical measures.

– **Contextualize the findings:** Interpret results within the context of market conditions and trading strategies.

FAQ on Forex Descriptive Statistics

**Q: What is the difference between mean and median?**

A: The mean is the arithmetic average, while the median is the middle value when the data is arranged in ascending order.

**Q: How does skewness impact trading decisions?**

A: Skewness indicates the asymmetry of the data distribution. A positive skewness may imply higher risk, while a negative skewness may signal a potential trading opportunity.

**Q: Why is normal distribution important in forex?**

A: Many statistical models and trading strategies assume normal distribution. Understanding deviations from normality is crucial for risk management.

Interpretation For Descriptive Statistics Forex

Conclusion

Interpretation of descriptive statistics is a cornerstone of successful forex trading. By understanding the underlying measures, traders can unravel data patterns, quantify risk, and make informed decisions. Whether you are a seasoned trader or a novice, embracing these statistical tools empowers you to navigate the forex landscape with greater confidence and efficiency.

So, are you ready to embark on this interpretive journey into the realm of descriptive statistics? Let your quest for knowledge guide you to trading success.