The vitality of financial hubs plays a pivotal role in the economic landscape of nations. India, a flourishing economic powerhouse, boasts two formidable financial domains: the Indian share market and the forex market. Each arena serves as a conduit for investors to channelize their financial acumen and reap the rewards of capital appreciation. While both markets bear similarities in the realm of investment, their scope, liquidity, and regulatory mandates set them apart. In this comprehensive analysis, we delve into the captivating nuances of these two financial behemoths, comparing their size, trading mechanisms, risk profiles, and regulatory frameworks.

Image: blog.elearnmarkets.com

The Elephant in the Room: Size Matters

The Indian equity market, meticulously tracked by the BSE SENSEX and NSE NIFTY 50 indices, stands proudly as the ninth largest in the world. Its captivating size, valued at an awe-inspiring $3.7 trillion, eclipses the $2.4 trillion market capitalization of the Indian forex market. This colossal disparity highlights the dominant stature of the stock market within India’s financial landscape, captivating the interest of domestic and global investors alike.

Trading Mechanisms: A Symphony of Differences

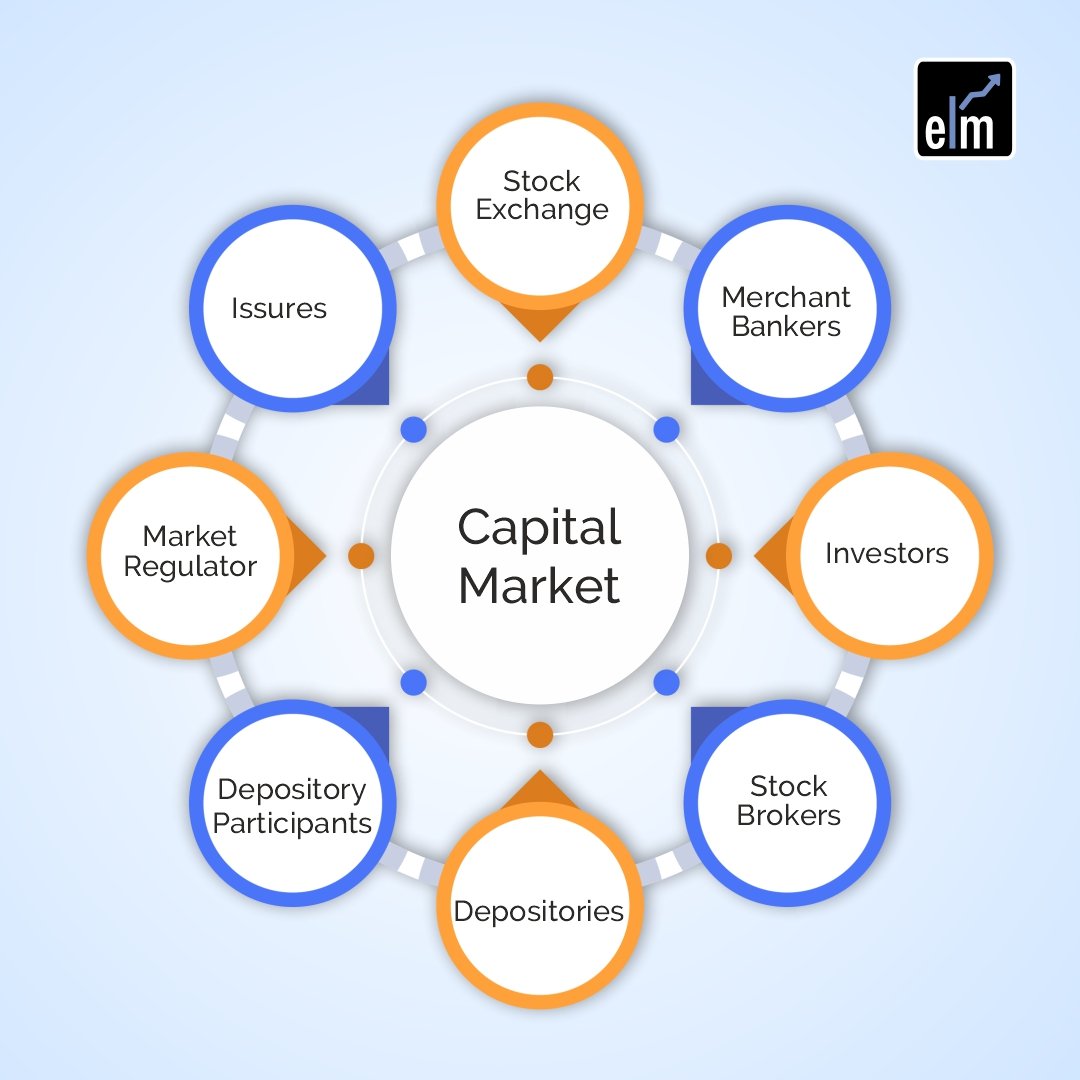

Delving into the intricacies of their trading mechanisms unveils a symphony of disparities. The Indian share market epitomizes a centralized exchange-traded ecosystem, overseen by the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE). Market participants engage in meticulous due diligence, adhering to a comprehensive regulatory framework, before executing buy and sell orders.

On the other hand, the Indian forex market operates in a dynamic, decentralized fashion, unconstrained by the confines of exchanges. Market makers and participants engage in bilateral transactions, relying on interbank networks to facilitate the exchange of currencies. This decentralized nature renders the forex market a fluid, round-the-clock financial ecosystem, accessible to a wider spectrum of investors.

Image: www.educba.com

Indian Share Market Capital Vs Forex Market Capital

Navigating the Seas of Risk: A Tale of Volatility

Navigating the ever-fluctuating tides of the financial realm necessitates an astute understanding of risk profiles. The Indian share market, despite its allure of potentially lucrative returns, commands a higher risk profile in comparison with the forex market. Equity prices are susceptible to a plethora of intrinsic and extrinsic factors, often resulting in rapid fluctuations that can erode invested capital.

In contrast, the forex market generally projects a lower risk profile. Currency pairs tend to fluctuate within narrower ranges, largely influenced by economic fundamentals and central bank policies. While not immune to volatility, forex trading offers a comparatively less turbulent environment for risk-averse investors seeking stability.