Image: currentaffairs.adda247.com

Introduction:

For over a century, India’s foreign exchange reserves have served as a vital backbone, ensuring the country’s financial stability and fueling its economic progress. In recent years, these reserves have reached unprecedented levels, marking a testament to India’s growing economic might. This article delves into the intricate world of India’s forex reserves, exploring their significance, composition, and implications for the economy.

Understanding Forex Reserves:

Forex reserves, also known as foreign currency reserves, represent the total value of foreign assets held by India’s central bank, the Reserve Bank of India (RBI). These assets consist primarily of foreign currency deposits, government bonds, and gold. Maintaining ample forex reserves is crucial for a nation’s economic health, as they provide a buffer against external shocks and facilitate international trade.

Importance of India’s Forex Reserves:

India’s forex reserves play a pivotal role in safeguarding the economy from external vulnerabilities. They enable the country to:

-

Stabilize the exchange rate and prevent sharp fluctuations in the value of the rupee.

-

Ensure sufficient liquidity to meet import needs, especially during periods of global economic instability.

-

Repay foreign debt obligations and maintain the country’s creditworthiness.

-

Build confidence among investors and enhance the overall stability of the financial system.

Composition of India’s Forex Reserves:

As of March 2023, India’s forex reserves stood at a staggering $632 billion, marking a record high. The reserves comprise:

-

Foreign currency assets ($558.7 billion): Includes deposits in foreign currencies, mostly in US dollars.

-

Gold ($36.6 billion): Accounts for approximately 7% of total reserves.

-

Special drawing rights ($22.9 billion): An international reserve asset created by the International Monetary Fund (IMF).

-

Reserve position in the IMF ($4.2 billion): Represents India’s share in the IMF’s reserves.

Factors Influencing Forex Reserves:

Several factors influence the level of India’s forex reserves, including:

-

Foreign exchange inflows: Generated through exports, foreign direct investment, and remittances from overseas Indians.

-

Foreign exchange outflows: Spent on imports, debt repayments, and foreign investment by domestic entities.

-

RBI interventions: The RBI actively manages the forex market to stabilize the exchange rate and prevent excessive volatility.

Implications for the Economy:

Strong forex reserves provide numerous benefits to the Indian economy:

-

Increased stability and resilience: Protects against external shocks, such as currency fluctuations or economic downturns.

-

Lower borrowing costs: Enhances India’s credit rating, leading to lower interest rates on foreign loans.

-

Export competitiveness: A stable exchange rate supports export-oriented industries, making Indian goods more competitive in global markets.

-

Investment confidence: Adequate forex reserves instil confidence among investors, both foreign and domestic.

Conclusion:

India’s forex reserves have become a cornerstone of the country’s economic strength. Their steady growth reflects India’s integration into the global economy and its resilience in the face of challenges. As India continues on its path of economic progress, maintaining robust forex reserves will remain essential for safeguarding the future stability and prosperity of the nation.

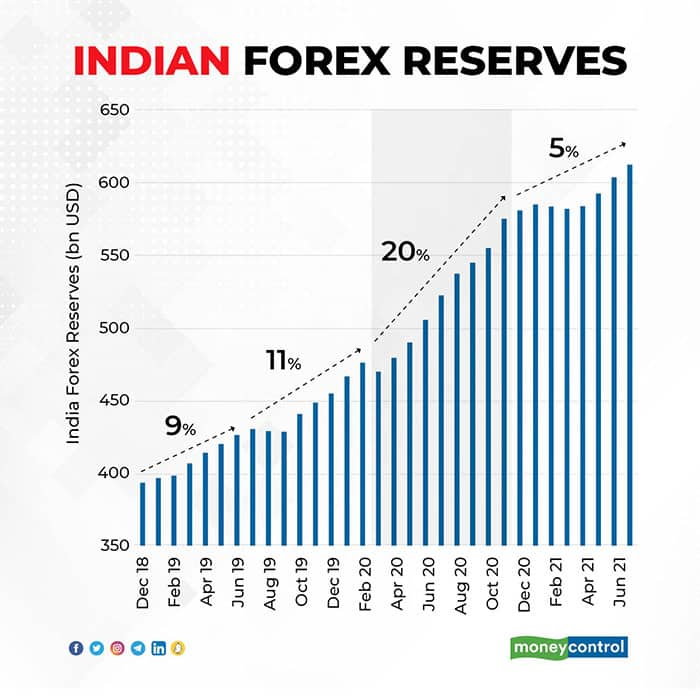

Image: www.moneycontrol.com

India’S Forex Reserves Currently Is Around