Unleash the Potential of the Financial Market with a Calculated Start

In the realm of finance, the allure of the foreign exchange (forex) market beckons traders with its immense liquidity, global reach, and 24/7 availability. However, embarking on this financial adventure requires a conscious evaluation of your initial investment. This comprehensive guide will illuminate the intricacies of forex account setup, empowering you with the knowledge to make informed choices and unleash the transformative potential of currency trading.

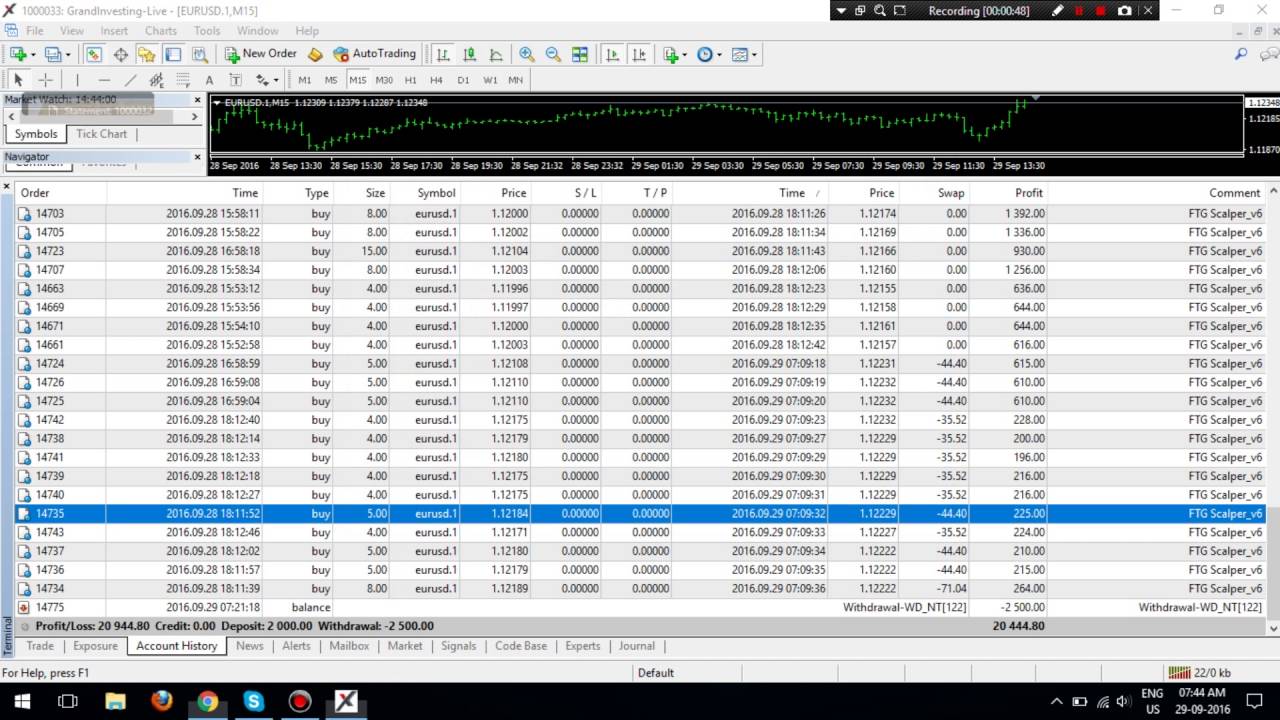

Image: www.youtube.com

Understanding the Forex Market: A Gateway to Global Finance

At the heart of the forex market lies the exchange of currencies between various countries. As the world’s largest financial market, it enables individuals, corporations, and even governments to buy, sell, and trade currencies. The ability to capitalize on fluctuations in currency exchange rates offers traders the prospect of substantial financial gain, but it also carries inherent risks.

Setting Up Your Forex Account: A Journey into Currency Trading

Before you can delve into the currency markets, you must establish a dedicated forex trading account. This critical step involves choosing a reputable forex broker, one that aligns with your financial goals and provides a user-friendly trading platform tailored to your proficiency level. Remember, different brokers offer varying account types, deposit requirements, and trading conditions. It’s essential to thoroughly research and carefully select a broker that meets your specific needs.

Initial Investment Unveiled: Key Considerations for Success

The initial investment required to open a forex account varies depending on the chosen broker and account type. While some brokers offer micro-accounts with accessible minimum deposits, others may require a more substantial initial outlay. It’s imperative to determine an appropriate investment amount that aligns with your financial constraints while providing ample room for potential growth.

Image: www.chinettiforex.com

Smart Risk Management: A Foundation for Trading Success

Before you embark on currency trading, it’s paramount to establish a sound risk management strategy. Set well-defined limits on your trades and leverage appropriately. Forex trading carries inherent risk, which prudent risk management practices can help you mitigate, fostering sustainable trading practices.

Leverage the Power of Education: Knowledge as Your Guiding Light

The forex market rewards those who invest in education. Diligently study market dynamics, trading strategies, and technical analysis techniques. Attend webinars, engage in simulations, and connect with experienced traders to expand your knowledge base. Continuous learning is the cornerstone of successful forex trading.

Expert Insights: Unveiling the Secrets of Success

Seasoned forex traders advocate for a disciplined approach, meticulous risk management, and consistent learning. Allocate time to developing a comprehensive trading plan that aligns with your risk tolerance and financial objectives. Seek guidance from reputable sources, including experienced traders, reputable brokers, and industry publications.

Initial Investment To Start Forex Account

Embrace the Challenge: Forge Your Path to Forex Success

Forex trading presents an unparalleled opportunity for financial gain, yet it also demands a disciplined and calculated approach. Embrace the challenge, harness the power of education, and navigate the market with a cautious mind and a bold espíritu. The rewards of successful forex trading lie within the realm of possibility, waiting to be seized by those who dare to venture forth with knowledge and confidence.