India’s bond yields and forex reserves are two pivotal indicators of the nation’s financial health and economic trajectory. This article delves into the complexities of these two interconnected elements, offering a comprehensive analysis of their significance, trends, and impact on the Indian economy.

Image: timesofindia.indiatimes.com

Significance of Indian Bond Yields and Forex Reserves

Bond Yields:

Bond yields represent the interest rates on government-issued bonds, offering an insight into investor sentiment towards the country’s economic prospects. Higher bond yields indicate a lack of investor confidence, while lower yields imply stability and growth.

Forex Reserves:

Foreign exchange reserves comprise the stocks of a country’s foreign currencies held by its central bank. These reserves act as a buffer against external shocks and maintain the stability of the nation’s currency.

Trends in Indian Bond Yields and Forex Reserves

Recent years have witnessed a dynamic interplay between Indian bond yields and forex reserves:

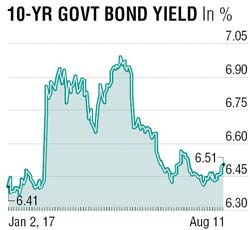

- Bond Yields: Indian bond yields have experienced significant fluctuations, rising in anticipation of inflationary pressures and falling during periods of economic slowdown.

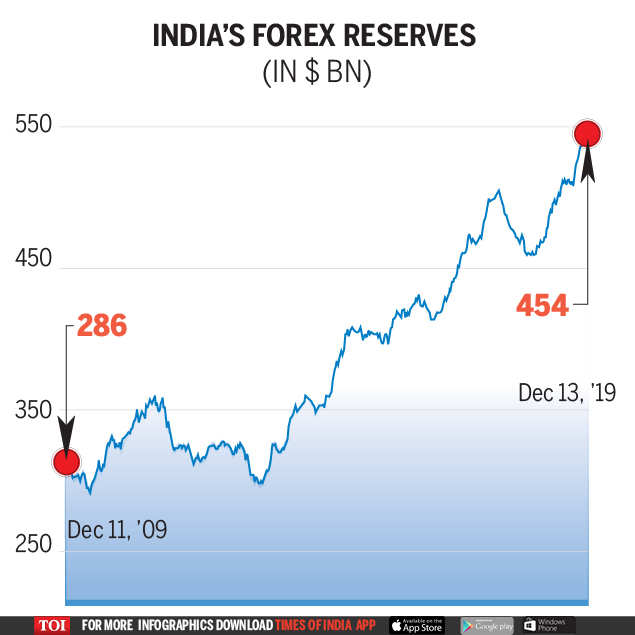

- Forex Reserves: Forex reserves have generally trended upwards, reflecting India’s trade surplus and inward foreign investment. However, sudden outflows and currency devaluation events have occasionally led to reserve depletion.

Impact on the Indian Economy

Growth and Inflation: Rising bond yields can dampen economic growth by increasing borrowing costs for businesses and consumers. On the other hand, lower yields can support growth by making it cheaper to invest.

Forex reserves provide a cushion against exchange rate volatility, helping to stabilize the economy and protect against external shocks.

International Trade: Forex reserves support India’s international trade. Sufficient reserves allow for foreign currency conversion and reduce the risk of import-export disruptions.

Balance of Payments: Forex reserves play a crucial role in balancing India’s payments to other countries, ensuring timely settlement of imports and servicing of external debt.

Image: www.dnaindia.com

Indian Bond Yields And Forex Reserves

Current Challenges and Future Prospects

While India’s bond yields and forex reserves are relatively stable, challenges remain:

- Fiscal Deficit: A high fiscal deficit can lead to increased government borrowing and higher bond yields.

- Inflationary Pressures: Persistent inflation can drive up bond yields and erode the value of forex reserves.

- Global Economic Uncertainty: External factors, such as the global economic slowdown or geopolitical crises, can impact investor sentiment and demand for Indian bonds.

Despite these challenges, India has a strong track record of managing its bond yields and forex reserves. Stringent fiscal discipline, sound monetary policies, and prudent forex management are key to maintaining economic stability and growth. As the Indian economy continues to navigate global and domestic uncertainties, the careful management of these two key financial indicators will be crucial.