A Comprehensive Analysis for Smart Investing

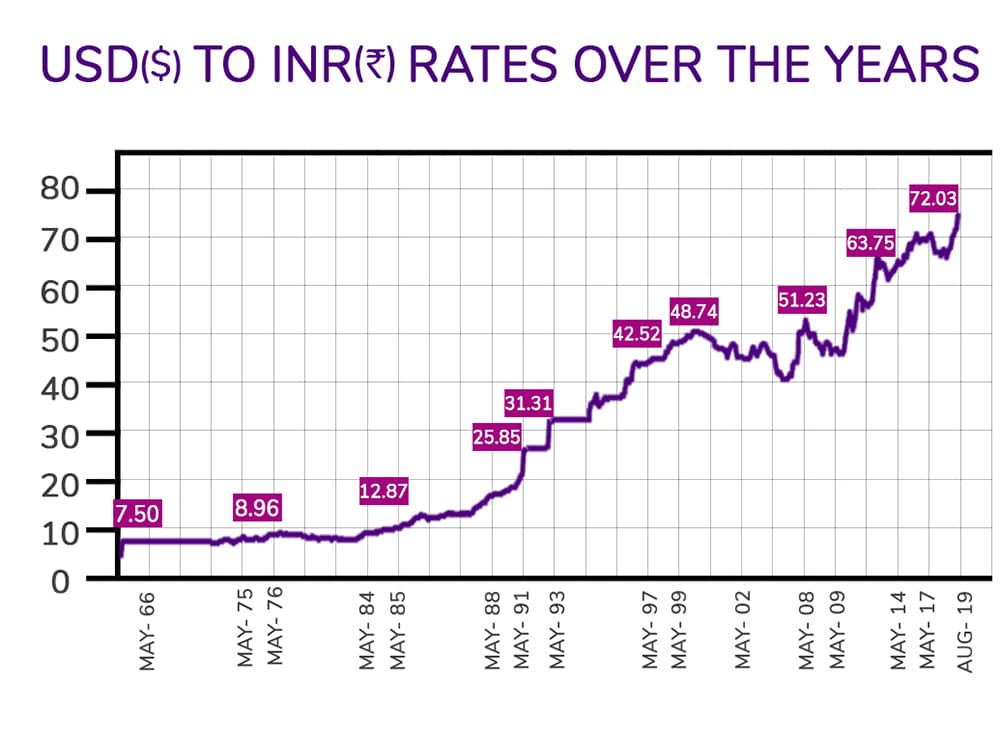

The Indian rupee (INR) has been on a rollercoaster ride against the US dollar (USD) in recent years. The rupee’s value has fluctuated due to numerous factors, including economic policy, interest rate differences, and global trade dynamics. As we navigate the uncertain economic waters of 2023, it’s essential to understand the factors shaping the Indian rupee’s value and make informed investment decisions.

Image: www.nytimes.com

Factors Influencing the Rupee-Dollar Relationship

The value of the Indian rupee is influenced by several key factors:

- Economic Growth: India’s economic growth rate is a major determinant of the rupee’s value. Faster economic growth leads to increased demand for the rupee, which strengthens its value against the dollar.

- Interest Rate Differential: The difference in interest rates between India and the US affects the flow of capital and ultimately the rupee’s value. Higher interest rates in India attract foreign investment, strengthening the rupee.

- Current Account Deficit: India’s current account deficit (CAD) measures the difference between its exports and imports. A widening CAD can weaken the rupee’s value, as it indicates a higher demand for foreign exchange to finance imports.

- Government Policy: Government policies, such as changes in fiscal or monetary policy, can impact the rupee’s value. Forex interventions by the Reserve Bank of India (RBI) can also influence market sentiment and affect the rupee’s trajectory.

- Global Economic Conditions: External factors, such as global economic growth, geopolitical tensions, and commodity prices, can affect the rupee’s value. A slowing global economy or a surge in oil prices can put pressure on the rupee.

Indian Rupee Value Predictions for 2023:

Economists and market analysts have made varying predictions for the value of the Indian rupee in 2023. Here’s a summary of their forecasts:

Some experts predict a gradual appreciation of the rupee against the dollar, driven by improving economic growth, increasing foreign investment, and stable interest rates. They anticipate the rupee to trade in the range of 80 to 82 against the US dollar by the end of 2023.

Others foresee a more cautious outlook, expecting the rupee to remain relatively stable within a broad range due to global economic headwinds, geopolitical uncertainties, and inflationary pressures. They estimate the rupee to remain around the 84-88 mark against the dollar.

Investment Strategies: Navigating Rupee-Dollar Dynamics

The fluctuating value of the rupee presents both opportunities and challenges for investors. Here are a few tips to navigate these market dynamics effectively:

- Diversify Your Portfolio: Invest in a diversified portfolio of assets, including stocks, bonds, real estate, and commodities. This can help mitigate risks associated with currency fluctuations and provide better returns over the long term.

- Hedge Foreign Currency Exposure: If you have significant foreign currency exposure, consider hedging your investments to minimize the impact of currency fluctuations on your portfolio’s value.

- Explore Currency ETFs: Currency-based ETFs offer opportunities to take advantage of currency movements. These ETFs track the performance of specific currencies and can provide exposure to specific foreign exchange markets.

- Stay Informed: Keep up-to-date with economic news and global market events that may impact the rupee’s value. This knowledge will help you make informed investment decisions and adjust your strategies accordingly.

Image: www.latestly.com

Conclusion:

The value of the Indian rupee versus the US dollar is a dynamic interplay of economic, financial, and global factors. Understanding these factors and making informed investment decisions can help you mitigate risks and seize opportunities presented by currency fluctuations. Whether you’re an experienced investor or just starting out, staying informed and implementing a diversified investment strategy is crucial for navigating the changing landscape of the rupee-dollar relationship.

Looking ahead to 2023 and beyond, the Indian rupee’s journey will likely be influenced by the country’s economic trajectory, global market conditions, and the interplay of various factors discussed in this article. By following these tips and expert advice, you can position yourself for success in the ever-evolving currency markets.

Indian Rupee Value Prediction Vs Dollars For 2019 Forex

FAQ on Indian Rupee Value Prediction vs. Dollars:

- Q: Which factors have the greatest impact on the Indian rupee’s value?

A: Economic growth, interest rate differential, and current account deficit are key factors that significantly influence the rupee’s value.

- Q: What are some investment strategies to manage currency fluctuations?

A: Diversifying your portfolio, hedging foreign currency exposure, exploring currency ETFs, and staying informed are effective strategies to mitigate risks and seize opportunities presented by currency movements.

- Q: How do economic conditions globally affect the rupee’s value?

A: Global economic growth, geopolitical tensions, and commodity prices can impact the demand for the rupee and influence its value against the dollar.

- Q: What is the expected trend of the rupee-dollar relationship in 2023?

A: The rupee’s value is projected to be relatively stable within a broader range, with some economists predicting a gradual appreciation due to improving economic conditions, while others foresee a more cautious outlook due to global economic headwinds.