In the ever-evolving world of finance, Indonesia has emerged as a formidable player in the global Forex market. Indonesian Forex fund management companies offer investors a unique opportunity to tap into the vast potential of currency trading, while mitigating the complexities and risks involved.

Image: www.acorn2oak-fx.com

Understanding Indonesian Forex Fund Management

Forex, short for foreign exchange, is the buying and selling of currencies from different countries. It’s the world’s most traded financial instrument, with daily transactions exceeding trillions of dollars. Indonesian Forex fund management companies specialize in managing investors’ funds in the Forex market, leveraging their expertise and insights to generate profitable returns.

Benefits of Investing with an Indonesian Forex Fund Management Company

Investing with a reputable Indonesian Forex fund management company comes with several key benefits:

-

Professional Expertise: Fund managers have years of experience in analyzing market trends and making informed investment decisions. They utilize sophisticated trading strategies and risk management techniques to maximize returns and protect investor capital.

-

Diversification: Forex funds often invest in multiple currency pairs, allowing for diversification and reducing overall risk.

-

Passive Income Generation: Investors can generate passive income through dividends or profit-sharing arrangements without actively trading themselves.

-

Access to Global Markets: Fund managers have access to global markets, providing investors with exposure to a wider range of currency pairs and trading opportunities.

-

Legal and Regulatory Compliance: Regulated fund managers operate within strict legal and regulatory frameworks, ensuring transparency and investor protection.

Choosing a Reliable Indonesian Forex Fund Management Company

With a wealth of options available, it’s crucial to carefully select a reliable and reputable Indonesian Forex fund management company. Here are some key factors to consider:

-

Track Record: Research the company’s past performance, including their rate of return and risk management strategies.

-

Transparency: Look for companies that disclose their investment strategies, fee structure, and fund performance regularly.

-

Regulation: Ensure the company is registered with appropriate regulatory authorities, such as the Indonesian Commodity Futures Trading Supervisory Agency (BAPPEBTI).

-

Customer Service: Choose a company that provides responsive and helpful customer service to assist you throughout your investment journey.

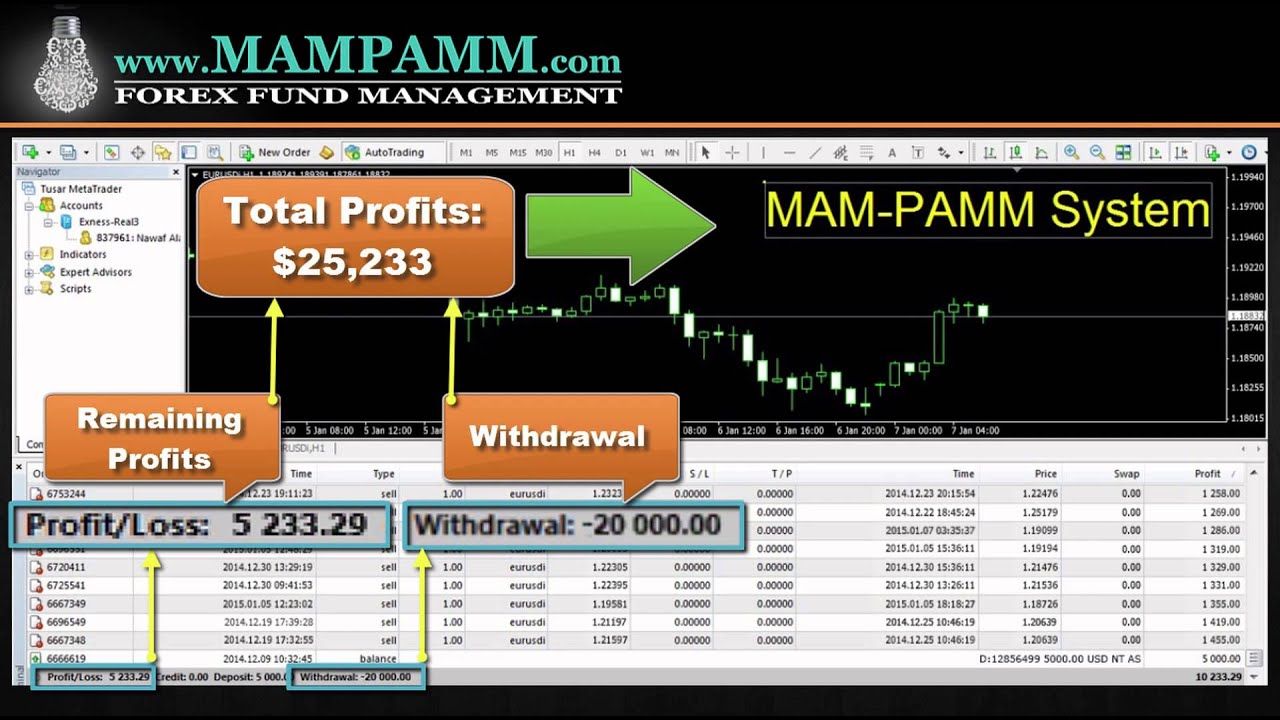

Image: www.youtube.com

Getting Started with Indonesian Forex Fund Management

To invest in an Indonesian Forex fund management company, follow these steps:

-

Research and Selection: Choose a fund manager that meets your investment goals and risk tolerance.

-

Account Setup: Open an investment account with the selected fund manager.

-

Fund Transfer: Transfer funds to your account in accordance with the company’s instructions.

-

Periodic Reporting: Receive regular reports on the fund’s performance and your investment status.

Indonesian Forex Fund Management Company

Empowering Investors with Financial Knowledge

Investing in the Forex market can be daunting, but with the guidance of an experienced fund manager, Indonesian investors can unlock the potential of this dynamic market. By leveraging professional expertise, diversification, and a commitment to transparency, these companies empower investors to navigate financial complexities and achieve their financial aspirations.