A Paradigm Shift in Foreign Exchange Management

India has recently implemented a significant shift in its foreign exchange management framework by adopting the direct rate mechanism for determining exchange rates between the Indian rupee and other currencies. This transformative move marks a departure from the previous indirect rate system and promises numerous benefits for businesses, individuals, and the Indian economy as a whole.

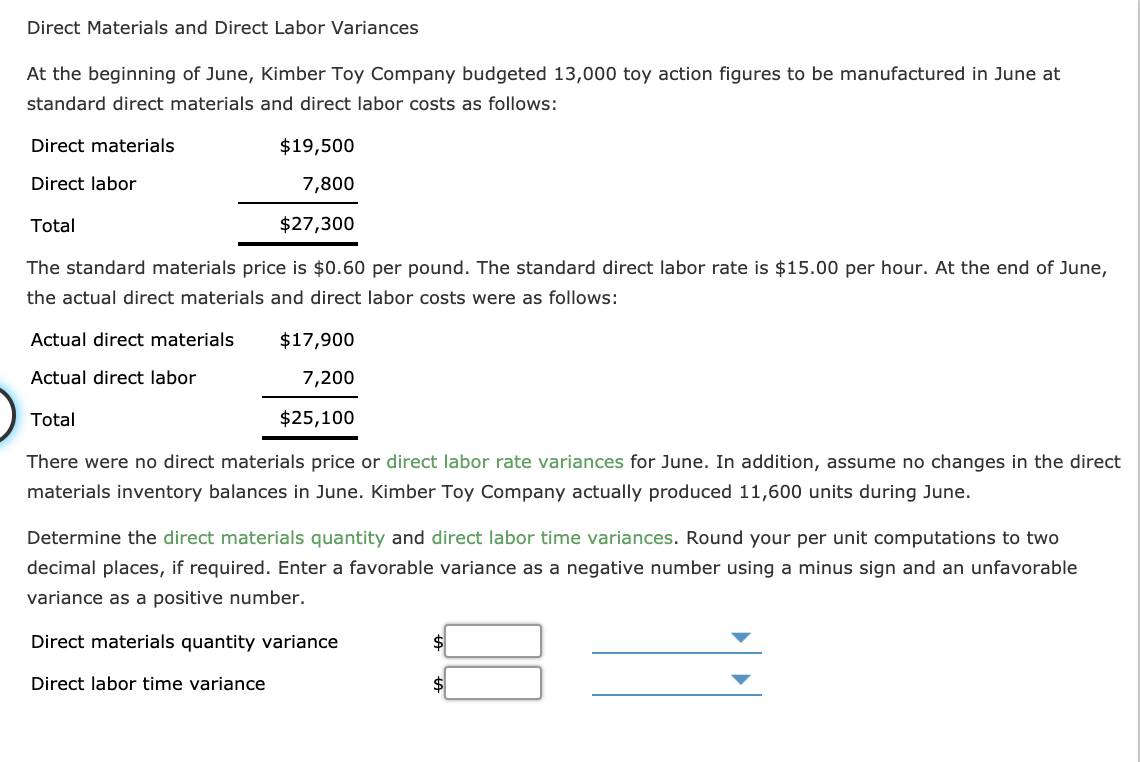

Image: www.chegg.com

Previously, India employed an indirect rate system known as the “cross-currency approach” to determine exchange rates. Under this system, the Indian rupee’s exchange rate was pegged to a third currency, typically the US dollar, and the exchange rates for other currencies were subsequently derived from this peg. This indirect approach introduced complexity and potential for exchange rate volatility.

In contrast, the direct rate system establishes a direct relationship between the Indian rupee and each relevant foreign currency. This approach eliminates the need for intermediate currency cross-conversions and ensures that the exchange rate is determined transparently and efficiently according to market demand and supply.

Advantages of the Direct Rate System

1. Enhanced Transparency and Predictability

The direct rate system promotes transparency in the foreign exchange market by directly reflecting changes in supply and demand for different currencies. This predictability allows businesses to plan their international transactions more effectively and make informed decisions.

2. Improved Risk Management

With direct exchange rates, businesses and individuals can accurately assess the potential exchange rate fluctuations and mitigate risks accordingly. The transparency of the system empowers market participants to make informed hedging decisions and minimize exposure to foreign exchange volatility.

Image: www.pelletplus.hu

3. Reduced Transaction Costs

The direct rate system streamlines foreign exchange transactions, reducing the need for intermediary conversions and associated costs. This cost reduction benefits both businesses and individuals who engage in cross-border transactions.

Implications for Businesses

The adoption of the direct rate system in India has significant implications for businesses operating internationally. By removing the complexities associated with the previous cross-currency approach, the direct rate system improves the predictability and reduces the risk of foreign exchange fluctuations. This enhances the efficiency of export-import operations and facilitates international investment.

Benefits for Individuals

The direct rate system translates into tangible benefits for individuals as well. When making international remittances or overseas purchases, the direct rate ensures a fair and accurate conversion of currencies, minimizing the potential for hidden charges or unfavorable exchange rates. This provides individuals with greater purchasing power and transparency when engaging in cross-border transactions.

Strengthening the Indian Economy

The transition to a direct rate system contributes to the stability and resilience of the Indian economy. The transparent and efficient exchange rate mechanism promotes foreign direct investment, facilitates international trade, and attracts global capital. This, in turn, fosters economic growth and creates new opportunities for businesses and individuals alike.

India Follows Direct Rate In Forex

Conclusion

India’s adoption of the direct rate in forex is a groundbreaking reform that brings numerous benefits to businesses, individuals, and the Indian economy. By enhancing transparency, predictability, and cost-effectiveness, the direct rate system empowers market participants and facilitates the smooth flow of international transactions. This strategic move paves the way for India’s continued integration into the global financial landscape and signifies the nation’s commitment to fostering economic prosperity.