In the ever-evolving realm of finance, we find ourselves navigating the intricate world of foreign exchange, or forex, which holds the power to shape our understanding of global economies. Central banks across the globe diligently scrutinize forex market dynamics to inform their monetary policy decisions, illuminating the vital connection between forex and our financial landscape.

Image: binary.ihowin.com

Forex: The Compass for Central Bank Policies

Internal updates within central banks are not mere routine exercises; they represent deliberate and meticulous assessments of forex market conditions. The exchange rates between different currencies provide a window into the relative strength or weakness of economies, influencing inflation, trade, and investment. By monitoring these exchange rates, central banks can craft monetary policies that are tailored to their specific economic objectives.

The Delicate Balance of Currency Values

When a currency strengthens against other currencies, it can make the goods and services of that country more expensive for other nations to import. This can lead to decreased exports and a potential slowdown in economic growth. Conversely, if a currency weakens, it can make exports more competitive and stimulate economic activity.

Forex as an Indicator of Inflation and Growth

Forex market movements can also provide valuable insights into inflationary pressures. A rapid appreciation of a currency can indicate heightened demand for a country’s goods and services, putting upward pressure on prices. Conversely, a sharp depreciation of a currency can signal slack demand and deflationary risks. Monitoring forex fluctuations helps central banks anticipate potential threats to price stability and take appropriate policy action.

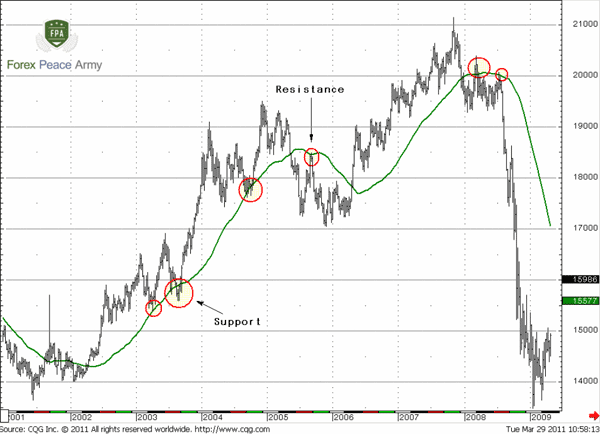

Image: www.forexpeacearmy.com

Shaping Investment Decisions

The forex markets also play a crucial role in shaping investment decisions for individuals and institutions alike. Investors analyze currency movements to assess the potential profitability of investing in different markets. A strong currency may offer a hedge against inflation and currency fluctuations, making it an attractive investment destination. Conversely, a weak currency may present challenges for investors, but it can also provide opportunities for currency speculation.

Global Interconnectedness: The Role of Forex in Today’s Economy

In today’s interconnected global economy, forex market movements can have ripple effects across borders. The decisions made by central banks in one country can impact currencies and economies in others. For instance, a sudden shift in currency policy in China can reverberate throughout the Asian Pacific region and beyond, affecting trade and investment patterns.

Lessons from the Pandemic

The unprecedented market volatility witnessed during the COVID-19 pandemic illustrated the importance of forex market monitoring. Central banks across the world deployed unconventional monetary measures, including quantitative easing, to combat the economic impact of the pandemic. These policies led to significant currency fluctuations, requiring central banks to carefully navigate the risks and opportunities presented by these turbulent markets.

Internal Updates Depends On Forex

Conclusion: Empowering Informed Decisions

Internal updates on forex markets provide invaluable insights for central banks, investors, and anyone navigating the complexities of the global economy. By understanding the interplay between currency values, inflation, economic growth, and investment decisions, we are better equipped to make informed decisions and mitigate potential risks. Whether you are a seasoned investor or simply interested in understanding the workings of the financial system, the lessons from forex market monitoring empower us to navigate the changing landscape with greater confidence and foresight.