Introduction

In the realm of international finance, foreign exchange reserves hold paramount importance. These reserves, denominated in various currencies, serve as a nation’s war chest, enabling it to meet a wide range of economic contingencies and external obligations. India, the world’s sixth-largest economy, boasts a significant stockpile of forex reserves, which have emerged as a cornerstone of its economic stability. In this comprehensive guide, we delve into the depths of India’s forex reserves, elucidating their significance, composition, and impact on the nation’s financial well-being.

Image: indianexpress.com

Importance of Forex Reserves

Forex reserves play a multifaceted role in the economic landscape of a nation. They provide the following crucial benefits:

-

Import Cover: Forex reserves serve as a buffer against potential import disruptions by providing a ready source of foreign currency to settle import bills. India’s import cover, an indicator of its ability to fund imports using reserves, has historically exceeded three months’ worth of imports, providing a significant degree of comfort and flexibility.

-

Financial Stability: Ample forex reserves act as a stalwart defense against external shocks, such as sudden capital outflows or currency fluctuations. They allow the central bank to intervene in the foreign exchange market to contain volatility and maintain financial stability.

-

Economic Growth: A healthy level of forex reserves underpins economic growth by enhancing investor confidence, attracting foreign investment, and mitigating exchange rate risks. This, in turn, fosters a favorable environment for domestic businesses and industries.

-

Sovereign Creditworthiness: Nations with substantial forex reserves are perceived as more creditworthy by international lenders. This superior credit rating translates into lower borrowing costs and improved access to global capital markets.

Composition of India’s Forex Reserves

India’s forex reserves comprise a diverse mix of foreign currency assets, gold, and Special Drawing Rights (SDRs):

-

Foreign Currency Assets: These constitute the largest component of India’s forex reserves, held in the form of deposits in foreign central banks, treasury bonds, bills, and corporate securities of various countries. US dollars account for the majority of these assets, followed by euros, British pounds, and Japanese yen.

-

Gold: India holds a significant quantity of gold, which is considered a safe haven asset during times of economic uncertainty. The country’s gold reserves are held in vaults within India and abroad.

-

Special Drawing Rights: SDRs are international reserve assets created by the International Monetary Fund (IMF) and can be exchanged for foreign currencies. They form a small but significant portion of India’s forex reserves.

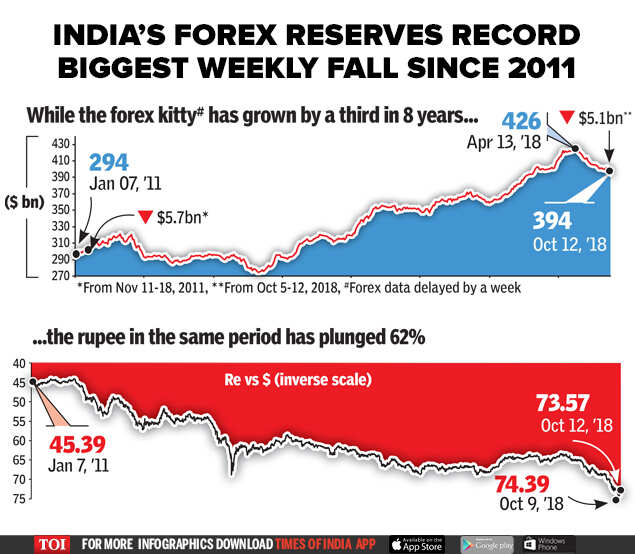

Trends and Developments in India’s Forex Reserves

India’s forex reserves have witnessed a steady upward trajectory over the past decade. Led by robust foreign direct investment, remittances, and export earnings, the reserves have surged from around $250 billion in 2010 to over $600 billion in 2023.

However, the reserves have not been immune to global economic headwinds. During periods of heightened risk aversion, such as the COVID-19 pandemic or the Russia-Ukraine conflict, there have been fluctuations in forex reserve levels. Nonetheless, the reserves have generally remained resilient, reflecting the underlying strength of the Indian economy.

Image: timesofindia.indiatimes.com

Significance of India’s High Forex Reserve Level

India’s substantial forex reserves serve as a source of national pride and economic confidence. They represent the nation’s preparedness to navigate economic storms, whether they arise domestically or internationally.

The ample reserves provide the government and the central bank with ample room for policy maneuverability. They enable the authorities to pursue growth-oriented policies without being unduly constrained by external vulnerabilities. Furthermore, the reserves provide a buffer against potential capital reversals, protecting the domestic financial system from sudden outflows.

India Forex Reserve In Milliion

Conclusion

India’s forex reserves stand as a testament to the nation’s economic prowess and its commitment to maintaining financial stability. The reserves play a pivotal role in ensuring import cover, financial stability, economic growth, and sovereign creditworthiness. The steady accumulation of forex reserves over the years has strengthened India’s resilience against external shocks and positioned it as an attractive destination for foreign investment. As India continues its economic ascent, its forex reserves will undoubtedly remain a cornerstone of its financial strength and global standing.