In today’s dynamic global economy, understanding the intricacies of foreign exchange trading has become essential for investors and individuals alike. Among the various currencies traded globally, the Indian rupee (INR) holds significant importance, offering unique opportunities for traders. In this comprehensive guide, we will delve into the fascinating world of Indian rupee trading, empowering you with the knowledge and insights necessary to navigate this exciting market.

Image: www.financebrokerage.com

What is Indian Rupee Trading?

Indian rupee trading refers to the exchange of the Indian rupee for other currencies, primarily the US dollar (USD), in the foreign exchange market (Forex). It involves buying and selling INR at fluctuating prices, with the aim of profiting from currency rate movements. Trading the INR provides traders with access to one of the largest emerging markets in the world, offering significant potential for capital appreciation.

Factors Influencing the Indian Rupee

Like other currencies, the value of the Indian rupee is influenced by a complex interplay of macroeconomic factors, including:

-

Economic Growth and Outlook: A robust economic outlook, characterized by strong GDP growth, low inflation, and rising consumer spending, tends to boost the rupee’s value against other currencies.

-

Inflation: High inflation rates can erode the purchasing power of the rupee, reducing its value relative to other currencies, whereas low inflation supports rupee appreciation.

-

Interest Rates: Changes in interest rates set by the Reserve Bank of India (RBI) can influence the attractiveness of INR assets for foreign investors, thereby impacting its value.

-

Global Economic Conditions: External factors, such as global economic growth, currency fluctuations, and geopolitical events, can also affect the INR’s valuation.

Understanding the Forex Market for INR

The Forex market for INR operates around the clock, with trading taking place in various financial centers such as New York, London, Tokyo, and Mumbai. Traders can access the INR market through a variety of means, including online brokerage platforms and banks. The most commonly traded INR currency pair is INR/USD, representing the exchange rate between the Indian rupee and the US dollar.

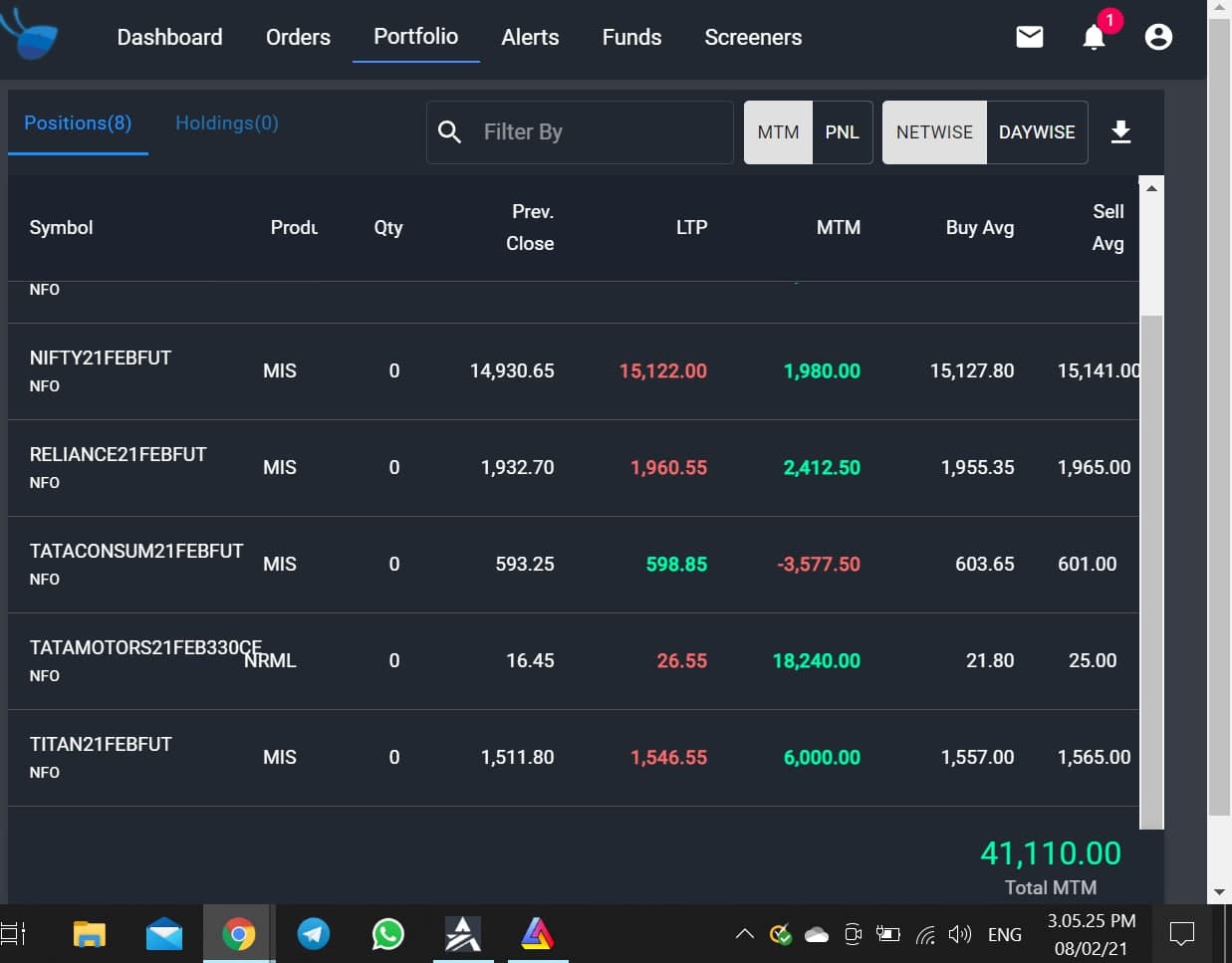

Image: www.intradaystar.com

Strategies for Successful INR Trading

-

Trend Analysis: Identifying prevailing currency trends using technical analysis tools can help traders make informed decisions about entry and exit points.

-

Fundamental Analysis: Studying macroeconomic data, news events, and political developments that affect the Indian economy can provide insights into potential currency movements.

-

Carry Trading: Forex carry trading involves borrowing a low-interest currency (USD in this case) and investing it in a higher-interest currency (INR). The strategy benefits from interest rate differentials but carries potential risks.

-

Hedging: Indian rupee trading can also serve as a hedging tool for businesses or individuals with exposure to currency fluctuations, mitigating potential losses akibat adverse currency movements.

Top Trading Tips

-

Start with a Trading Plan: Define your trading objectives, risk tolerance, and trading strategies before entering the market.

-

Manage Risk Effectively: Employ risk management tools such as stop-loss orders and position sizing to minimize potential losses.

-

Stay Informed: Monitor financial news, economic data, and geopolitical events that may impact INR trading.

-

Educate Yourself: Continuously learn and stay updated on Forex trading principles and currency market dynamics.

-

Choose a Reputable Broker: Partner with a reputable and regulated online broker that offers a user-friendly platform, low transaction fees, and multilingual support.

Indian Rupee At Forex Trading

Conclusion

Embarking on Indian rupee trading can be a lucrative endeavor for those who possess a solid understanding of the market, its dynamics, and potential risks involved. By embracing the strategies outlined in this comprehensive guide, and constantly expanding your knowledge, you can transform the challenges of Forex trading into opportunities for success. Remember, the Forex market is a global stage where smart trading decisions can reap significant rewards, empowering you to confidently navigate the ever-evolving financial landscape.