In the dynamic world of finance, traders constantly strive to optimize their profitability while minimizing risks. Accurately determining position size is a critical aspect of ensuring trading success, and this is where the indices position size calculator steps in as an indispensable tool.

Image: graphics.eiu.com

Equipping Traders with Confidence and Precision

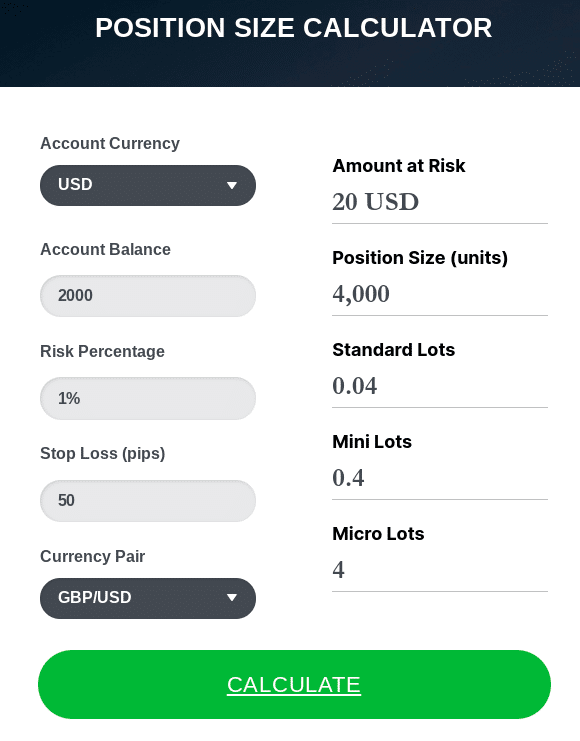

An indices position size calculator is a powerful tool designed to assist traders in determining the optimal number of contracts or shares to trade based on their account balance, risk tolerance, and desired gain or loss percentage. By incorporating these parameters, the calculator empowers traders to enter and exit trades with greater confidence and precision.

Demystifying the Indices Position Size Calculator

To understand how this calculator works, let’s break down its key components:

- Account Balance: This refers to the amount of capital available for trading.

- Risk Tolerance: This quantifies a trader’s willingness to bear losses, expressed as a percentage of their account balance.

- Desired Gain or Loss Percentage: This represents the trader’s target profit or acceptable loss on the trade.

The calculator combines these parameters using predefined formulas to calculate the appropriate position size. This eliminates the guesswork and allows traders to make informed decisions based on sound mathematical principles.

Real-World Applications

In the realm of practical trading, the indices position size calculator proves its value in numerous scenarios:

- Risk Management: By precisely calculating position size, traders can mitigate potential losses and protect their capital.

- Maximizing Profitability: The calculator helps traders identify the optimal trade size to maximize their potential returns while limiting downside risk.

- Trading Multiple Indices: When trading across different indices, the calculator adjusts for the varying risk profiles, ensuring consistent risk management practices.

- Testing Trading Strategies: Traders can utilize the calculator to backtest their strategies, refining their risk-reward ratios and identifying optimal trade sizes.

Image: learn2.trade

Leveraging the Calculator’s Capabilities

To harness the full power of the indices position size calculator, it is imperative to:

- Use Reliable Data: Input accurate and up-to-date information to ensure the calculator’s accuracy.

- Consider Market Conditions: Adjust parameters based on market volatility and current trends to account for changing risk profiles.

- Monitor and Adjust: Regularly review trade performance and adjust position size as market conditions evolve.

Indices Position Size Calculator

Embracing the Power of Precision

The indices position size calculator is a crucial tool that empowers traders with the precision and confidence they need to navigate the complexities of the financial markets. By meticulously calculating appropriate trade sizes, traders can mitigate risks, optimize returns, and elevate their trading performance to new heights. Unlock the potential of this invaluable tool and embark on a path of informed and successful trading.