India’s foreign exchange reserves are a crucial aspect of its financial stability and economic growth. Maintaining adequate forex reserves ensures that a country can meet its external obligations, import essential goods, and combat economic crises. Let’s delve into the intriguing history of India’s forex reserves, tracing their growth, fluctuations, and significance.

Image: www.zeebiz.com

A Historical Trajectory: India’s Forex Reserves

In 1947, at the time of India’s independence, its forex reserves stood at a meager $400 million. Over the subsequent decades, the country’s reserves witnessed a gradual but steady increase. However, it was in the 1991 economic reforms that the transformative change occurred. The adoption of a market-oriented economy and liberalization policies ushered in a surge in foreign capital inflows, significantly bolstering the country’s forex reserves.

Throughout the 2000s and early 2010s, India’s forex reserves continued to grow, fueled by robust foreign investment and a favorable balance of payments. The country’s export sector played a pivotal role in this growth, particularly in industries such as IT services, pharmaceuticals, and gems and jewelry.

Forex Reserves: A Buffer for Economic Stability

Maintaining ample forex reserves is of paramount importance for a developing economy like India. These reserves act as a buffer against external economic shocks, such as sudden changes in global demand, fluctuations in commodity prices, or financial crises. A healthy level of forex reserves gives India the ability to intervene in the foreign exchange market to stabilize the value of the rupee, manage inflation, and ensure the availability of foreign exchange for importing essential goods.

In recent years, India’s forex reserves have faced both challenges and opportunities. The COVID-19 pandemic led to a significant drawdown in reserves as the country experienced a decline in exports and foreign capital inflows. However, the post-pandemic economic recovery and subsequent geopolitical events have resulted in an influx of foreign capital and a rebound in forex reserves.

Factors Influencing India’s Forex Reserves

A multitude of factors impact India’s forex reserves, including:

- Foreign direct investment (FDI)

- Foreign institutional investment (FII)

- Remittances from overseas Indians

- Balance of trade

- Government intervention in the foreign exchange market

- Global economic conditions

The Reserve Bank of India (RBI) plays a crucial role in managing India’s forex reserves through various monetary and fiscal policy measures. The RBI intervenes in the foreign exchange market to stabilize currency fluctuations and maintain an optimal level of reserves.

Image: www.drishtiias.com

Tips for Effective Forex Reserve Management

Based on the experience of leading economists and central banks, here are a few key tips for effective forex reserves management:

- Maintain an adequate level of reserves: A sufficient level of forex reserves provides a cushion against external shocks and enhances economic resilience.

- Diversify reserve assets: By diversifying its forex reserves across different currencies, assets, and countries, India can reduce risks associated with fluctuations in exchange rates and asset prices.

- Use reserves prudently: Foreign exchange reserves should be used judiciously to intervene in the foreign exchange market, manage inflation, and import essential goods.

- Monitor global economic conditions: Keeping a close watch on global economic trends and geopolitical developments is crucial for anticipating potential risks and adjusting forex reserve management strategies accordingly.

FAQs on India’s Forex Reserves

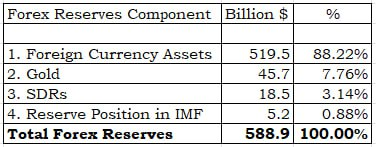

- Q: What is the current level of India’s forex reserves?

A: As of January 2023, India’s forex reserves stood at around $580 billion.

- Q: What are the major factors that have contributed to the growth of India’s forex reserves?

A: Strong foreign capital inflows, a robust export sector, and government policies have all played significant roles in boosting India’s forex reserves.

- Q: How does India use its forex reserves?

A: India uses its forex reserves to stabilize currency fluctuations, manage inflation, and import essential goods.

India Forex Reserves History Chart

Conclusion

India’s forex reserves have come a long way since its humble beginnings. The country’s continuous efforts to maintain adequate reserves have contributed to its economic stability and resilience. As India navigates the ever-evolving global economic landscape, the prudent management of forex reserves will remain a crucial cornerstone of its financial security and growth. We invite you to explore further resources and engage in discussions to deepen your understanding of this vital aspect of India’s economic policy.