India’s foreign exchange (forex) reserves are a critical indicator of the country’s financial stability and economic health. These reserves comprise foreign currencies such as US dollars, euros, and yen, as well as gold and special drawing rights (SDRs).

Image: www.financialexpress.com

India’s Forex Reserves History and Significance

India’s forex reserves have witnessed significant growth in recent years, indicating the country’s strong economic position. The reserves have been instrumental in various ways:

- Import Cover: Forex reserves provide a cushion to meet the country’s import needs, especially during times of economic uncertainty.

- Exchange Rate Stability: The central bank can use forex reserves to intervene in the currency market to maintain exchange rate stability.

- External Debt Repayment: Forex reserves are crucial for meeting external debt repayment obligations and ensuring financial stability.

In May 2014, India’s foreign exchange reserves reached an all-time high of $320 billion. This record level signaled India’s economic resilience and its ability to withstand external shocks.

Factors Influencing Forex Reserves

Fluctuations in forex reserves can be influenced by several factors, including:

- Trade Balance: A surplus in the trade balance leads to an increase in forex reserves, while a deficit reduces them.

- Foreign Direct Investment (FDI): Inflows of FDI increase forex reserves, while outflows have the opposite effect.

- Remittances: Money sent back to India from overseas can boost forex reserves.

- Exchange Rate Movements: Fluctuations in exchange rates can impact the value of forex reserves.

- Central Bank Intervention: The central bank can buy or sell forex reserves to influence exchange rates or manage inflation.

Implications of High Forex Reserves

India’s high forex reserves provide the economy with several benefits:

- Increased Stability: It enhances the country’s resilience to external shocks and reduces its vulnerability to financial crises.

- Lower Borrowing Costs: High forex reserves can lead to lower borrowing costs for India, both domestically and internationally.

- Investment Opportunities: Foreign exchange reserves can be invested to generate returns and support economic growth.

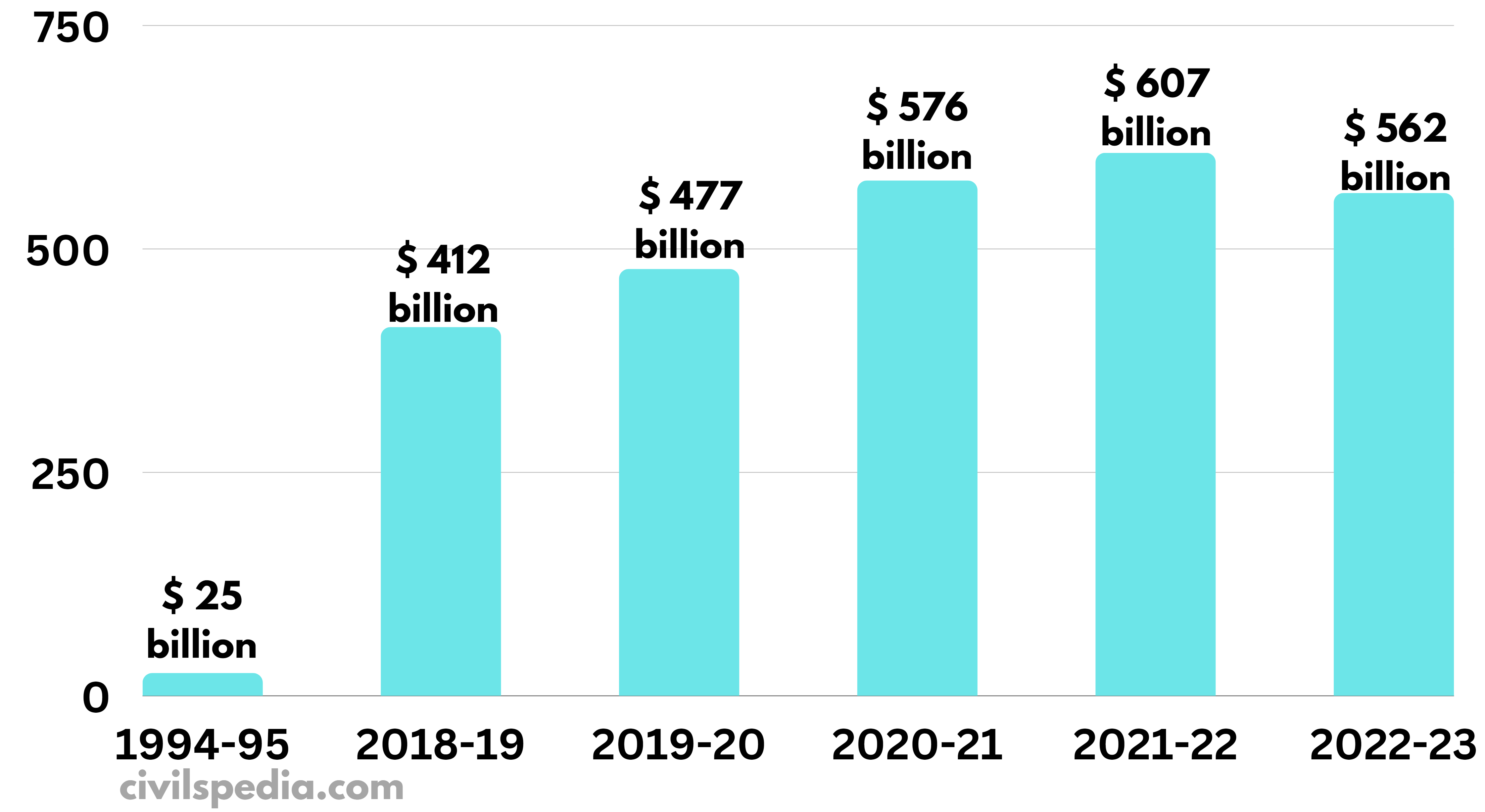

Image: civilspedia.com

Expert Advice and Tips

To maintain high forex reserves, it is crucial for India to:

- Promote Exports: Encourage businesses to export more goods and services to increase the trade surplus.

- Attract Foreign Investment: Create a conducive environment for foreign investors to boost FDI inflows.

- Encourage Remittances: Improve channels for international remittances to increase foreign currency inflows.

- Manage Exchange Rates: Implement policies that promote exchange rate stability and prevent excessive volatility.

- Prudent Central Bank Interventions: Ensure that central bank interventions in the forex market are aimed at fostering stability rather than short-term speculative gains.

FAQs on India’s Forex Reserves

Q: What is the significance of forex reserves?

A: Forex reserves play a critical role in ensuring import cover, exchange rate stability, and external debt repayment.

Q: What are the factors that influence forex reserves?

A: Factors include trade balance, FDI, remittances, exchange rate movements, and central bank intervention.

Q: Why are high forex reserves beneficial for India?

A: High forex reserves provide stability, lower borrowing costs, and investment opportunities.

India Forex Reserves May 2014

Conclusion

India’s foreign exchange reserves are a testament to the country’s economic strength and global standing. The high level of reserves in May 2014 was a significant milestone, highlighting India’s resilience and ability to navigate external challenges.

By adopting prudent policies and implementing expert advice, India can continue to maintain its high forex reserves, ensuring financial stability and promoting sustainable economic growth.

Are you interested in learning more about India’s forex reserves and their implications for the economy? Share your thoughts or ask questions in the comments section below.